20x faster customer onboarding

Automate onboarding with intelligent ID verification, secure document checks and AI-driven analytics to welcome legitimate users and prevent the threat of identity scams.

Arrange a Demo

KYC solutions for risk-free compliance

Ensure secure and compliant onboarding by automating verification, screening and risk assessments across your user base with RelyComply’s all-in-one KYC platform.

Trusted by market leaders

Our solutions

IDV & User Verification

Accurately onboard authentic customers using intelligent solutions like liveness detection and bank and address verification.

Learn moreDocument & Customer Verification

Validate legitimacy with secure document checks, completing the initial digital handshake that leads to ongoing trust.

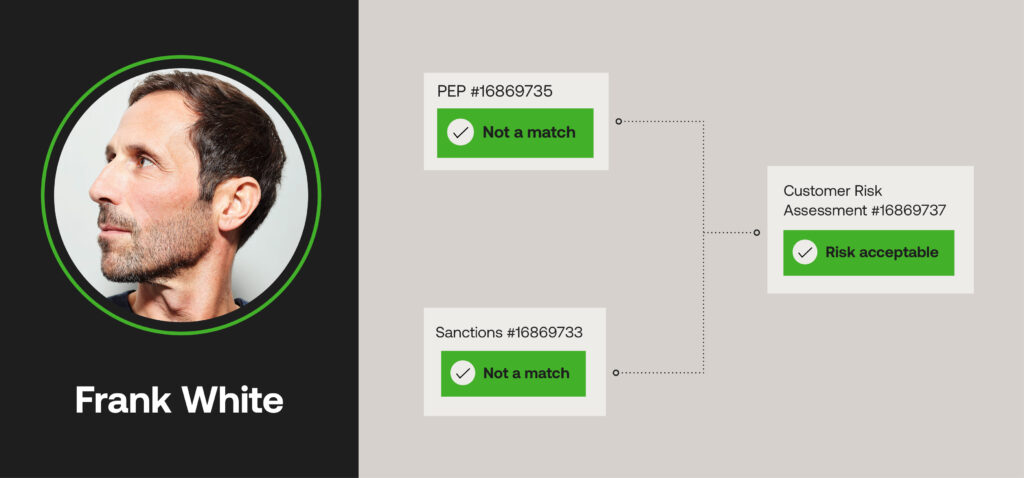

Learn moreCustomer Screening

Spot PEPs, sanctioned individuals or risky entities in seconds with powerful proprietary algorithms that reduce false positives.

Learn moreCustomer Risk Assessment

Customise risk profiles and thresholds for effective due diligence at your fingertips.

Learn moreAdverse Media

Automatically flag any suspicious profiles or behaviours against trusted, updated news sources.

Learn moreSpot real-time risk from trusted sources

With a customisable dashboard, you can choose which screenings to run, when, and on whom—ensuring a tailored compliance approach. Daily PEP and sanctions screenings help you stay updated on any changes while identity verification runs as needed. Quickly check if customers appear on global watchlists or have been flagged in adverse media, all from a single platform designed for seamless due diligence.

Quick steps to bring customers on board

Reduce onboarding time by 30%

Reduce Total Cost of Ownership by 25%

Increase customer retention rate by 30%

Future-proof your AML strategy with Gartner's Market Guide: KYC platforms for banking

Stay ahead of evolving regulations and fincrime threats. Discover the key trends, technologies, and vendors transforming AML compliance.

Gartner Market Guide: KYC Platforms for BankingScreen customers with confidence

Gain modern KYC tools to instantly detect suspicious activity during customer onboarding, including rapid liveness checks and AI-powered identity validation.

Rapid liveness checks

Curb the risk of mocked-up still images or deepfakes using algorithms to distinguish real humans in real time.

AI text extraction

There’s no need for manual, back-and-forth email chains of documents, with AI technology able to pull out, collate, and assess the most pertinent information.

Daily IDV checks

Scan personal customer information (names, photos, etc.) against the most up-to-date adverse media lists and watchlists, including PEPs and sanctioned individuals.

Platform features

AI-powered identity validation

Uses next-level biometrics and daily IDV checks to verify identities quickly and accurately.

Real-time document authentication

AI text extraction to pull out, collate, and assess ID documents.

Selfie face matching and liveness detection

Rapid liveness checks ensure the person is genuine and matches their ID.

Address and account authentication

Verifies user addresses and bank account details.

GraphQL API integration

Enables seamless, flexible data retrieval.

Configurable verification rules

Customise verification processes to meet compliance needs.

Frequently Asked Questions

Quick KYC insights

Investigating ISO 20022 AML compliance for secure, scalable cross-border payments

A deep dive into the importance of the ISO 20022 global standard for cross-border payments, and its relation to ISO 27001 and AML partnerships.

How economic shifts increase financial crime risk UK firms face, and the necessary AML compliance

Exploring the knock-on financial crime risk UK faces amid 2026 economic instability, and where RegTech can mitigate dynamic AML risk.

Reframing fintech compliance in Africa as a competitive advantage

Exploring how Africa’s rapid fintech expansion can achieve elite compliance through RegTech partnerships to grow nationally and internationally.