The challenge

The drastic effect of disparate systems

The bank prides itself on its bespoke products for corporate and retail clients, with a commitment to innovation and service excellence that makes it a trusted partner within the financial industry. But like other large institutions, they faced the challenge of overcoming a fragmented AML process under strict regulatory rules.

Teams separately handling onboarding, monitoring, and reporting tasks added the risk of non-compliance, which cost the sector a whopping R943 million in fines between 2023 and 2024, making proactive risk management critical.

Aware of the significant obstacles of these disparate, outdated systems, namely operational flaws that made reacting to new compliance rules slow and resulted in high costs, which could worsen due to the risk of fines. In the bank’s case:

- These workflows ultimately raised the total cost of ownership by up to 30%.

- Configuring new regulatory rules took up to three months.

Why RelyComply

Quick implementation for immediate business gains

The existing process hindered their team’s ability to retain the competitive edge they’ve continually carved in the South African banking landscape. The plan was to unite the team to strengthen compliance oversight with an AML system that could integrate with their business risk requirements.

To achieve an end-to-end solution, the bank implemented RelyComply’s platform, which could centralise financial crime detection and reporting results to regulators. This included an advanced transaction monitoring system to improve proactive control over AML.

Phase One of the implementation lasted six months and focused on planning, technical design, data ingestion, configuration, and testing. With a cloud-based architecture in place, they could enhance its existing systems and be fit to scale in several ways:

- A versionless API design could update and integrate the system without disrupting existing processes, all in an easy-to-use format.

- Leveraging GraphQL and Webhook APIs achieves simple synchronisation across disparate systems, consolidating pertinent AML data and workflows.

- The team can fetch only the required data in a single request, speeding up data operations.

- Real-time notifications ensure that significant events (customer updates or case creation) are reflected across these interconnected systems.

Following a swift deployment, the compliance team took advantage of the system’s similarly quick automation capabilities to perform analysis in a fraction of its original time – from days to minutes.

This transformed their approach to risk management, eliminating manual work and focusing productivity on high-risk areas. Ultimately, this increased accuracy across the end-to-end AML framework.

Our impact

Single view platform drives long-term growth

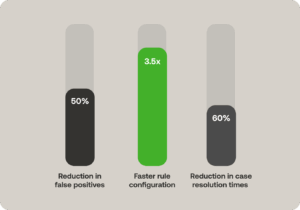

As a result of configuring their AML processes on RelyComply’s AML platform, the bank achieved measurable results to reflect their efficiency goals:

• 50% reduction in false positives with accurate risk-based processes, enabling better case management and prioritisation.

• 3.5 x faster rule configuration

• 60% reduction in case resolution times

• 57% increase in productivity for the compliance team allowed the bank to reallocate resources strategically, fostering adaptability to changing regulatory landscapes

• 30% increase in compliance efficiency with enhanced transaction monitoring, reducing regulatory risk.

Additionally, 100% of users found Transaction Monitoring on our platform easier to use than previous systems, with 80% rating it extremely easy to use, and 100% of reports were submitted to regulators on time.

“Facing compliance head-on is a challenge, but we’re able to tackle regulatory hurdles in a far more streamlined and powerful way using RelyComply. The set-up was swift and simple, unifying and empowering our AML team to mitigate risk with confidence, helping the business to provide sustainable, cutting-edge solutions for our customers.”

– Executive Head of AML and Compliance

End-to-end solution lowers total cost of ownership

The new AML setup is fully adaptable to any changes caused by regulatory uncertainty and financial crime methods. Streamlined AML workflows drive more sustainable practises, allowing the bank to focus more on strategic growth initiatives. These improvements have helped position them as an innovator, helping to maintain its leadership in niche financial services.