Ensure regulatory compliance and streamline operations

Table of Contents

Staying compliant relies heavily on a financial company’s operational arm. Under the watchful eyes of regulatory bodies, it’s imperative to provide evidence for adequate anti-money laundering (AML) systems. This is not relatively easy if data is juggled between multiple platforms and people. And without an audit trail, potentially harmful criminal activity can slip out of sight.

With a compliance officer at the helm, firms can check the capabilities of technology platforms and conduct thorough client risk assessments (CRA) for any future audit. Leveraging a modern system works in tandem with making strategic tweaks, as previously manual processes can be replaced by smart transaction monitoring and screening. So even though meeting compliance obligations is necessary, it offers the chance to optimise operational inefficiencies while reducing risk: it’s a win-win.

Importance of regulatory compliance

In the financial world, nefarious actors lurk to flush criminal proceeds through legitimate means. This could be money from corruption, human or wildlife trafficking, racketeering, and terrorism. Without regulatory bodies around the globe indebted to surfacing this dirty money, these actions can continue unopposed.

Any financial institutions, be they burgeoning startups or multi-regional traditional houses, are tasked with sticking to the legislations of global and local authorities to develop and run AML systems.

Discovering any suspicious and illegal activity. The UK’s National Crime Agency (NCA), a government body, controls the fight against organised crime, and the Financial Conduct Authority (FCA) monitors the conduct of financial companies operating in the UK.

The FCA’s tally of fines in 2023 reached over £52.8 million for failures to meet compliance requirements. Fines and reputational damage are critical punishments for businesses that fail to provide satisfactory CRA and AML measures, especially if missed risk alerts are linked to the broader devastating consequences of fincrime.

Establishing an airtight CRA model

Operational inefficiencies still blight the industry. Recovery from past AML failures and fines often spurs attempts to patch over legacy technology, which is prone to errors in outdated data sets and is unfit to change with new regulations. When analysts need to perform manual tasks that smarter tech could accomplish (AI, for example), there’s a significant risk of false positives – incorrectly identifying safe accounts as suspicious – which increases costs and workloads to correct them and can negate the accuracy of risk profiles.

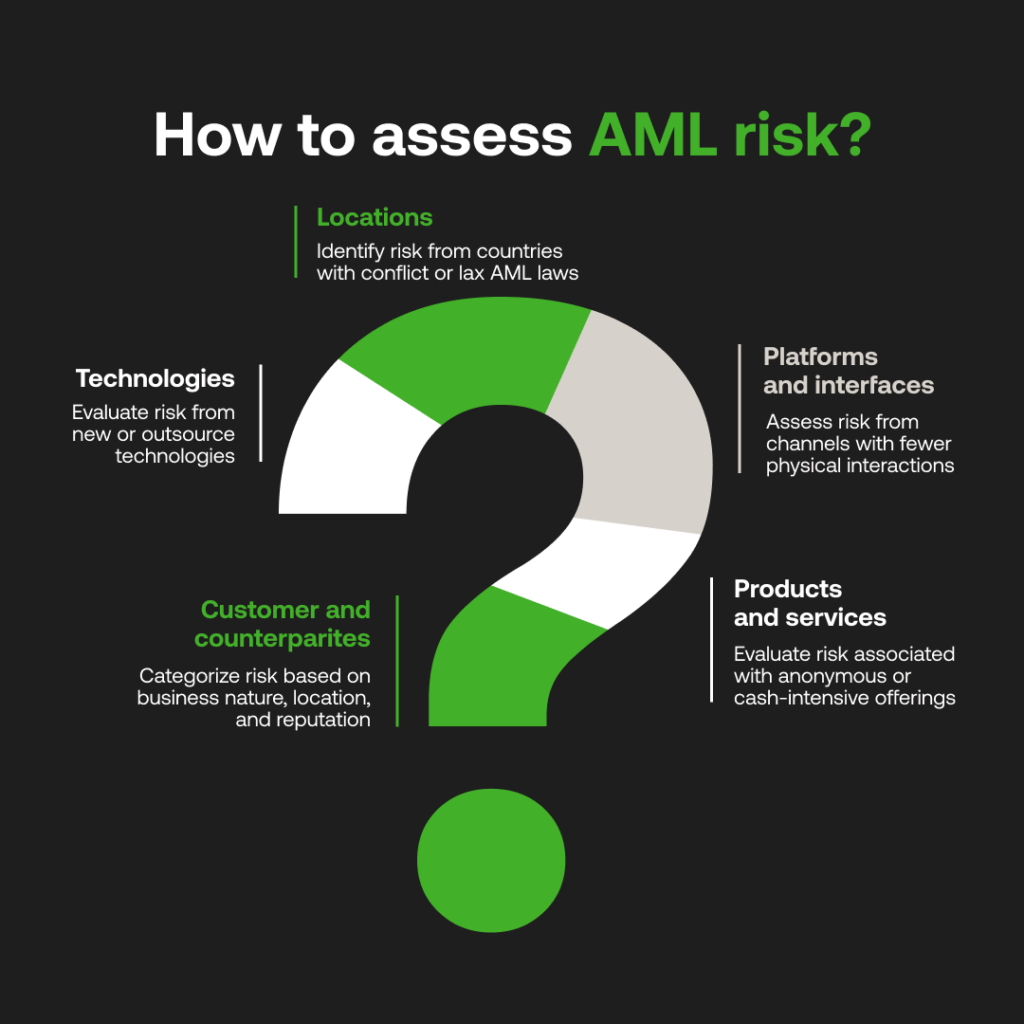

A strategic approach is needed for firms to streamline operations through robust CRA to avoid penalties. Appointed compliance officers act as a businesses’ knowledge base to maintain complete oversight on AML regulatory issues and to conduct risk assessments by investigating the following vulnerabilities:

- Customers and counterparties: Determining every account’s nature of business, location, reputation, transactional behaviour, etc., helps categorise them as low, medium or high risk. The latter could include offshore businesses, politically exposed persons (PEPs), casinos or arms dealers that require enhanced due diligence.

- Products and services: Particularly risky products could be anonymous or cash-intensive, including private banking or wire transfers. It’s imperative to assess the risks of any new products before launch.

- Platforms and interfaces: Any channels that require fewer physical interactions pose a higher risk, namely online, mobile, or telephonic channels.

- Locations: Any countries involved with conflict and those with lax AML legislation can be risky.

- Uncommon or new technologies: Outsourcing methods and acquisitions also require a risk assessment.

Ultimately, CRA requires building a comprehensive profile, which stems from establishing robust AML policies and using automated technology to process data and reduce risk.

Conducting compliance audits

Steps towards a successful audit start with instilling a compliance-first culture. With everyone in a financial business understanding the processes in place to check customers and transitions, it stresses the importance of compliance and their duty within it to stop any threat.

The internal audit comprises compliance teams outlining AML policies and procedures, maintaining records and documentation, and providing repeatable employee training. Systems and operational reports must ensure data is housed correctly and used correctly and that client information, transaction reports, etc., aren’t missing any information that could risk failing an external audit.

AML policy covers many areas of compliance measures – customer due diligence, onboarding and know your customer (KYC) checks, transaction monitoring to assess payment patterns, transaction screening to match any suspicious payments against adverse media or lists, and the reporting of suspicious activity. Compliance heads can also implement custom risk thresholds to manage the severity of alerts.

An adept monitoring and compliance platform should cover all these bases and be flexible to adapt to inevitable regulatory change. Luckily, tech is available to secure this proactive approach to compliance.

Implementing monitoring and control systems

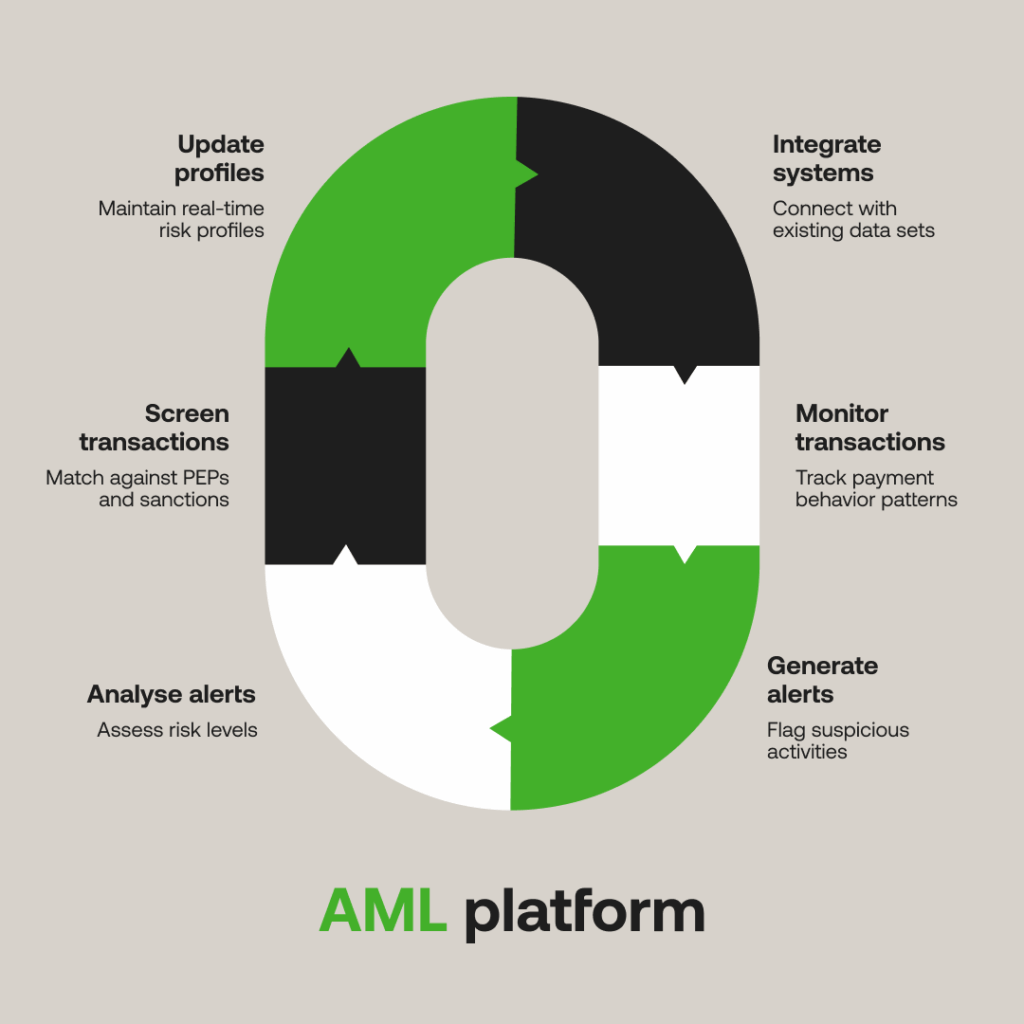

Modern AML platforms can integrate with existing systems and data sets, but they amplify operational efficiency through transaction monitoring and screening.

Transaction monitoring can help craft a holistic view of an account or a group of accounts by tracking payment behaviour patterns over time. Real-time alerts can flag suspicious activity outside these usual patterns for an analyst to deem high-risk and take further investigative steps. By implementing AI-based transaction monitoring, AI automatically scans the system’s vast data sets in seconds to negate any low-risk alerts (according to risk thresholds). This gives a firm more time to investigate high-risk individuals, companies, or payments and reduces false positives.

Smart systems are perpetually up to date, profiling risk in real time. Transaction screening involves smart matching against PEPs or sanctions lists to determine payment identification or management. It’s imperative to provide timely flags as and when suspicious transactions occur to solve risk factors swiftly.

Benefits of integrating compliance and operations

Taking hold of automated technology and data processing helps compliance heads conduct CRA with greater speed and accuracy. But it also removes the manual headache of compliance to, in turn, smooth operational AML hurdles. Constant automated processes, particularly transaction monitoring and screening, ensure thorough audit trails are ready for regulatory matters.

With an all-in-one platform covering each task within an AML procedure, the risks of suspicious transactional behaviour are reduced and businesses can stay one step ahead of the fincrime underworld. Regulation may shift accordingly, but so can the modern monitoring and compliance system.

Talk to our team today to learn more about how RelyComply’s AI-driven AML platform can help reduce risk and automate due diligence, monitoring, screening, and more.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.