Is AI the silver bullet for streamlining AML compliance?

Table of Contents

With financial crime on the rise, global industries are finding new ways to fight back. Regulators have had little choice but to be more stringent with legislation when the real-world impact of money laundering and terrorist financing can be so worrying. Streamlining AML compliance is more important than ever.

The financial world finds itself in the firing line for incomplete compliance protocols. Adhering to regional rules from local money regulators or recommendations laid out by the International Financial Action Task Force (FATF), firms have the unenviable task of reducing financial crime risk by implementing anti-money laundering (AML) compliance processes, which could be costly, lengthy, or both. If achieving full compliance was so easy, criminals wouldn’t be able to get ahead of vigilant firms and regulators.

In a positive light, AML compliance technology is advancing quickly. Artificial intelligence (AI) is becoming a popular automation tool, transforming old manual ways of mitigating risk, producing accurate data-driven insights less prone to human error. That said, its success still relies heavily on an irreplaceable human element.

AI’s dual application for streamlining AML Compliance

There’s a lot of hype surrounding AI technology and the list of things it can achieve. These can often be misconstrued as more abstract ideas. In practical terms, however, AI serves two distinct applications for AML compliance protocols.

AI first automates tasks previously undertaken by people. It’s not so much ‘taking human jobs’ as it can be advertised; instead, it provides a shortcut to lessen time-consuming tasks. We see AI in facial recognition software for speedy logins and natural language processing (NLP). In contrast, AML analysts use automation to summarise documents, check messaging sentiment, or extract notable adverse media. The technology helps verify customer information and track interactions over a period of time. Automation can often be cheaper than off-the-shelf tools that may or may not do a better job than their human counterparts.

Elsewhere, AI is a form of advanced data analysis that can process vast amounts of information to learn patterns and pick out anomalous red flags. No human can mimic a computer’s intrinsic skill for data processing, which is already useful for transaction monitoring and works well with a company’s bespoke data sets. With humans handling parts of compliance efforts that AI can’t automate and vice versa, they could make AML and counter-terrorist financing (CTF) processes more efficient.

Understanding AI risk

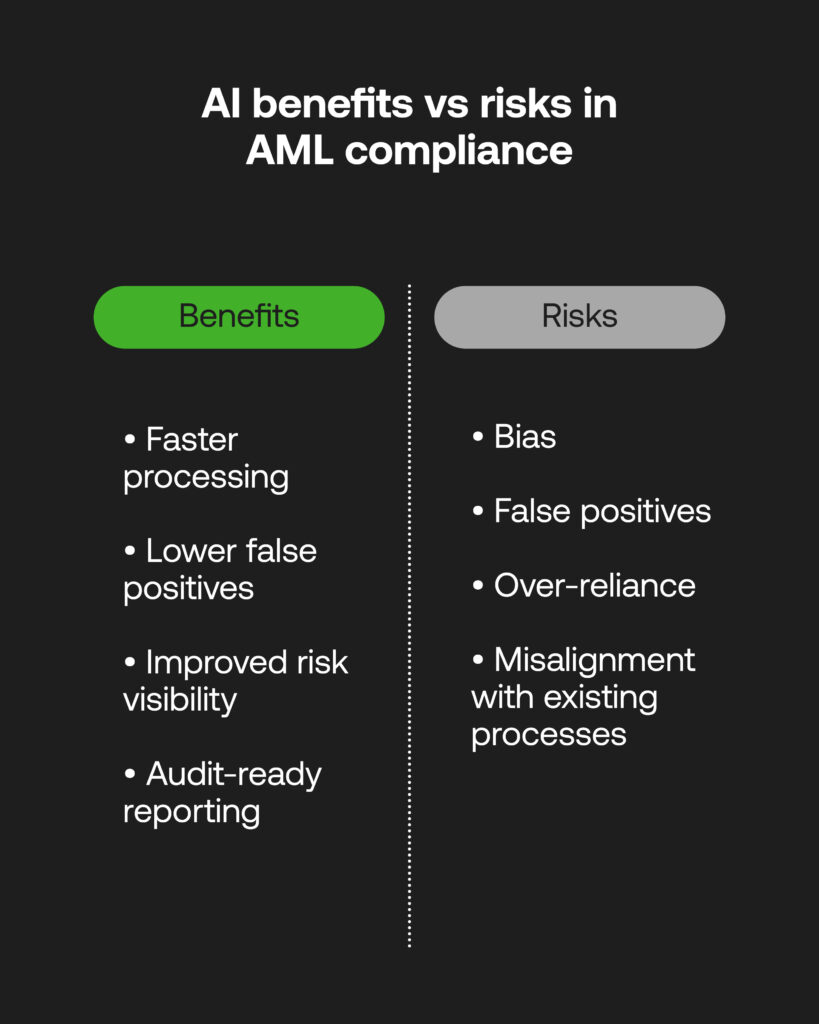

This progression of AI is not without its dangers; however, it could be tempting for firms to dive in at the deep end with an advanced AI solution. Evaluating how the technology, at various maturity levels, can suit existing business processes isn’t so straightforward.

There are still problems within AML processes that need to be ironed out. Suspicious activity is traditionally flagged according to rules-based systems, where errors can be missed or whereby analysts flag ‘risky’ data that isn’t there (false positives). One report cites these false-positive rates at 95%. Both can lead to strong regulatory action, harmful repercussions in the real world, and damage to professional reputations.

And while AI has been used as a starting point in low-risk cases, it’s not as simple as implementing an AI solution and letting it work things out for you. Uninformed usage of AI for AML compliance can, in a worst-case scenario, trouble the waters regarding understanding customers and building trust in financial systems. Facial recognition, for example, has seen race and gender biases when used for identification. In contrast, AI algorithmic bias could continue down this tricky path by reproducing flawed historical biases, such as producing incorrect risk profiles for customers based on unconnected fraudulent transactions within their jurisdiction.

While AI can unlock benefits for AML compliance, firms need to understand if they can hone it, which calls for AI specialists to make educated decisions around its use.

AI and humans work better together.

Luckily, in capable hands, the AI space has moved on so rapidly that we understand its positive impact far more than we used to. AI goes beyond just one metric to identify the context and characteristics of specific transactions, which could predict future criminal activity based on the regularities it learns. Being able to tag and index customers or transaction data accordingly can help visualise pertinent information that would otherwise be missed while reducing the risk of false positives.

AI-backed technology increases the speed of processing more accurate data, understanding risk, and providing audit evidence immediately. But the buck stops with a compliance officer, who needs the correct financial data to make critical decisions. Humans and AI tools ultimately try to achieve the same goals, and each half of the partnership reinforces the other.

AI may not be a silver bullet on its own. A new-look compliance solution driven by automation and advanced data analysis could make a world of difference in battling money launderers when partnered with experts in the field.

Find the right AML RegTech partner

Legacy systems can no longer keep up with each step of AML compliance; manual onboarding, monitoring, and due diligence processes could miss vital information, pose risks, and place staff under tremendous time constraints. Instead, our end-to-end solution provides fast, innovative technology for powerful AML screening and monitoring and can integrate seamlessly with your compliance systems.

To learn more about how AI-driven solutions can improve streamlining AML compliance, speak to the RelyComply team.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.