Discover 2026 compliance trends

An AML guide to planned, proactive automations

2026 compliance trends are already shaping how financial institutions plan their key approaches for the year ahead. With tighter budgets and heightened regulatory oversight competing against the drive for innovative growth, a risk-based compliance strategy remains a critical focus across the financial services sector—a topic consistently discussed at roundtables, industry meetings, and through our RegTech partnerships here at RelyComply.

Recent years have highlighted the need for stronger security in response to evolving digital threats. Today, AI for regulatory compliance is stepping up, bringing greater expertise and judgment to strengthen AML defenses. Institutions prioritising proactive compliance are not only mitigating risk but also building confidence in technology to stay ahead of regulatory challenges.

So much so, that three cornerstone compliance trends have emerged through 2025, concretely displaying greater strides being made to avoid regulatory repercussions.

Cooperative KYC and AML compliance 2026

Recently in RegTech circles, financial companies have been investing in vendors to patch over their AML shortcomings. High-profiled failures in anti-fincrime controls may have had a distinct effect, in line with cybersecurity issues and data breaches becoming commonplace (as opposed to a niche corner-of-the-internet activity). Legacy compliance systems and processes cannot continue, and RegTechs offer a digitalised, integrated service to oblige with regulatory vice-grips – locally and globally.

It’s not just the nitty-gritty transaction monitoring and reporting protocols that are pronounced needs, but customer trust and transparency. Data governance – through GDPR, MiFID II, and other regulations – is as much a trust-winning exercise with onboarded customers as lengthy historical relationships. Encouraging protections and sustainability in maintaining data health has seen compliance teams, IT professionals, and executives all banding together to facilitate a more collaborative growth strategy hinging on regulatory technology.

Now, what dominates an aligned 2026 compliance strategy is platform takeup along the whole ecosystem from governments to regulators, down to fintechs or small enterprises. With risk-based management a must, and luckily more affordable today, that’s possible through a partnership-led roadmap considering the following priorities.

- Bringing compliance in at the early stages

Firms have become far more diligent with their compliance in recent years. Fines and broken reputation is too heavy a burden to face, and has stressed why risk controls are not a post-mortem operational checklist. Instead, compliance needs to be an embedded function that has a base level of sophistication worthy of modern AML; with the ability to scale up bespoke, smart automation tools that contribute to an end-to-end system.

Industry leaders are talking more about 2026 compliance strategy being an integral part of their current commercial planning. Of course, given the ‘cost of compliance’ banner, all matters of tech development pricing, vendor licenses, fees, add-ons and user training are a financial compromise to be obtained with CFO buy-in.

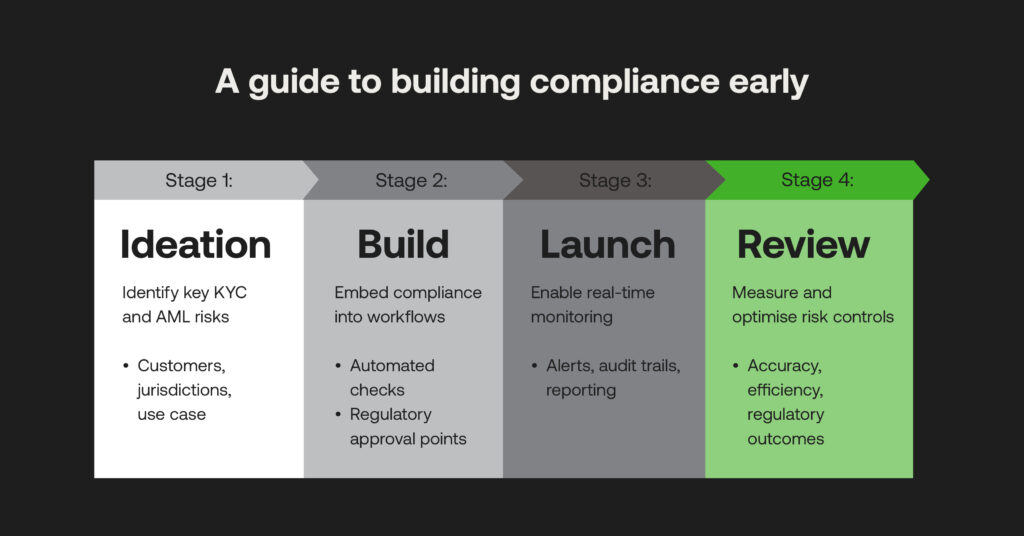

Considering product development early makes sure the system drives the compliance strategy rather than reacts to it. In that way, it’s best to look for how a regulatory system can empower efficiency and obtain ROI goals, helping justify its total cost of ownership in line with the entire financial institution’s regulatory effort:

- Business objectives, such as retained and new customer bases or greater workflow productivity, can be aligned to regulatory expectations – turning AML into a competitive advantage for growth, rather than a hurdle.

- Considered system builds have mandatory end-stage regulatory approvals in mind from the start, ensuring that prior investigative analytics, due diligence, and onboarding measures are implemented smoothly, quickly, and securely.

- Developing a RegTech system with integration experts allows designs to be roadtested for specific AML needs, preventing the hefty costs and time associated with retrofitting compliance measures post-launch.

For example, a design stage may involve a fintech looking to instill tricky cross-border payment compliance. Identifying KYC and AML risks at ideation stages (such as sanctioned individuals, or adverse media) means that tweaks can be made then, and the platform’s effectiveness is not dulled when it comes to deployment. Team sprints could be considered as regular cross-department reviews to determine the impact of technical implementations on regulatory metrics and best practice.

- Quantified compliance risk across products and markets

It was once commonplace to hear compliance banded around as a lazy buzzword, doing little for its reputation as a check-box legality. Regulatory leaders though, in conjunction with recommendations supplied by FATF and national regulators, can make risk management far more measurable – less ‘fluffy’ to try and justify RegTech spend to the C-level boardroom.

This involves assessing whether allocated resources are being used over time, according to product-level efficiency and upward to expanding compliance expertise across a business. Audits on legacy technology during the investment decision stage can identify weak AML spots which need improved functionality the most, while assessing product development continually can reiterate where it best benefits the compliance function:

- Benchmarking which product offerings on the market can limit risk exposure, and complement existing data formats, volumes, and workflows is key to ensuring a more selective and seamless transition to digital AML compliance.

- A system able to unite departments and track workflows showcases if data is being shared efficiently during AML processes – ultimately highlighting compliance maturity across a workforce.

- A risk-based compliance strategy requires customer profiles to be user-set against thresholds determining high-risk factors or transactional behaviour, where a sophisticated AML product can update these records in real-time and avoid retrospective troubleshooting.

- When various jurisdictions operate different regulatory regimes, compliance leaders should account for geographical discrepancies, and enable AML systems that account for regions with added risk.

Producing a quantifiable risk framework for an AML system goes beyond instilling a front-line defence, essentially ensuring that it’s operating at its best to surface pertinent AML data, and provide metrics that support the business line. The lifecycle management of RegTech investment involves acting on the results of singular products and their handling teams. From there, highly strategic operational changes are made that matter most to cost, manual effort and investigative accuracy.

- AI in compliance: Simplifying complexity

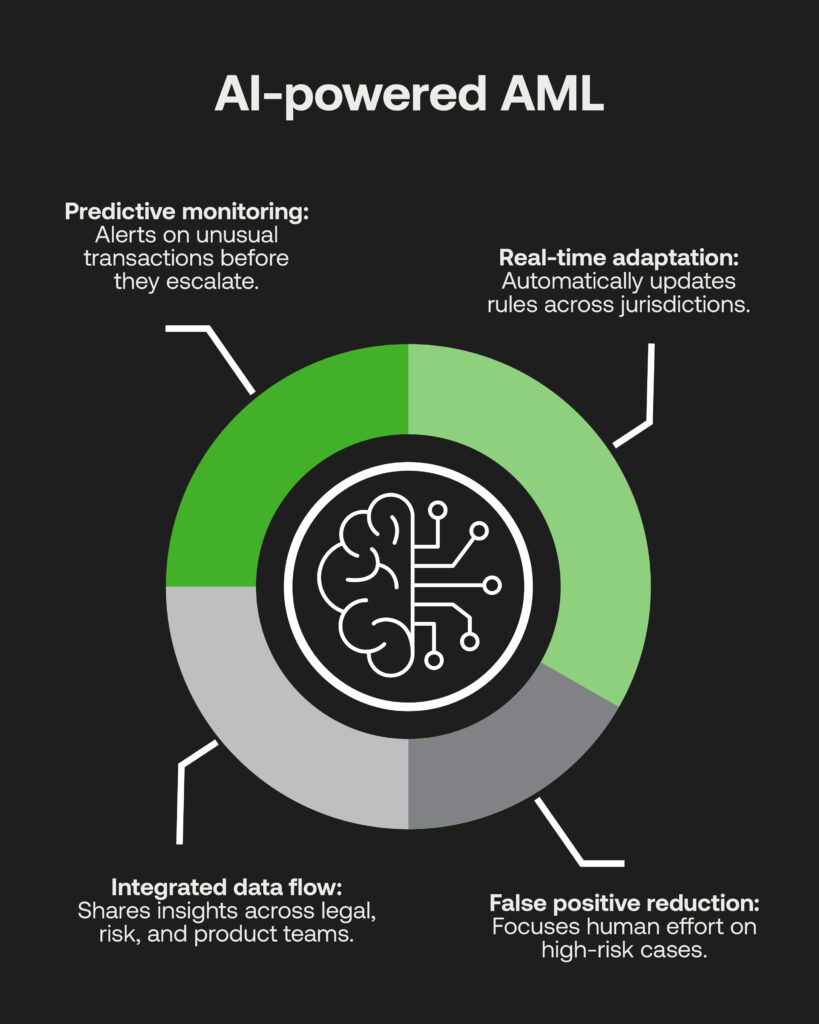

As compliance priorities go, enabling artificial intelligence as a core digital advantage for AML is vital. While many misinformed pilot projects may not reap the rewards of AI’s data processing capabilities, in the hands of data engineers they’re indispensable tools to achieve monitoring and screening functionality with cutting-edge accuracy.

Manual customer identification and payment monitoring is a dying art; given the complexity of growing transaction volumes, contexts, and types (now including cryptocurrencies and other digital assets), compliance inefficiency gets compounded when firms are without ways to automate the incremental stages involved in risk assessment.

Trained AI models against historical data – which financial systems have in abundance – can alert unusual patterns in these monolithic datasets, raising only high-risk possibilities and reducing wasted hours on false positives. AI can also flexibly adapt systems to regulatory changes, including those specific to geographic markets, and share interoperable real-time data across legal, risk and product teams for reporting measures.

AI’s predictive and round-the-clock methods are now the foundational tool underpinning a 2026 compliance strategy, enabling financial institutions to not feel inhibited by regulatory pressure and spend more time boosting risk-based protocols. Starting small with AI applications and guided implementations can provide a base level for advanced AML, where its ability to scale can be actioned later under growing customer numbers.

Choosing to make AML compliance imperative

Operating models for compliance have had to evolve, just in the way that financial criminals do their best to curb the sophisticated defences institutions are taking under direction of watchdogs. For the whole ecosystem to flourish, compliance leaders are spearheads for shifting the narrative around AML ‘best practices’ becoming advantageous, automated powerhouses that safeguard business reputations, and their end customers.

If these compliance trends are followed actively and across the board from Tier 1 banks to burgeoning lenders or payment providers, that attitude to proactive risk management should permeate every part of the landscape – positioning every major player as an innovative, savvy proponent for AML, even when regulatory measures only continue to skyrocket.