AML whistleblower protection: key to fight fincrime

Robust legal support for AML Whistleblower Protection is crucial to encourage reporting and safeguard those who speak up to help prevent financial crimes including money laundering and terrorist financing.

Whistleblowers who report suspicious transactions or activities can provide invaluable insights that allow authorities to detect and prosecute crimes that may otherwise go unnoticed. However, potential whistleblowers often face difficult choices and risks when deciding whether to come forward.

The Whistleblower’s Dilemma

Insider whistleblowers have unique access to information about potential wrongdoing that authorities may not be able to detect through traditional supervision channels. But the decision to step forward is fraught with risks. Whistleblowers may face retaliation in the form of dismissal, demotion, harassment, slander or threats. The emotional toll and social stigma associated with whistleblowing can also be heavy burdens.

Understandably, many are reluctant to jeopardise their careers and livelihoods to report misconduct. By strengthening legal protections for whistleblowers, this can help provide the security and confidence to enable reporting. Anonymous reporting channels may also encourage whistleblowers to come forward without exposing their identities.

Legal Framework for AML Whistleblower Protection

Laws that shield whistleblowers from retaliation provide a foundation for safe reporting.

Within the US, the Anti-Money Laundering Act (AMLA) of 2020 created a landmark whistleblower program to improve the detection and enforcement of Bank Secrecy Act violations. However, gaps in protections and incentives hindered its effectiveness.

The US 2022 AMLA Improvement Act then helped strengthen the program by setting a minimum 10% reward for successful tips, expanding eligibility to auditors and compliance officers, and establishing a fund to pay rewards. It also widened the scope to include sanctions violations. While bank employees still lack full retaliation protections, these amendments have significantly enhanced the AML whistleblower program to better uncover financial crimes.

Elsewhere, the European Union’s Directive (EU) 2019/1937 of The European Parliament and of The Council of 23 October 2019 protects whistleblowers from retaliation and requires firms to establish confidential reporting channels. On 15th February 2023, the EU referred 8 countries to the Court of Justice for the European Union for failing to comply.

Many other countries have adopted similar laws. The first Whistleblowers Protection Act in Japan was implemented in 2004, with its guidelines amended in 2021. These have been enforced since June 2022 to establish new requirements for Japanese businesses.

However, laws are still lacking in some regions, including parts of Asia and Africa, while many existing laws do not meet best practice standards endorsed by the Organisation for Economic Co-operation and Development (OECD) and anti-corruption groups. There are often gaps in the scope of protected disclosures or entities covered.

Key Components of Effective Whistleblower Protection

Strong whistleblower programs share common features that enable the safe reporting of potential misconduct:

Anonymity and Confidentiality

Fears of exposure often deter whistleblowing, so options to report anonymously and keep a whistleblower’s identity confidential are critical. Anonymous hotlines, online portals, and encrypted digital drops allow anonymous disclosures. Confidentiality prevents exposure during both investigation and in case proceedings.

Legal Safeguards and Remedies

Laws must prohibit retaliation and provide remedies if retaliation occurs. This includes reinstatement, civil damages, and criminal sanctions for retaliators. The burden of proof should rest on the employer to show that adverse actions are not retaliation. A waiver of liability removes legal risks for good faith whistleblowers.

Encouraging AML Whistleblowing

Beyond legal protections, fostering an ethical culture that encourages speaking up is vital and leaders should actively affirm that retaliation will not be tolerated. Policies should require periodic staff training on whistleblowing rights and procedures andrewards or incentives for useful disclosures can also motivate insiders to come forward.

Public awareness campaigns can also promote reporting financial crimes as a civic duty whilepartnerships with civil society groups can provide support networks for whistleblowers.

Challenges and Barriers

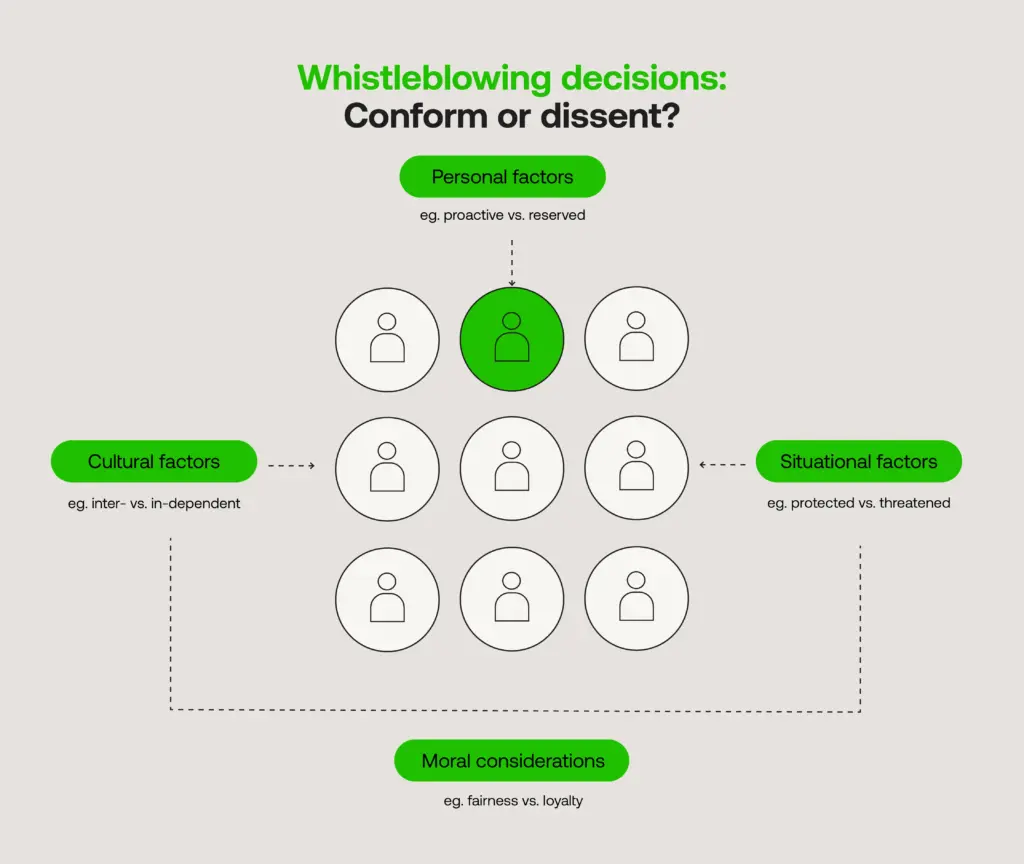

Implementing effective whistleblower protection faces obstacles due to cultural attitudes and a lack of trust for the following reasons:

- A fear of retaliation persists especially where protections are new or untested.

- “Anti-snitching” norms consider whistleblowing disloyal in some cultures.

- Whistleblowers may be perceived negatively as motivated by money or revenge.

- The lack of anonymity and a weak shielding from retaliation undermine trust.

- Narrow definitions of protected disclosures leave many unsure whether their report qualifies.

- Overly complex or opaque reporting procedures create uncertainty.

- Resource constraints may limit an authorities’ capacity to receive and act on disclosures.

Holistic solutions are required to overcome these barriers. Outreach and training to shape attitudes around whistleblowing, combined with strengthened legal systems, can help build re-establish trust and the willingness to report financial crimes.

Whistleblowers FAQ: a South African perspective

What rights do whistleblowers have?

What does the South African law say about protecting whistleblowers?

What constitutes occupational detriment against a whistleblower?

What recourse do whistleblowers have if they face retaliation?

What institutions can a whistleblower make a protected disclosure to?

How can whistleblower protections be strengthened?

Where can I find more information on whistleblower rights?

This is the accordion title

This is a hidden block

The Role of Technology

Technology provides new channels for secure and anonymous whistleblowing. Encrypted online portals allow documents to be submitted anonymously and digital drops like GlobaLeaks or SecureDrop enable anonymous messaging. AI chatbots are also available to interact with whistleblowers and guide them through the disclosure process.

Data analytics techniques can help detect retaliation by flagging patterns such as unusual job transfers. Although technology facilitates disclosure, the human element remains critical – whistleblowers want to know disclosures are received and acted upon. Ongoing communication around the investigation progress provides this reassurance.

Conclusion

Robust legal protection enables whistleblowers to expose wrongdoing that could otherwise fester if undetected. As AML efforts move beyond a “check the box” compliance approach towards risk-based enforcement, insider information will become more crucial.

Whistleblowers provide unique intelligence to disrupt sophisticated money laundering typologies. Countries worldwide must implement comprehensive whistleblower programs to be integrated across regulatory agencies.

With strong safeguards and incentives in place, insiders can help authorities more than ever to effectively combat financial crime.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and can not guarantee accurate, timely or reliable information for use in future cases.