Reframing fintech compliance in Africa as a competitive advantage

Fintech compliance in Africa has had to experience a serious innovative streak. With a widespread digital-first economy, startups offering payment apps, insurtech and remittance services have been addressing the challenges of financial literacy and accessibility for underbanked individuals. That should be a beacon of progress on the international stage, if not for regulatory matters being one of the industry’s insurmountable barriers.

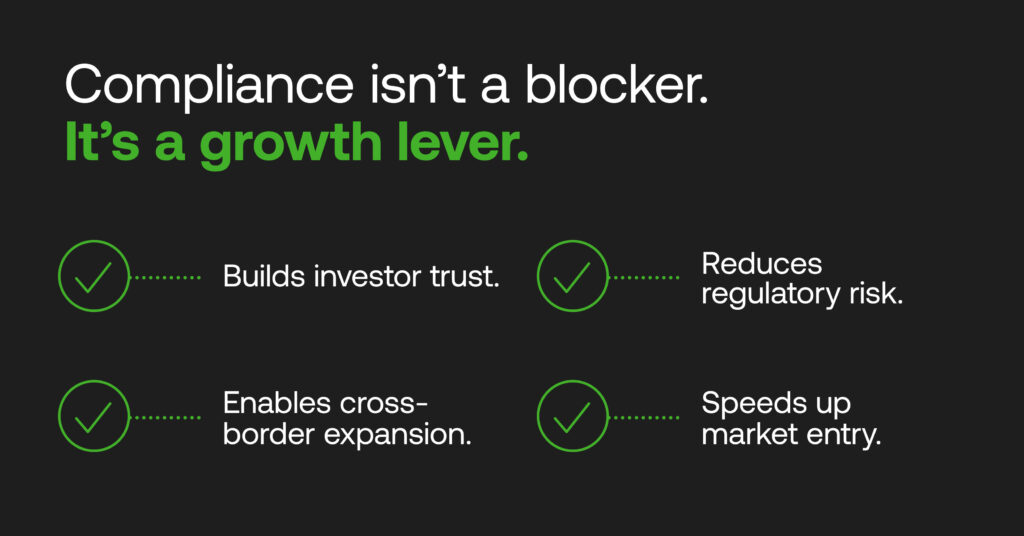

These hurdles raised by local anti-money laundering (AML) guidelines and international watchdogs trying to standardise measures do exist, but should not be considered oppositional to bringing new products to market, or becoming operational across borders. Global spending on AML systems is likely to surpass $75 billion by 2030; mostly due to them setting up compliance as a competitive advantage for ambitious, bankable fintechs.

Ultimately, firms that will invest in more cost-effective regulatory technology (RegTech) will be the long-term winners, unlocking African fintech investment readiness, access to widespread customer pools, and opportunities to scale their diverse solutions to areas where they’re needed most.

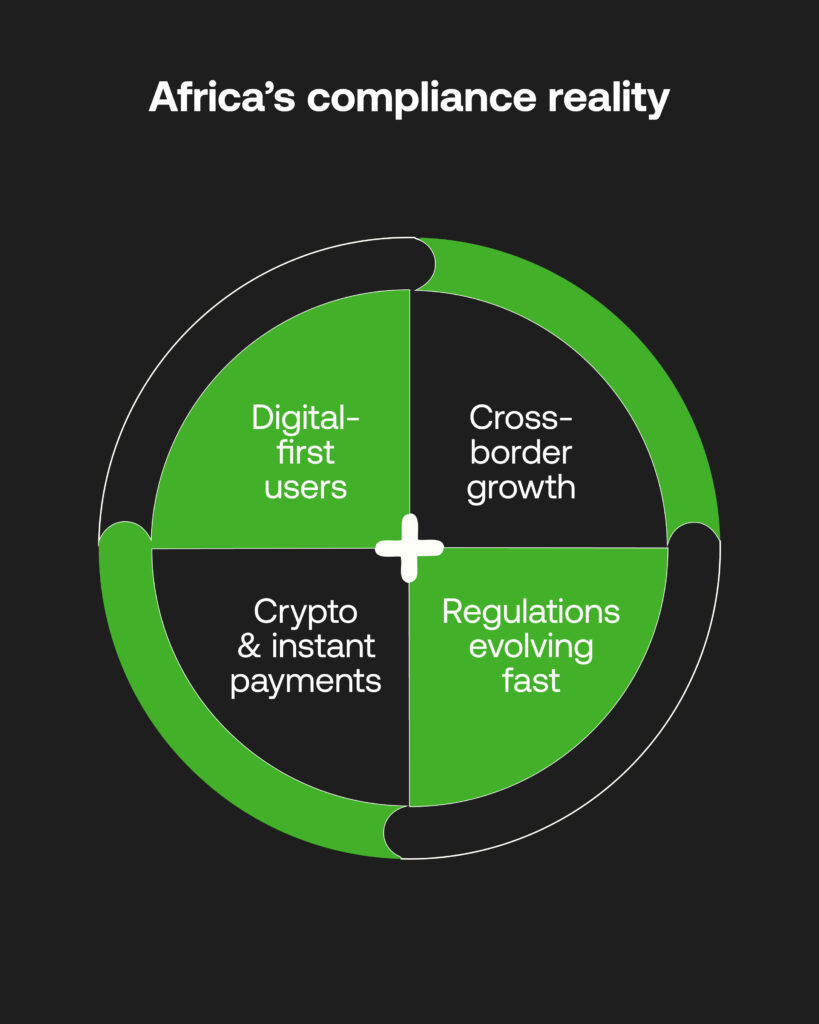

Africa’s thriving fintech demand

Serving a population with increasing access to the internet and smartphones, Africa’s fintech infrastructure is constantly reinventing itself to boost the financial inclusivity of its nations’ economies. Eight out of the continent’s nine tech unicorns are fintechs, and the sector accounted for 60% of all equity funding. The e-payment space alone was valued around $40 billion in 2025, with Nigeria, South Africa, Egypt, and Kenya serving as fintech’s major hubs.

Of course, digitalisation’s sheer velocity has meant that African fintech regulation and companies’ capabilities are having to adapt simultaneously to impending challenges. Cryptocurrencies, for instance, are becoming dominant to serve a continent of 54 million digital asset users – where Nigeria’s stablecoin boom is highlighted by almost 26 million adopters.

With opportunities presented to both businesses and their consumers, unfortunately criminals see new routes to explore. This is especially true when regulations around ethical and transparent AI, cryptocurrencies, and new payment rails are playing catch-up to shifting criminal methodologies, and leaving non-compliant fintechs vulnerable.

The move to an elite compliance mentality

This is why AML processes cannot be seen as a theoretical backroom function that’s an afterthought to developing fintech problems. They now make up the backbone to financial companies’ compliance-driven growth plans – helping them control risk and meet local and global regulatory standards, building a steady trustful reputation in tandem.

There are of course minimum requirements that fintechs across many verticals must oblige by. Failing the requirements of FATF (surrounding AML and counter-terrorist financing, CTF, protocols) can land nations on its greylist or blacklist and derail capital inflows. Nigeria and South Africa are well acquainted in the need to improve monitoring, reporting and data-led collaboration for greater prosecutions, having been recently delisted. Likewise, “elite compliance” involves expanding beyond baseline pillars of compliance to become continuously committed firms.

Traditionally, the challenge involved being able to invest sums into a money pit – the ‘cost of compliance’ of retrofitting inflexible legacy AML systems, or deploying new ones to maximise AML effectiveness against regulatory rigour. Compliance now covers data protection laws for customers (present in 46 African countries), AI usage, AML for instant cross-border payments, or increased reporting requirements, as in the case of South Africa’s FIC. There’s even growing numbers of institutions made accountable for protecting their financial ecosystems from harm.

Being able to instill anti-fincrime compliance rules into action is what will benefit entrants and banks wanting to scale internationally. Africa is doing well to combat fragmented regional regulations in some cases, such as expanding Unipesa’s Pan-African Payment and Settlement System (PAPSS) initiative to harmonise cross-border transactions, but it will involve greater public and private sector collaboration for uptake to spike. Elsewhere, by the end of last year, 70% of cross-border payment service providers in Africa and Europe had instilled machine learning risk models for advanced transaction monitoring.

Elite compliance through RegTech

All fintechs must have a practical, reiterative compliance framework to follow. Being able to integrate regulatory changes and innovate products at the same time is easier said than done, but strong foundations can help firms identify glaring gaps in their data and AML systems.

RegTech acts as a bridge to take compliance appetite toward actionable investigations – not just across African nations, but to any worldwide region where banks and fintechs may operate. This involves pivoting toward strategic partnerships that can cover the remits of a business; their jurisdictional hurdles, the types of assets they handle, onboarding operations, and reporting capabilities to relevant authorities.

Targeted and collaborative setups can explore ways to keep existing AML controls and expand a digital infrastructure, covering identity verification, case management, tracked audit trails, third party watchlist screening, and automated reporting. A unified risk-based system should monitor and raise alerts in real-time, and therefore allow fintechs to function soundly without the regulatory roadblocks at every necessary aspect of required AML/CTF.

Preparing for developing fintech trends

What’s for certain is that regulatory changes will always have fintechs’ compliance teams on their toes, which elite compliance processes and platforms can adapt to in order for scaling efforts to continue.

Africa’s fintech future is currently looking to greater regulatory frameworks for virtual assets (particularly in light of stablecoin’s popularity), explainable AI, as well as increasing sophistication in cybersecurity and anti-fraud measures, embedded finance (for payment tools and other mobile banking applications), and cross-border APIs.

Since 2025, ISO 20022 has risen as the global standard for transparent cross-border payments that hope to up user experiences and tackle rising criminal threats. That framework will become an increasing requirement, involving robust data privacy capabilities and automated transaction monitoring that RegTechs can offer.

In the case of AI governance, in South Africa its Financial Sector Conduct Authority (FSCA) has a 3-year Regulation Plan underway to align its combined work with the South African Reserve Bank (SARB) and the Prudential Authority with international standards, much like the development of multiple national strategies across Africa.

The practical roadmap for Africa’s bankable fintechs

Reaching for high-tier levels of compliance is a continuous journey, driven by principles and cemented through tried-and-proven systems that maximise investigation efficiency, gain more accurate alerts, lower false positives, and help submit detailed suspicious activity reports (SARs) to authorities, strengthening Africa’s proactive AML efforts.

Partnering with a RegTech team to integrate existing data with an end-to-end automated onboarding, monitoring, and reporting system is a growing need rather than a luxury – but an investment that can be future-proofed to shifting global rules, or if a fintech is looking to expand overseas.

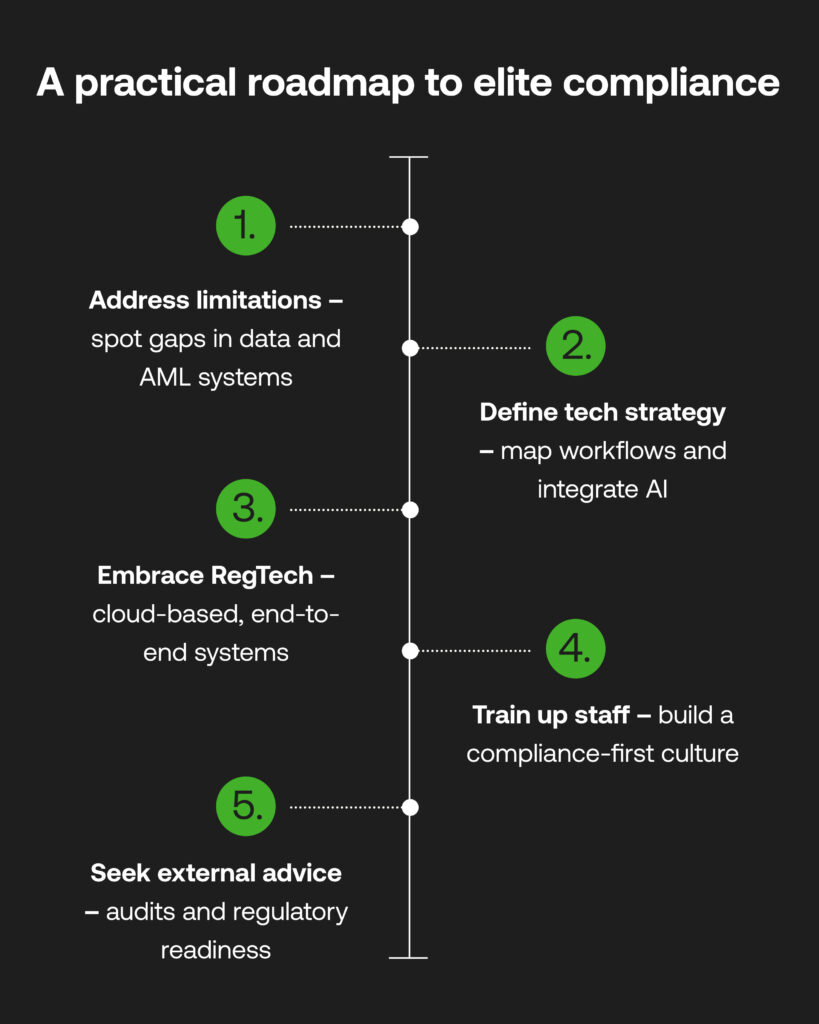

Working collaboratively instills elite compliance as a groundwork, which when the following roadmap is undertaken by fintechs, banks, government bodies, and regulators, will create an overarching anti-fincrime safeguard:

- Address current limitations: From increasing regulatory knowledge, addressing existing documentation to identify siloed workstreams and data, fintechs can see vulnerabilities in their AML/CTF systems that do not meet local and global standards.

- Define a tech strategy: Establish which effective workflows are already working, and how stacks can be integrated with AI-driven capabilities, from initial KYC to continuous tracked analytics to regulatory reporting.

- Embrace a RegTech partnership: Gain on-hand support and expertise to quickly deploy next-gen cloud-based systems that are secure, elastic infrastructures uniting all stages of AML into a single source of truth that can update automatically.

- Train up staff: Instill a compliance-first culture with educational talks and frequent training on the importance of fintech AML for the modern, digital world.

- Seek external advice: Internal and external audits can hold firms accountable for the quality of their AML protocols, and systems, ensuring preparedness for visits from supervisory authorities.

With overheads being a constant budget worry, utilising RegTech has been estimated to cut compliance costs by 30-50%, blighted by manual error and false positives of legacy systems. Shifting to an elite compliance approach is about mitigating future risk, but also differentiating a firm as one that takes AML seriously, for its own reputation, and for its customer satisfaction, helping it flourish in the fintech market.

When compliance grants a competitive edge

Fintech compliance in Africa is on the rise, and its continuation relies on AML adoption being prioritised as much as the development of competitive financial instruments. When reputable firms suffer from ill-compliance, it can have large ramifications on recovering their trust – a major currency in the global financial world.

Luckily, even in today’s fast-paced environment surrounded by regulatory idiosyncrasy and criminal exploitation, RegTech offers a route to cost-effective compliance as a key growth enabler. Being attuned to risk will reward the innovators in payments, digital assets, e-wallets and more, who in the years to come will become pivotal for Africa’s stance on the global fintech stage.