How AML technology is transforming compliance

In an era where financial crime grows more sophisticated by the day, the role of AML technology has never been more critical. Rapid advancements in artificial intelligence, real-time analytics, and RegTech innovation are transforming how institutions detect, investigate, and report suspicious activity – moving the industry from reactive controls to proactive, intelligence-led strategies. As regulators worldwide introduce stricter oversight and heightened transparency expectations, firms must navigate a landscape where AML technology is not just a competitive advantage but a regulatory imperative. The future of AML will depend on how effectively organisations can combine cutting-edge tools with human expertise to stay ahead of evolving risks, emerging criminal typologies, and increasing global compliance demands.

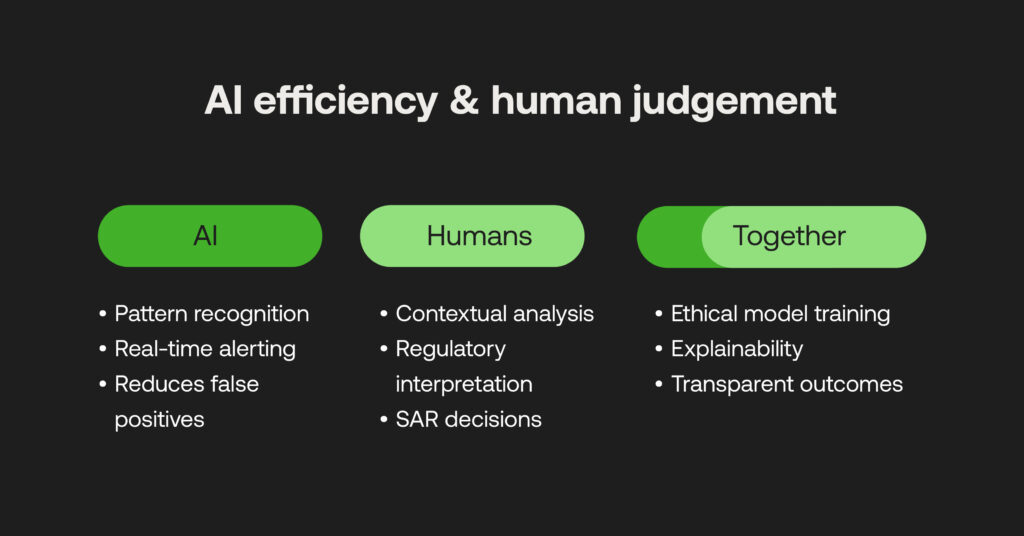

Artificial intelligence and machine learning

AI excels at pattern recognition, data processing, and accurately pinpoint high-risk alerts that reduce false positives and manual error. Working in collaboration with human analysts that remain essential for complex decision-making, contextual analysis, regulatory interpretation, and final SAR determinations.

The most effective approach combines AI efficiency with human judgment and regulatory expertise. This is particularly true for ensuring training machine learning models are carried out ethically and with ‘explainability’ for full transparency, in light of strengthened AI laws globally.

Real-time monitoring and analytics

Following human-set rules, AI algorithms can track, analyse and flag anomalous transactions from vast historical datasets around the clock. This lowers the need for manual intervention on low-risk alerts, only surfacing suspicious payment behaviours that require deep analysis.

Automation as the backbone of AML technology

Using APIs, RegTech solutions provide an extensive suite of AML automations that integrate with existing systems to be deployed quickly and safely with ongoing support. For example, the use of AI to closely screen payments against trusted global sources, and monitoring for anomalous actions in real-time.

Cloud-based AML systems

Cloud-based architectures offer flexibility for financial institutions to scale their AML processes with growing user bases, extensive volumes of data and regulatory change from a single, centralised data management platform. Cloud servers are distinct for their enhanced data security.

Emerging technology, trends and predictions

Digital currencies create challenges including cross-border transaction monitoring, mixing services that obscure transactions, decentralised finance (DeFi) protocols, privacy coins, and rapid technological evolution. Traditional AML approaches need to adapt for blockchain analysis, smart contract monitoring, and digital asset-specific risk indicators.

Expected changes to regulatory coverage include increased automation requirements, real-time reporting obligations, expanded digital asset regulation, enhanced beneficial ownership requirements, and greater international coordination.

Global harmonisation efforts

FATF’s Recommendations exist to guide global requirements AML/CTF where regional authorities are responsible for maintaining their financial system’s commitment to anti-fincrime controls. FATF is exploring the possibility of converging standards through better cross-border collaboration, the potential for beneficial ownership registers.

The EU’s introduction of AMLA is attempting to unite frameworks for member states and international bodies (including the United Nation, the Organisation for Economic Cooperation and Development (OECD). G7 nations and the International Monetary Fund) are encouraging the use of advanced technology to strengthen coordinated AML capabilities worldwide.

Public-private partnerships in AML

Greater nationwide AML efforts rely on data sharing, collaboration and partnerships between regulators, government agencies, financial institutions, law enforcement to facilitate the reporting of suspicious activity that leads to prosecution (in line with FATF’s 11 Immediate Outcomes). RegTech providers can bridge the gap between the public and private sectors through advocating and implementing advanced technology that allows for timely reporting to authorities and consistent best practice in investigating financial crime.

Regulatory outlook and emerging trends

The FCA’s five-year plan will continue to develop RegTech approaches to fighting financial crime, as well as guide regulations for cryptocurrencies and digital assets, and provide clarity in its documentation. In July 2025, the FCA also reviewed its treatment of UK PEPs (FG25/3). In the post-Brexit world, the UK still maintains alignment with EU AML directives while developing independent standards.

South Africa published its draft AML and CTF Amendment Bill in 2024, covering greater governance, and expanding regulatory powers over any emerging risks, threats, and technologies. This corresponds to the progress seen since the country’s FATF greylisting, largely a result of collaboration between institutions, the Department of Social Development, the FIC and SARB)that has led to better AML frameworks for investigation and eventual prosecution.

FATF’s increasing oversight looks to provide a standard for AML harmonisation: expanding the role of compliance technology to react to changing criminal typologies.

Digital assets, including Bitcoin and other cryptocurrencies, continue to pervade AML discourse. While transparency can be achieved in decentralised finance, these payment types can hide laundering activity easily where AML systems must be adept at monitoring these new payments types.

Cross-border transactions are increasing in the global connected financial world. Firms in the UK, the EU and South Africa must monitor payments against compliance obligations, instill enhanced due diligence on intermediary or partner institutions and banking networks, while maintaining visibility across the payment chain. ISO 20022 messaging standards are improving transparency but require system upgrades.

AML technology solutions are becoming more greatly embedded within regulatory frameworks, and the work of governmental bodies, law enforcement and financial institutions to achieve a more proactive approach to compliance. With real-time analytics and data sharing capabilities, these connected authorities can surface high-risk alerts immediately to prosecute for wrongdoing. RegTech becomes a bridge for detecting and reporting financial crime across the ecosystem.

The future of AML is human and machine

As financial crime accelerates in scale and complexity, the future of AML compliance will be defined by the strength of collaboration between technology, human expertise, and regulatory alignment. Emerging tools – from AI-driven analytics to cloud-based architectures – are reshaping how institutions detect and respond to suspicious activity, while global harmonisation efforts and evolving regulations continue to raise the standard for transparency and accountability. Organisations that embrace this convergence will be better equipped to identify risks in real time, adapt to new criminal behaviours, and meet tightening compliance expectations across jurisdictions. Ultimately, the institutions that succeed will be those that recognise technology not as a replacement for human judgement, but as a catalyst for more accurate, efficient, and resilient financial crime prevention.