INDUSTRIES

Swift, safe and secure AML for any Bank

Tackle the balance of compliance costs with growing threats using a single, powerful KYC/AML solution.

Arrange a demo

Revolutionise cross-border financial flows

From traditional houses to app-focused neobanks, innovation has reinvigorated the entire ecosystem. However, this does not deter criminal opportunities through crypto or other digital assets, exploiting inefficient legacy systems and confusing, siloed data sources that blight the industry.

Being in control of compliance starts with a single platform, from onboarding the right customers to protecting their accounts and the system from bad actors through AI-based detection. Even with regulators being forced to tighten their anti-fincrime controls, RelyComply’s flexibility enhances every AML step better in managing money movements in this rapidly ever-changing world.

One solution for every need

Integrating with existing systems and driven by AI’s automated data processing, it instils smooth end-to-end onboarding, transaction monitoring, screening, and more from a single customer view.

Take advantage of AI

Surface suspicious activities in real-time according to your bank’s risk appetite and business needs without costly and cumbersome manual intervention, lowering false positives by up to 40%.

A scalable solution in a modern world

Configure your risk thresholds, collate trusted data sources, and adapt to differing payment standards to stay ahead of inevitable requirements from global watchdogs as and when they happen.

Quick AML insights

The 3 essential AML pillars of Travel Rule compliance 2025

Find out why the new Travel Rule provides a lifeline in standardising the ways that crypto asset service providers and adjacent entities share user data with other financial institutions.

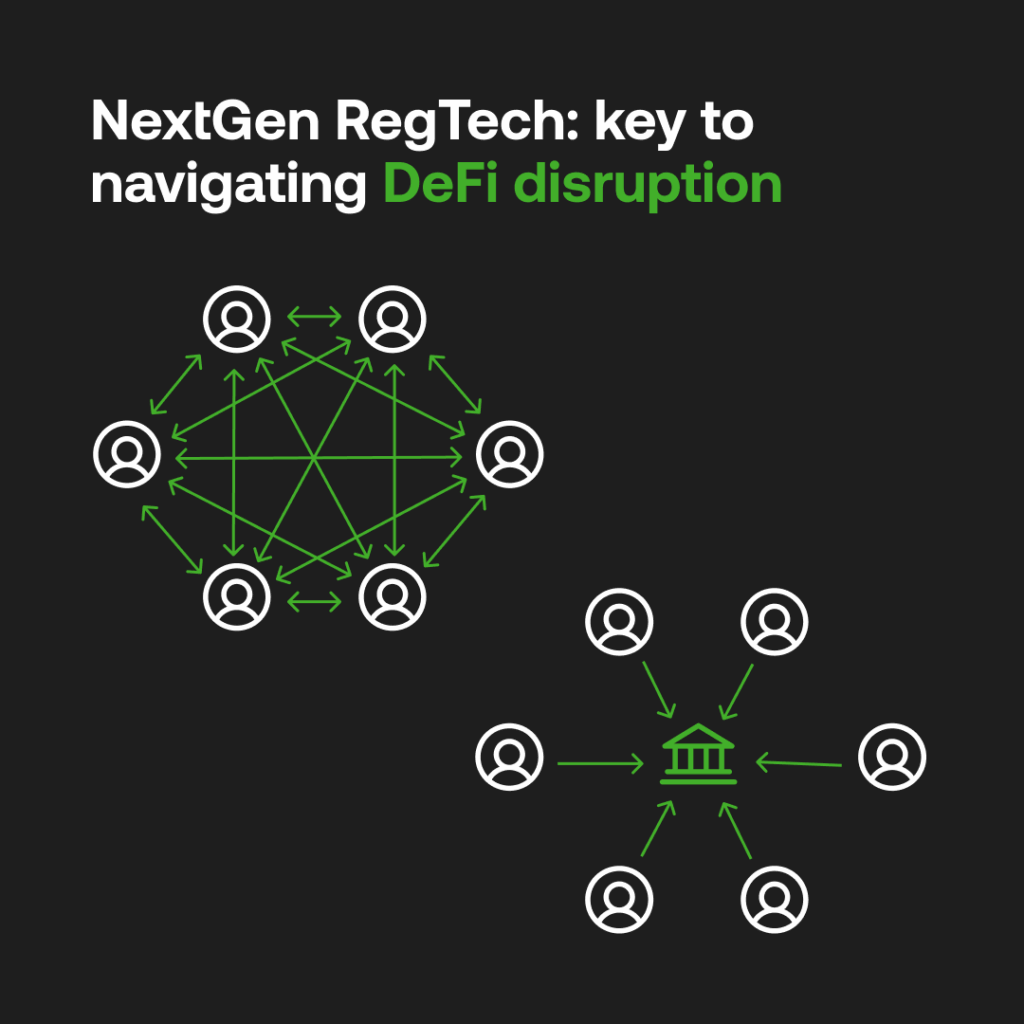

Why NextGen RegTech is key to banks navigating DeFi disruption

Legacy banks vs. digital disruptors: Who wins the future of finance? Explore how digital disruptors are reshaping retail banking.

Co-created AML compliance

No two compliance journeys are the same and neither is our approach. In this article, RelyComply’s Customer Success Lead, Erin Daubinet, shares how we work hand-in-hand with enterprise teams to design AML solutions that scale with their business.

Future-proof your AML strategy with Gartner's Market Guide: KYC platforms for banking

Stay ahead of evolving regulations and fincrime threats. Discover the key trends, technologies, and vendors transforming AML compliance.

Download the report