The challenge

Navigating complexity in mobile payments – without slowing down

Already innovating the jostling mobile payments world, SnapScan looked ahead to the next race in its rapid evolution: an end-to-end anti-money laundering solution that could merge seamlessly with its trusted technologies and operational engines.

Crafting an exceptional customer onboarding journey is tricky, and finding a robust yet flexible platform to match international banks’ scrupulous AML standards. In order to achieve this, they needed:

- Easy integration: merge an end-to-end AML platform with existing systems

- Remain compliant: boost customer onboarding experiences in light of tricky AML regulations for global banks

Why RelyComply

Compliance to meet customer expectations

Our partnership immediately jumped into gear to establish an effortless integration. Mapping out a comprehensive digital merchant onboarding workflow covered the much-needed bases of rigorous customer due diligence for directors, major stakeholders, and related parties.

We leveraged a suite of RelyComply solutions to make SnapScan’s onboarding not only compliant but smart and efficient:

-

Seamless AML Integration: Embedded our platform directly into SnapScan’s existing operations for a smooth, end-to-end workflow.

-

Digital Onboarding Workflows: Built automated CDD processes for directors, major stakeholders, and related parties.

-

Advanced Screening & Risk Tools:

-

PEP and Sanctions Screening: Instantly identify politically exposed persons and sanctioned individuals worldwide, reducing risk without slowing onboarding.

-

Configurable Client Risk Assessments: Set custom thresholds, trigger Enhanced Due Diligence only when necessary, and provide fully auditable risk scores tailored to their workflows.

-

Adverse Media Checks: Continuously monitor global media to flag potential risks, keeping compliance proactive and reputational risk in check.

-

Our impact

Customer onboarding – triumphantly transformed

Switching to RelyComply for their AML merchant onboarding needs, SnapScan has swiftly changed the game for their customers. Manual document uploads, such as proof of address or business registrations, are a thing of the past. SnapScan can now ensure onboarding processes that are smoother and easier to use for customers.

-

20% faster verification times, eliminating delays in merchant onboarding.

-

10% increase in accuracy of verifications, enabling quicker, hassle-free sign-ups.

“After looking for a simple integration to amplify SnapScan’s merchant onboarding, we’re delighted to have found RelyComply, who not only helped supercharge the work of our compliance teams but eased the banking sign-up process for our satisfied customers.”

– Talis Stewart, Product Manager

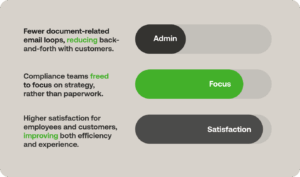

Transforming compliance into a competitive advantage

The solution marks a bright horizon for SnapScan’s compliance team. Replacing tedious piles of paperwork is one thing, but it re-dedicates time to craft a clear, risk-focused compliance strategy to strengthen the business. A big win is that SnapScan is also freed from endless email loops with customers over document details.

With verification rates boosted by 10%, customers get through sign-up speedily with way less hassle, marking the success of RelyComply’s integration approach. SnapScan hasn’t just fine-tuned its process to make their team’s life easier—they’ve also upped customer satisfaction and shone a new light on what great onboarding experiences look like.