A platform of possibility

"Being close to our customers allows us to develop cutting-edge features to help combat new fraud and money laundering typologies. This wouldn’t be possible without the great people behind it. Attracting and nurturing top talent is key to driving our sustainable growth, and it will remain our focus as we continue to scale.”

Bradley Elliott, CEO of RelyComply

We accept the challenge, and challenge the accepted.

Financial criminals are getting smarter. Global regulators are getting stricter. Even the most reliable banks are prone to letting illegally obtained money flow through the financial system.

That’s why we’re here.

Since 2020, RelyComply has been spearheading innovations in compliance for the financial industry. Onboarding checks? No problem. 24/7 screening? Sorted. With our AI-enhanced technology, we turn thousands of hands-on investigations into seconds, save costs, and much more.

Uncomplicating compliance

It’s in our DNA.

What sets our platform apart

With a blend of speed, agility, and a customer-centric approach, we are shaping and defining the future of compliance workflows.

We harness the power of artificial intelligence and cutting-edge technologies to empower our clients with the flexibility and efficiency they need exactly where they need it.

Meet the leadership team

Bradley Elliott

Chief Executive Officer

Brad has over 15 years of experience founding and scaling businesses across fintech, SaaS, martech, and edtech. He has built and led an award-winning digital consultancy, launched one of South Africa’s first mobile payment platforms, developed an on-demand marketplace later acquired by a major insurer, and created a social analytics platform that harnesses data to drive engagement. He believes technology is a powerful enabler for solving complex global challenges.

James Saunders

Co-Founder and Chief Technology Officer

With a graduate degree in Pure Mathematics and Computer Science, James has founded and scaled many enterprises as an experienced technologist, developing fully integrated data analysis platforms, complex, large-scale risk and insurance modelling, and automated design systems in the energy industry. Having previously co-founded BusinessOptics, an AI solution company, his diverse background extends to computer vision and security, mobile auditing, robotics and developing financial and environmental planning systems.

Alex Bain

Head of Sales

Alex is a UK-based Cape Town native whose technical sales positions have covered hardware, software, and services across EMEA, North America, and APAC. Passionate about how technology can bring positive change, Alex has contributed to multiple scaling successes, including the fastest-growing NoSQL data platform on the market.

Kieran Duggan

Product Manager

Starting in Mechatronics and Biomedical Engineering, Kieran has helped develop user-centric software and overseen the whole product-build process, which includes detailed technical design, business modelling, and customer success. Joining us from the corporate landscape, where Kieran played a major part in delivering successful product lines for worldwide enterprises, he’s looking forward to building adaptable technology in the AML space to enable positive change.

Erin Daubinet

Customer Success

Erin brings over five years of experience in the FMCG sector, where she worked with South Africa’s top retailers and global manufacturers across operations, sales, product, and account management. Her career highlights include serving as 2IC to the Head of Operations during a period of rapid company growth, successfully launching two multi-million-rand B2B SaaS products, and mentoring team members into leadership roles. Since joining RelyComply, Erin has played a key role in ensuring clients realise value quickly and consistently. Her focus is on driving meaningful outcomes—streamlining onboarding, building strong relationships, and ensuring the platform delivers tangible compliance benefits. Erin is deeply committed to turning complex challenges into simple, strategic wins for RelyComply’s clients.

Reece Turner

Growth Marketing

Reece heads up Growth Marketing at RelyComply, leading brand, strategy, and go-to-market execution across global markets. With experience across RegTech, insurance, and FMCG, he knows how to turn good marketing into real business momentum. Known for his hands-on leadership and entrepreneurial mindset, Reece brings clarity, energy, and a customer-first approach to every challenge.

Quick AML insights

The 3 essential AML pillars of Travel Rule compliance 2025

Find out why the new Travel Rule provides a lifeline in standardising the ways that crypto asset service providers and adjacent entities share user data with other financial institutions.

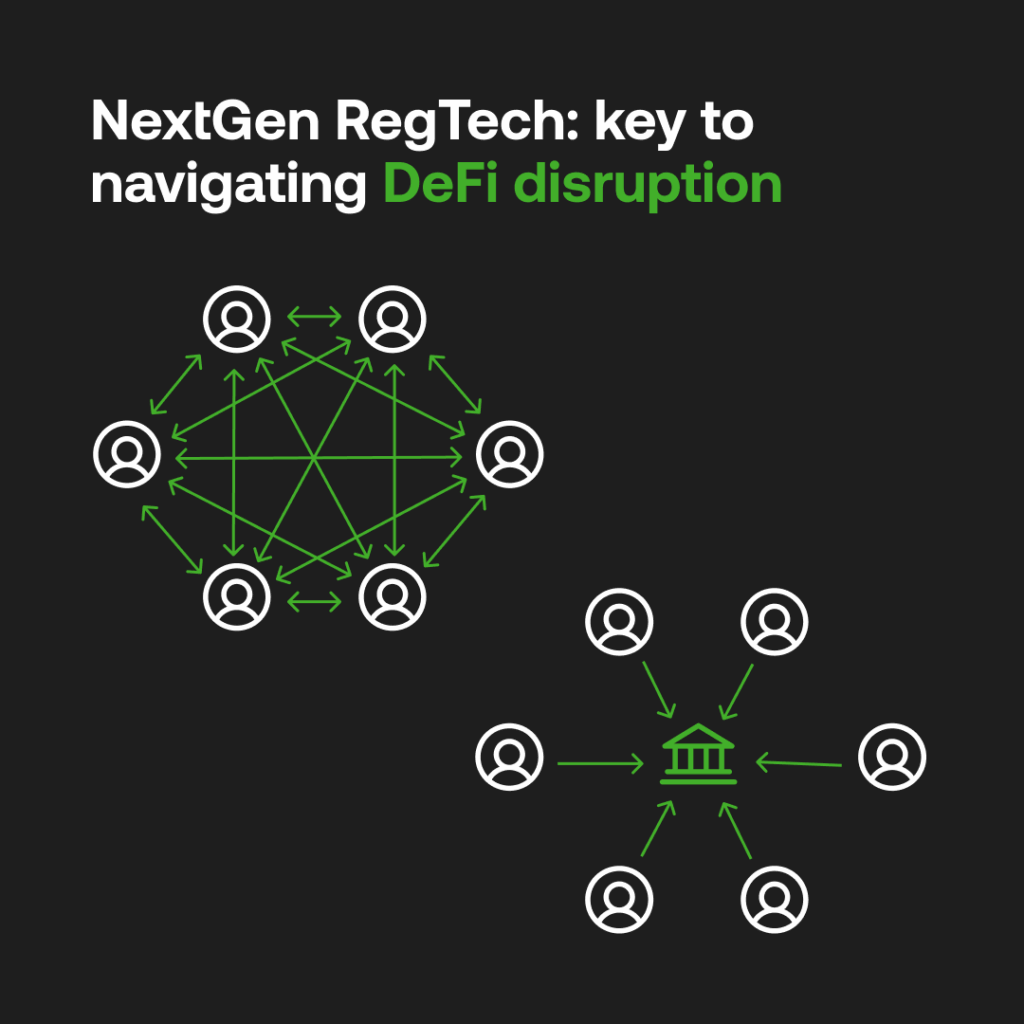

Why NextGen RegTech is key to banks navigating DeFi disruption

Legacy banks vs. digital disruptors: Who wins the future of finance? Explore how digital disruptors are reshaping retail banking.

Co-created AML compliance

No two compliance journeys are the same and neither is our approach. In this article, RelyComply’s Customer Success Lead, Erin Daubinet, shares how we work hand-in-hand with enterprise teams to design AML solutions that scale with their business.