10x faster financial crime detection

Backed by intelligent features like real-time processing, machine learning, and proprietary algorithms.

Arrange a demo

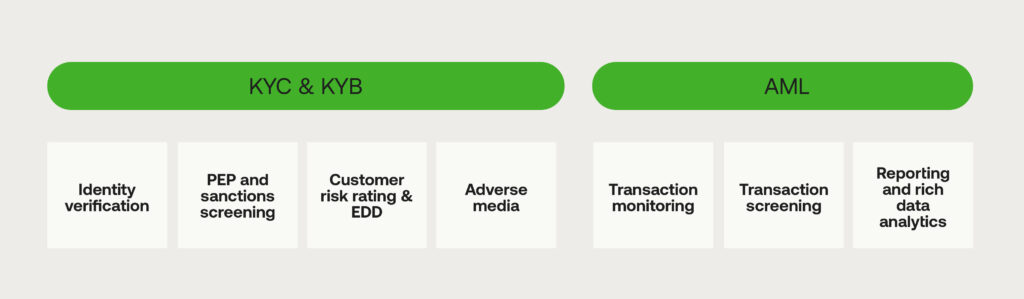

Comprehensive AML and KYC solutions

A single end-to-end AML platform that streamlines compliance, enhances risk detection, and automates monitoring for complete financial crime protection.

Trusted by market leaders

Our Solutions

Transaction monitoring

Only flag critical alerts. Powered by serverless data analytics and proprietary machine-learning capabilities to analyse billions of complex transactions in seconds.

Learn MoreTransaction Screening

Scan trusted global watchlists from one place to let legitimate payments flourish and receive real-time alerts about potential risks.

Learn MoreRegulatory Reporting

Pre-populate, validate and share high-quality audit reports in a few quick steps with GoAML integration.

Learn more

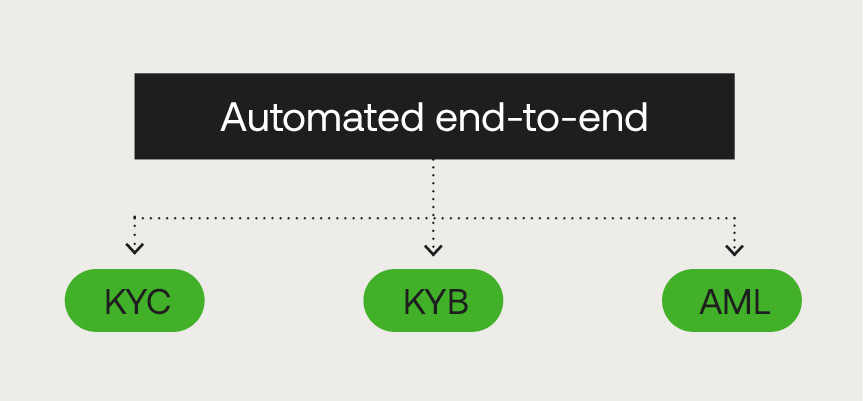

A fully integrated, single AML and KYC platform

Cut Suspicious Transaction Report errors by 50%

Accelerate compliance reporting by 40%

Improve detection of suspicious activities by 35%

Future-proof your AML strategy with Gartner's Market Guide: KYC platforms for banking

Stay ahead of evolving regulations and fincrime threats. Discover the key trends, technologies, and vendors transforming AML compliance.

Download the report

Effortlessly integrate RelyComply with your tech stack

RelyComply seamlessly integrates core banking platforms, payment processors, and CRM systems through robust, fully configurable GraphQL APIs. This enables real-time transaction screening with minimal disruption, enhancing efficiency and security. The platform’s AML case management system ensures a single source of truth, empowering compliance teams to swiftly and accurately detect and address financial crime.

Speed to value

Our AI-driven platform can deliver a best-in-class KYC/AML solution quickly and smoothly, while being agile enough to adapt to legislative changes.

Highly configurable

Legacy technology stacks can be complex and cumbersome. Our solution can be rapidly integrated with existing systems, reducing time-to-market.

A single customer view

Our compliance case management system offers a single source of truth for every customer throughout the entire compliance journey.

Platform features

AI-driven screening

Leverage proprietary algorithms to detect risks and ensure compliance.

Real-time screening

Instantly checks transactions against the latest global sanctions.

GraphQL API integration

Enables flexible, efficient data retrieval and system connectivity.

Supervised or unsupervised machine learning

Combines predefined rules with adaptive AI for smarter AML detection.

Low latency real-time analysis

Processes transactions instantly with minimal delay.

Integrated business analytics tools

Get a holistic view of your business’ efficiency and proactive risk mitigation

Frequently Asked Questions

Quick AML insights

Why financial crime in the UK makes the nation a prime target

Delving into the newfound ways that a mature, diverse and developed financial ecosystem is perpetually exploited to boost financial crime in the UK.

Discover 2026 compliance trends

Examining strategic priorities for innovative RegTech capabilities in 2026, from building quantified compliance risk to utilising AI systems.

How to reintegrate your AML tech stack for success

Why 2026 demands a ‘less is more’ approach The AML tech stack has become a crutch for financial leaders. While the RegTech boom was reaching fever pitch, buying up disparate, single-function services felt essential for transforming compliance for good, almost fashionable. Fast forward a few years and the stack built from these point solutions has … Continued