Building a sustainable KYB compliance ecosystem

Table of Contents

There’s no beating around the bush: the financial world may feel connected, but the regulatory gaps between players paint a very different picture. Achieving a worldwide standard for anti-money laundering (AML) is tough given jurisdictional cultural differences, market competition and levels of risk attached to regions. However, without shared expertise and experience in implementing RegTech, a safe financial future may cease to exist at all.

AML compliance is changing face numerous times to remain proactive to the criminal evolution we see resulting in hefty fines, for both the globe’s largest banks and more cash-strapped hungry startups. Advantaged technology can democratise the ability for fallible firms to perform quality know your business (KYB) checks that reduce the potential for faulty AML controls, as well as gain greater transparency around who owns a business and what they’re all about – ultimate beneficial owners (UBOs).

The existence of UBO registries is a tough nut to crack. It will take a while (or perhaps never at all) to see them spring up over the world, but identity verification stems from a healthier ecosystem adept at storing and sharing KYB data compliantly to face a new frontier of fincrime.

Tracking UBOs: the foundation for strengthened KYB

Onboarding businesses is as much a priority as gaining new customers to achieve growth, and confusing business structures provide larger hurdles to consistently maintain sound KYB. Labelling who is technically a UBO is a known thing worldwide – defined by South Africa’s Companies Act as anyone with a minimum of 5% ownership of an entity – but that does not make them simple to find.

UBOs may mask themselves to cover reputational damage or laundering, or to withhold pertinent data from competitors. This lack of transparency only compounds the complex task of separating sophisticated criminals from legitimate customers at the KYB stage, so much so that confidence in managing shell company risk remains low even at large institutions, around 29%.

When the existence of shell companies and the inner workings of a business are not made clear, it poses integrity problems for the entire system, no less as UBO data (when available) is handed over at the behest of the very companies being monitored. Some nationwide or continental agencies are championing public registers, others more limited non-public registries for the use of regulators and law enforcement, but evasive bad actors can still take advantage of this disparate approach to UBO verification.

If Business and Entity Verification (BEV) processes are taken more seriously by regulators, governments and financial institutions (FIs), UBO data can be less fragmented and fit for use in identity verification (IDV) software that is gathering steam. When automated, FIs can benefit from shifting in line with inevitably updated global registries or sanctions lists.

The compliance pros and cons of third-party partnerships

Low UBO visibility will very likely dismantle public confidence in any company, including any third-parties FIs will look to partner with. That certainly does not mean resisting any co-dependent relationships (as vendors can significantly improve operational means, technological tools or support). Instead, it requires changing the narrative that FIs must reduce the burdens of manual onboarding to build more accurate, technology-driven KYB that can outline the company structures, UBOs, and indirect vendors associated with external providers.

Of course, any third-party partnerships will come with added ‘baggage’ from their external networks; interconnectedness is great, so long as due diligence is displayed at every organisation in the supply chain. Managing risk for one layer is tough enough without advanced KYB monitoring and screening, exacerbated to account for every other entity that will have their own capabilities in identifying UBOs. This can worryingly be made even more difficult with tricky identity obfuscation technology used by fraudsters. 82% are not able to detect synthesised identity data in UBOs structures.

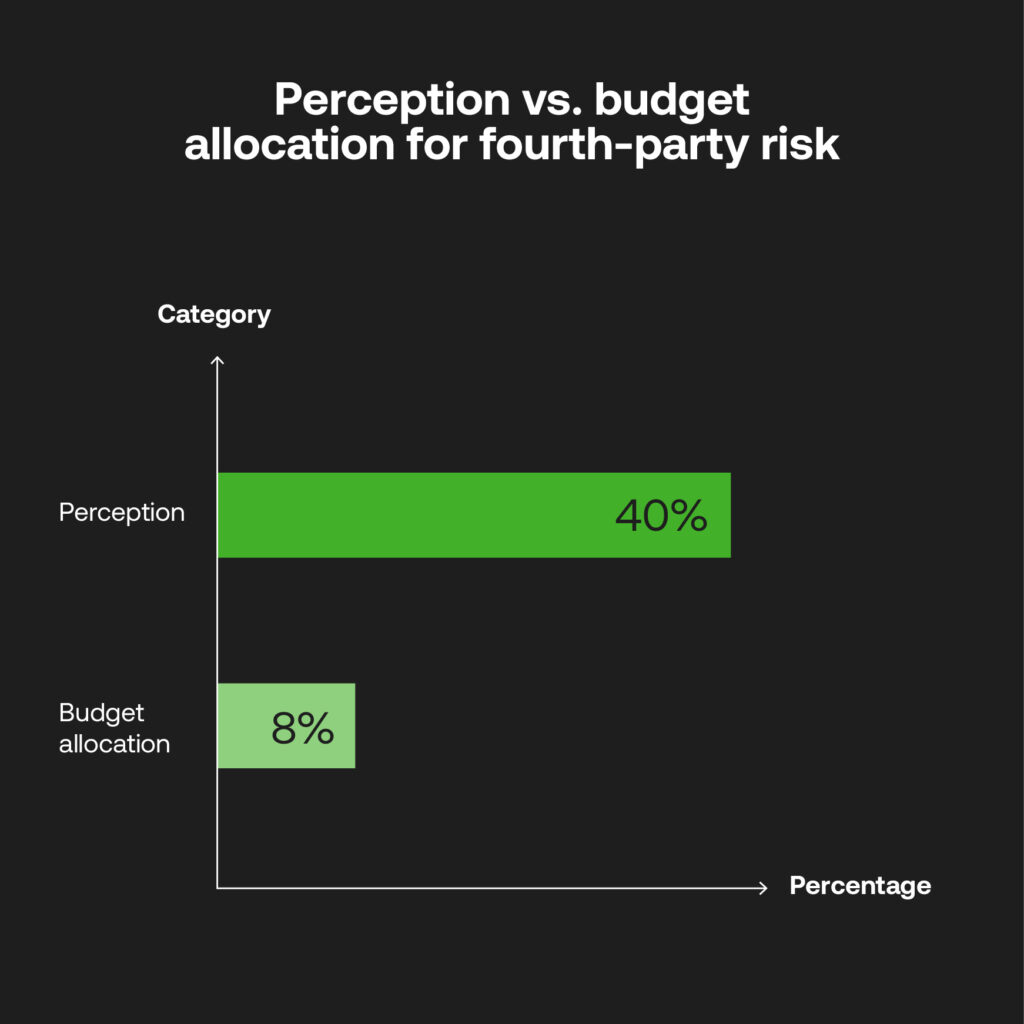

While around 40% of practitioners see fourth-party risk as the undeniable leading risk factor when doing business with partners, only 8% of AML budgets is allocated to this. This is perhaps due to the cost constraints of KYB compliance, or the lack of awareness of technological advantages. Still, it represents how constant visibility into company structures is the only way to truly understand the data security of the entire ecosystem. Only FIs that can verify identities immediately to accurate degrees will pull ahead, gaining the operational and competitive advantages of real-time KYB that regulators seek from accountable institutions.

How continuous KYB crafts trust in the financial ecosystem

Progress in the system is hindered when quick fixes for onboarding are made, but not maintained. Even instant verification is not a one-and-done solution for KYB – the moving world demands continuous monitoring that updates any business risk profiles that may be exposed to laundering or other forms of fincrime. Therefore an entire AML function has to retain oversight, in one view and with automatic tools to ‘complete’ missing compliance gaps. Only then can businesses be reactive to sophisticated criminal methods and regulatory backlash, rather than anticipating potential risks.

RegTech is paramount to instilling KYB for the modern world, and to monitor customers and their organisations around-the-clock with trusted watchlists. Technology can raise alerts, identify patterns and help to understand the motives and actions behind illegitimate fund flows and entities, but the buck lies with compliance teams to instill risk thresholds and analyse the information that leads to any third-party threats being nullified straight away. It takes a human-RegTech hybrid for AML systems to be up to task.

Even further than this, collaboration across borders has to become a norm. In a 2024 Gartner KYC vendor survey, 36% of respondents identified the indispensable adoption of collaborative cross-industry networks for real-time detection. The current landscape of low or no UBO data usage provides blind spots to be exploited, where data privacy considerations are making FIs and regulators reluctant to share intel. The added takeup of RegTech across the ecosystem – from large-scale traditional banks to market entrants – will be required to ensure risk-based data storage and sharing is done so compliantly, to then be used to improve KYB capabilities across as many regions as possible.

Being transparent about all business relationships shows accountability, and therefore reinforces trustworthiness to any parent company looking to buy from, or partner, with someone.

RegTech as systematic building blocks

Reform for UBO registries is a much talked-about topic for governmental agencies, and it’s imperative that FIs feel ready to implement greater IDV in this crucial period of AML adjustment to the risks UBOs pose. RegTech platforms help identify any threat from a third-party vendor, ensuring that enhanced due diligence is only required where it’s needed to hone in on genuine threats that let legitimate partnerships flourish:

- Automate UBO discovery: when document uploads (for business addresses and registrations) are automatic, this reduces tedious and manual practices while AI goes a step further in extracting valuable data for verification.

- Integrate with registries and company data: AI-powered IDV can rapidly assess company directors, key stakeholders, UBOs and third parties using reliable data against government-approved lists, registries and adverse media.

- Scale configurations: compliance teams can craft risk-based strategies for bespoke business profiles, and continuously flag data anomalies to report suspicious activity to authorities immediately and maintain trust.

A connected ecosystem will require KYB protocols that are enhanced by RegTech, as even the here-and-now feels under threat by evasive company structures that can create holes in the world’s entire AML commitment. The future is driven by cooperation where every player tasked with detecting known fincrime risks can contribute, helped by real-time and continuous KYB technology that turns data into action. Financial criminals will not have the last laugh when proactive onboarding checks are in place, and the entire system they try to manipulate is empowered to stay ahead.

We hope you have enjoyed this series on the operational benefits of tech-powered KYC/KYB in this competitive landscape! If you have any questions on AI-driven onboarding and continuous KYC/B, please get in touch with the RelyComply team for a demo of our platform.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.