RegTech: best defence against evolving financial crime

Table of Contents

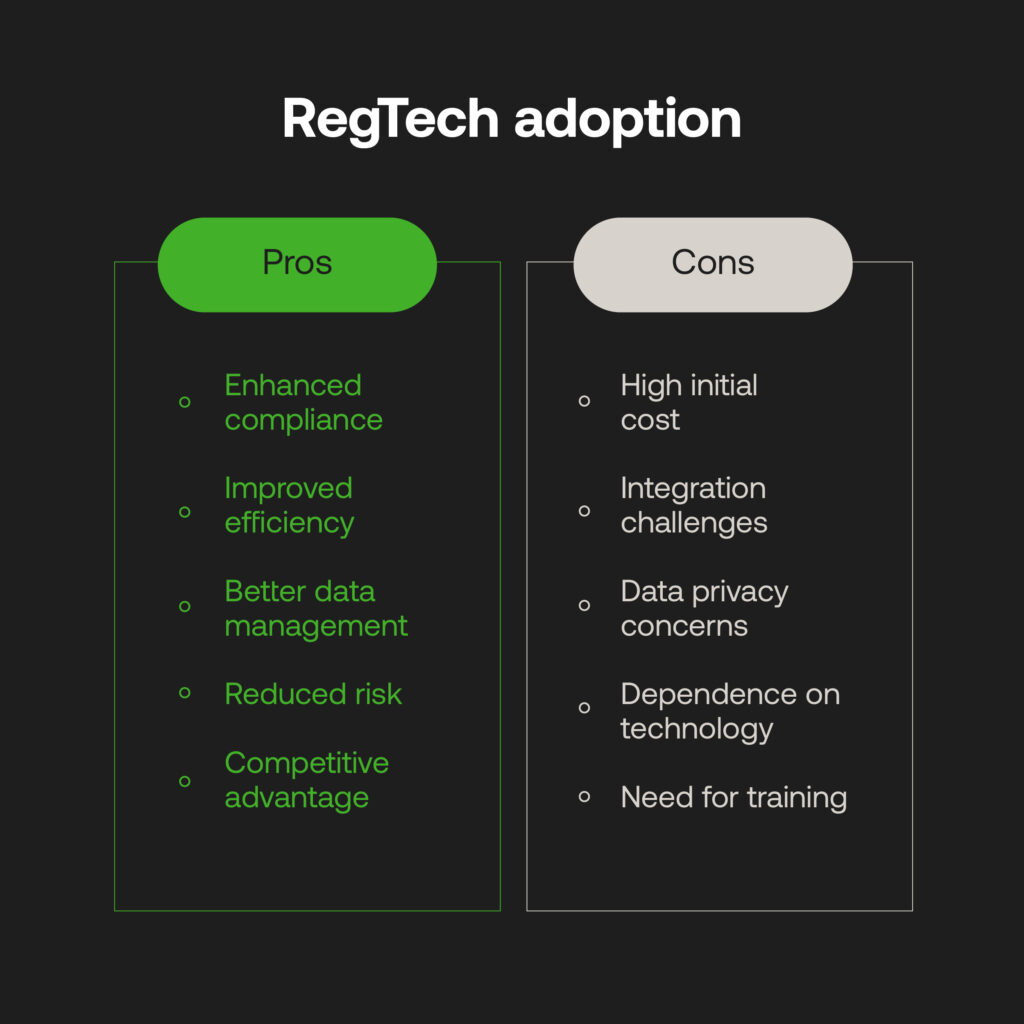

Financial crime networks are becoming increasingly sophisticated and more challenging to detect. As cross-border transactions increase in speed and volume, so does the challenge of keeping pace with the constantly evolving regulatory landscape.

To combat this, regulators are enforcing tighter anti-money laundering (AML) requirements. The message is clear: if you want to stay compliant, you must remain agile.

However, agility is tough when relying on outdated systems, manual workflows, and scattered data. Even the most well-meaning organisations can fall behind without the right technology and a compliance-first culture. And that means paying the price – from fines, to reputational damage and exposure to criminal risk.

Regulatory technology (RegTech) is a game-changer, and at RelyComply, we’re proud to be leading the change.

Award-winning innovation, recognised by the industry

RelyComply’s approach to compliance isn’t just effective but industry-recognised. In the past year alone, we’ve been honoured with multiple global accolades for innovation and impact in RegTech:

RegTech100 – 2024 & 2025

AIFinTech100 – 2024 & 2025

FinCrime Tech50 – 2024 & 2025

London MoneyLIVE Summit – Best Use of Emerging Technology – 2025

These awards highlight the most forward-thinking companies tackling the toughest compliance challenges – from identity verification to transaction monitoring and everything in between.

At RelyComply, we accept the challenge and challenge the accepted.

Compliance challenges are growing — so must your AML systems

The global regulatory environment is only getting tougher. Companies are being scrutinised for:

- Failing to identify beneficial ownership structures

- Weak or outdated KYC practices

- Ineffective transaction monitoring

- Gaps in staff training and reporting processes

In South Africa, regulators have ramped up enforcement following the country’s greylisting by the FATF. While this marks progress, local watchdogs continue to pressure accountable institutions to demonstrate robust, ongoing AML risk management, not just compliance on paper. For example:

- In 2024, the Financial Intelligence Centre (FIC) issued administrative sanctions against multiple financial service providers for failing to report suspicious transactions, implement proper customer due diligence, and provide evidence of ongoing staff AML training. Fines ranged from R250,000 to over R1 million, depending on the severity of the violations.

- In mid‑2024, Safrican Insurance Company was sanctioned R13 million (with R6 million conditionally suspended) for failures in CDD, record-keeping, and a lack of a formal Risk Management and Compliance Programme.

- In January 2025, the South African Reserve Bank’s Prudential Authority fined Capitec Bank R56.25 million for multiple failures, including weak customer due diligence, tardy suspicious transaction reporting, and unaddressed alerts in its automated monitoring system.

- In late 2024, Old Mutual Life Assurance was fined R15.9 million for widespread AML governance failures: inadequate CDD, lack of suspicious transaction reporting, and lack of a fully implemented RMCP.

These examples highlight the real-world risks of falling behind. Despite best intentions, many firms rely on outdated systems, siloed tools, and manual reviews, leaving them vulnerable to non-compliance, reputational damage, and resource strain.

How RelyComply sets you apart

We’re building technology that doesn’t just solve today’s problems – it anticipates tomorrow’s. RelyComply’s intelligent, end-to-end compliance platform is trusted by forward-looking firms that want to simplify their systems, reduce risk, and stay compliant across jurisdictions.

Here’s how we help:

AI-Powered Risk Detection

Our platform automatically flags suspicious transactions in real time, with fewer false positives and faster case resolutions.

End-to-end Visibility

Monitor customer risk across the lifecycle – from onboarding and KYC to transaction monitoring, adverse media screening, and reporting.

Highly Configurable Compliance Workflows

Adjust thresholds, rules, and scenarios to suit your unique risk profile and business goals.

Easy Integration

Integrate into existing systems and data sources without disruption. No need to rebuild – just refine.

Technology is the future of trust

Criminals continue to evolve. So should your compliance.

With emerging regulations, increasing pressure from global watchdogs, and the growing sophistication of financial crime, manual methods alone just won’t cut it. You need RegTech to scale with your risk, adapt to change, and deliver confidence.

At RelyComply, we’re proud to be shaping the future of financial crime compliance and are recognised for it by the world’s leading industry platforms.

Ready to stay ahead?

Whether building from scratch or modernising outdated systems, RelyComply is here to help.

Get in touch for a demo or discovery session with our team.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.