How 2023 IFTRs may affect your business

Table of Contents

- What is an IFTR?

- What is the Objective of Section 31 of the FIC Act?

- What should give rise to an International Funds Transfer Report?

- Who should submit International Funds Transfer Reports?

- What information should be reported in an International Funds Transfer Report?

- The period for submitting an International Funds Transfer Report

- How should an International Funds Transfer Report be submitted to the Centre?

- What should the consequence of a failure to report an International Funds Transfer be?

On 20 January 2023, The Financial Intelligence Centre announced the commencement of Sections 31 and 56 of the Financial Intelligence Centre Act, 2001 (FICA) will take effect on 1 February 2023.

What is an IFTR?

An IFTR “International Funds Transfer Report” requires accountable Financial Institutions (FIs) and non-financial businesses to report certain information about electronic fund transfers that come in and out of South Africa and which are over a specific threshold amount to the FIC (Financial Intelligence Centre).

An IFTR is a requirement of the FIC in Section 23 of the FICA, which states: “If an accountable institution through electronic transfer sends money above a prescribed amount out of the Republic or receives money above a prescribed amount from outside the Republic on behalf, or the instruction, of another person, it must, within the prescribed period after the money was transferred, report the transfer, together with the prescribed particulars concerning the transfer, to the Centre.”

Financial institutions are defined as banks, credit unions, credit card companies, money transfer companies, payment processors and digital wallets – essentially any organisation that handles money on behalf of another person or business. Non-financial businesses are any firm which receives funds or makes payments on behalf of others through an external party such as a financial institution.

For example, if you accept fund transfers on behalf of your customers, you may be required to collect, verify and submit certain information under the IFTRs. The information gathered by the IFTRs will be used to fight corruption and money laundering by strengthening anti-money laundering (AML) and combating the financing of terrorism (CFT) measures across the international community.

The threshold amount of which a transaction must be reported to the Centre under section 31 of the Act is R19 999,99.

These regulations take effect on 1 February 2023.

What is the Objective of Section 31 of the FIC Act?

The objective of section 31 is to ensure that information relating to cross-border electronic funds transfers is made available to the Financial Intelligence Centre as soon as possible to enhance its ability to analyse data concerning financial flows. IFTRs strengthen the FIC’s ability to detect suspicious or unusual activity and disseminate relevant information to investigating and prosecuting authorities.

What should give rise to an International Funds Transfer Report?

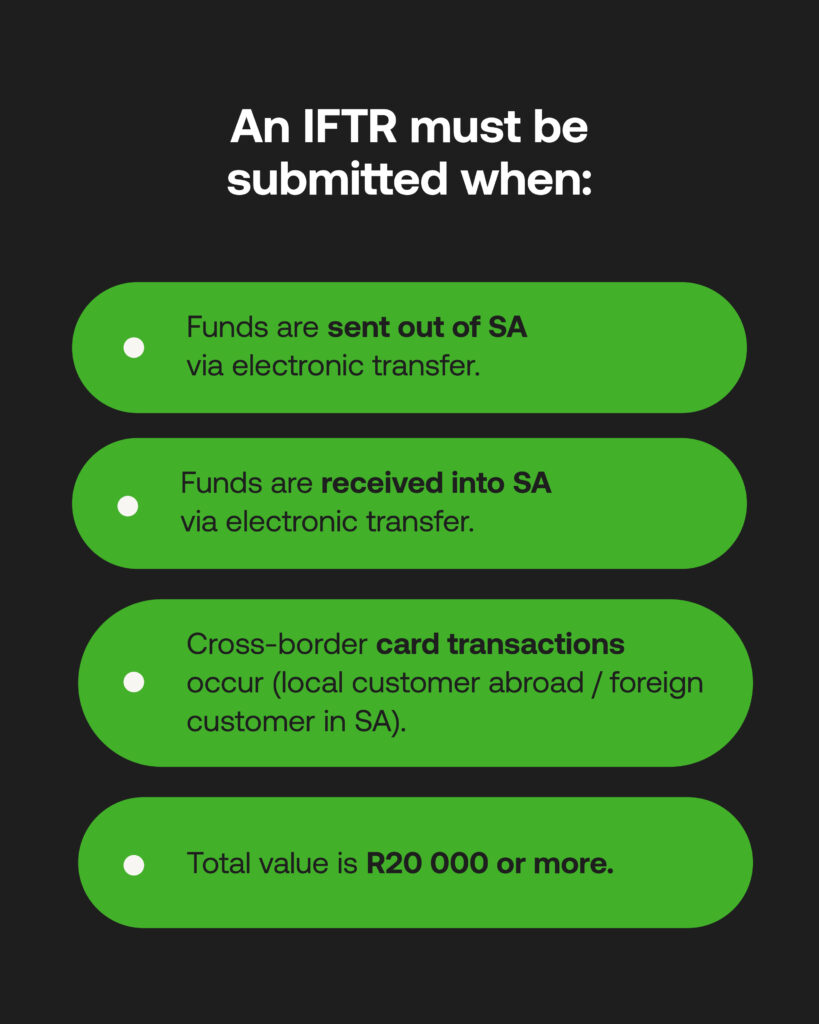

Accountable institutions must submit an IFTR when a transaction above the prescribed threshold has occurred via an electronic transfer into or out of South Africa. Examples of transactions of this nature include:

- Remittances through which funds are sent, or payments are made to persons located outside of South Africa;

- Remittances through which persons in South Africa receive funds (including payments) from persons located outside of South Africa;

- Credit and debit card transactions with a merchant outside of South Africa;

- Credit and debit card transactions by a person outside of South Africa with a merchant in South Africa.

Due to the potential terrorist financing threat posed by cross-border electronic funds transfers in small amounts, it is prudent that countries should have mechanisms in place to trace such transfers and should minimise thresholds while being conscious of the risk of driving these transactions underground.

For this reason, the Centre proposes that the threshold for IFTR reporting be set at a relatively low value while avoiding requiring reporting on high volumes of transactions comprising low-value remittances.

This means that all cross-border electronic transactions (the sending of funds out of South Africa and the receiving of funds from outside of South Africa) from a value of R20 000 and above will have to be reported to the Centre.

Who should submit International Funds Transfer Reports?

It is important to note that only some categories of accountable institutions are authorised to conduct the business of cross-border funds transfers.

These institutions are authorised in terms of the Regulations under the Currency and Exchanges Act, 1933 (Act 9 of 1933) (the Exchange Control Regulations) to conduct authorised transactions under the Regulations.

Institutions with this authorisation are Authorised Dealers (ADs). Authorised Dealers with Limited Authority (ADLAs) and a category of financial services providers with a direct reporting dispensation under the Exchange Control Regulations. In addition to ADs, ADLAs and financial services providers with a direct reporting dispensation under the Exchange Control Regulations, the Post Office is also allowed to conduct transactions to transfer funds out of South Africa and to receive funds from outside South Africa and does so using postal orders and money orders.

ADs, ADLAs, and financial services providers with a direct reporting dispensation under the Exchange Control Regulations and the Post Office are accountable institutions that fall within the scope of Items 6, 12 and 19 of Schedule 1 to the FIC Act. Accordingly, in practice, the obligation to report information under section 31 of the FIC Act will fall only on the accountable institutions in these categories that may legally conduct transactions to transfer funds into and out of South Africa.

What information should be reported in an International Funds Transfer Report?

The information relating to the transfer is to be reported to the Centre under section 31 of the FIC Act and will be prescribed in the Regulations. The following information pertaining to the transfer must be provided to ensure sufficient transparency and traceability to analyse the financial flows enabled through the transfer:

- Recipient of payment

- Purpose of payment

- Total value of the payment

- Value of currency used in payment

- Reference number

- Date of the transaction

- Account numbers

- Transactions Numbers

- Confirmation from the foreign authority that the person to whom the payment was made was an individual or an entity that legally owned the funds or the goods or services being purchased

- Source of the funds used to make the payment

The prescribed information to be reported in respect of an international funds transfer consists of certain compulsory information that is essential for the Centre’s analysis process and further information that will have to be supplied if it is readily available to the reporting institution. The full description of the proposed information to be contained in an IFTR can be found in the proposed amendments to the Regulations in Annexure A (new proposed regulation 23E to be inserted in the Regulations).

The period for submitting an International Funds Transfer Report

It is proposed that a report under section 31 of the FIC Act be sent to the Centre as soon as possible but not later than three days (excluding Saturdays, Sundays and public holidays) after the accountable institution has become aware of the fact that the transaction has occurred.

How should an International Funds Transfer Report be submitted to the Centre?

It is proposed that reports under section 31 of the FIC Act be submitted directly to the Centre using the goAML platform.

What should the consequence of a failure to report an International Funds Transfer be?

From 1 February 2023, Section 31 of the FIC Act comes into operation, and section 56 of the FIC Act will also take effect.

Section 56 deals with the failure of accountable institutions to report electronic transfers. A person who fails to report such transactions may be found guilty of an offence or non-compliant and subject to an administrative sanction.

Section 68 of the FIC Act states that a person convicted of such an offence is liable to imprisonment for a period not exceeding 15 years or to a fine not exceeding R100 million.

In addition to the provisions of the FIC Act that will apply to a failure to report an international funds transfer, it is proposed that regulation 29 of the Regulations be amended to reflect that a failure to provide the prescribed information to be reported concerning an international funds transfer following the new proposed regulation 23E would amount to an offence, or alternatively, to non-compliance that would be subject to an administrative sanction.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.