Why financial crime in the UK makes the nation a prime target

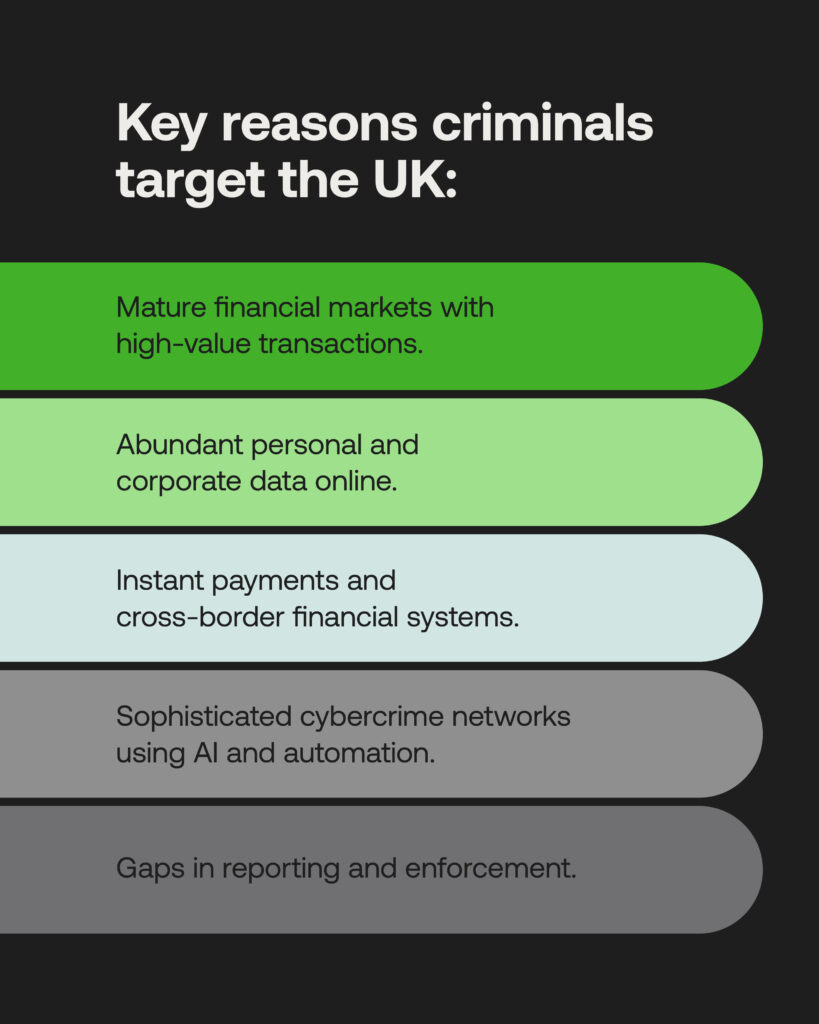

Some financial markets are considered mature, and others undeveloped, but they’re all one and the same for criminals. In fact, financial crime in the UK has boomed; as a financial services powerhouse, it’s a pantheon of underbelly activity affecting banks, fintechs, government bodies and, of course, paying customers and seemingly random individuals.

It feels at odds with the UK having such a highly regulated financial world, from stringent checks to prove yourself a liable company under both the Financial Conduct Authority and Companies House, to well-resourced investigative functions and police forces through the National Crime Agency (NCA) fraud services. But with every digital advance taken in compliance, there’s distinct weak links that social engineering scams know all too well.

Fraud is an old school crime that will always evolve (to the tune of defrauding the UK economy out of around £200 billion each year). Here’s where even the UK’s strong defences can fall short, and where greater anti-money laundering (AML) UK efforts must be given a spotlight.

The contextual scale of economic crime in the UK

No corner of the world – geographically speaking, offline, online, and on the dark web – is away from the clutches of financial crime. The misconception that developed nations have it under wraps is decidedly untrue, with the fact that 40% of the UK’s recorded crime is fraud related. Further, around 67% of what is reported is cybercrime related.

That highlights what is not reported to police: a whopping 86% of cases. This is a trend going skyward, and facilitates other areas of financial-based crime. Fraudulent income has to be laundered, and is done so in varyingly sophisticated means.

It’s not just digital threats that catch out institutions charged with finding criminality, though. In fact, first party fraud (using legitimate identities to dissuade institutions) is deemed “reasonable” by almost half of UK adults, with 10% admitting to committing it or being complicit to it. So much so this is justified as a type of “friendly fraud”, such as inflating funds to secure a mortgage.

This normalises pettier crime that muddies the waters between legally-obliging citizens and fraudster networks that can hide among transactions more easily among an annual 57 millions acts of economic wrongdoing.

Beyond tech: Enablers of modern financial crime trends UK

The digital frontier is wide-reaching, with connotations as being a Wild West for financial criminals. As brilliant as automated fincrime detection is on one side, this has been developed exponentially by hackers, fraud networks, and larger crime syndicates the past couple of decades:

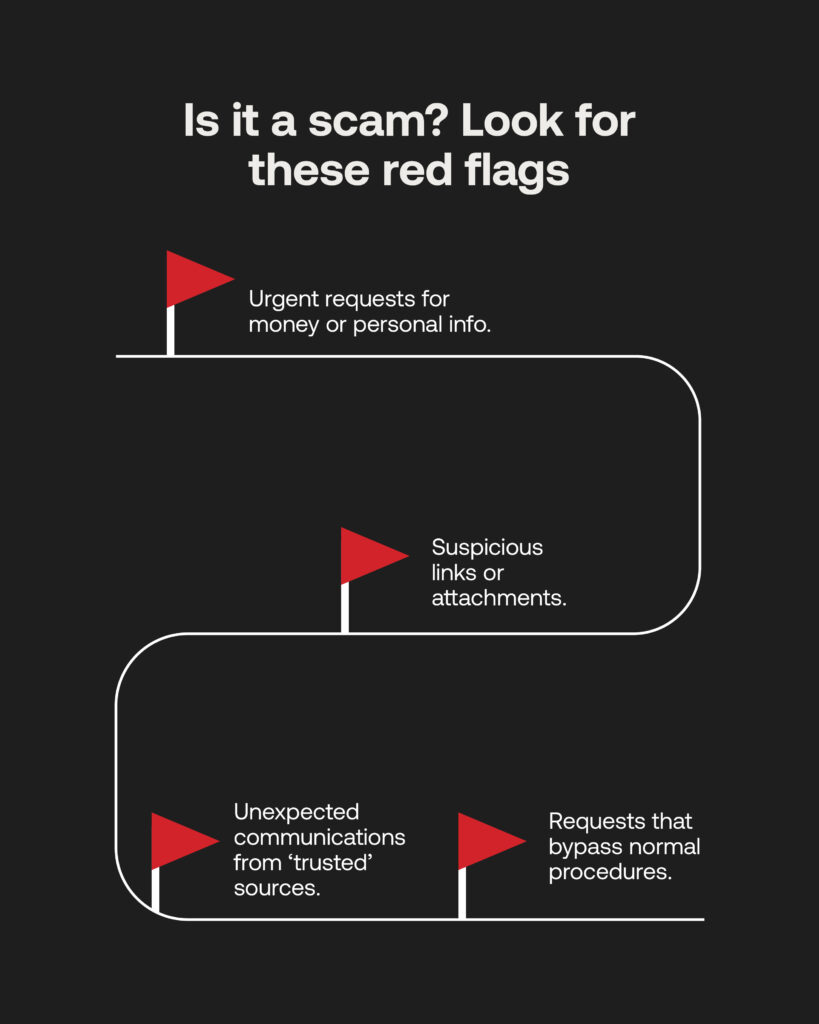

- AI-generated content means that scams can run freely, in huge amounts with non human intervention whatsoever. Even when only 1% might click a dodgy emailed link out of millions, that’s potentially a lot of profit for the criminals.

- With the internet saturated with companies and individuals’ data (on social media, Companies House etc.), scraped personal information is catnip for criminals to make convincing emails to commit CEO fraud or invoice fraud.

- When these communications are getting so much more plausible than more obvious traditional spam, this creates a completely automatic crime machine in any place, any time.

Clearly technology’s effect on criminal growth is the most stark difference compared to old school phishing techniques. In crude terms, criminal enterprises have grown from startups to million-dollar giants utilising the internet to mask money from jurisdiction to jurisdiction, or convert fiat currency to crypto and digital assets.

This is a real problem for financial crime in the UK as an economic hub covering vast areas, political ties, and servicing other markets with advanced money instruments that become conduits for in-the-know criminals. Even regulations’ calls for instant payments is a poison chalice to some extent, as this requires widespread automated screening and identity verification tools to sniff out opportunistic launderers at the source.

Given the spellbinding extent of global crime, it can be easy for the UK government and agencies to forget the role that individual members of the public play. Everyone’s data and accounts are in danger of being targeted, but there has to be awareness around how criminals exploit low technological maturity – and how people can, and should, report any near misses or full-scale defrauding.

It becomes even scarier knowing that scammers these days – using bank transfer scams, investment scams, romance scams, and purchase scams – will not stop at draining life savings from victims often too embarrassed or scared to do anything about it. Now, criminals look to double down their methods on vulnerable people, such as making them moles to move their funds or set up bank or crypto accounts. People must be aware of online risks in order to prevent it.

Supporting a digital skillset

Financial crime leaders have to preach best practice, but also must be practitioners for AML and terrorist financing (CTF) protocols that are more linked to fraud than ever. In fact, these usually separate functions are being more jointly connected under the financial compliance banner.

What this means is the technology utilised by the ‘bad side’ has to be mastered by the compliance function. Not only will this free up time in onboarding actual customers, alerting bad actors and transactions and lowering false positives, but it limits administrative tasks to increase the rate of proper investigation and prosecution.

For that to happen, there needs to be a dialogue between compliance experts, regulators, government officials and even ex-scammers or consultants to promote the importance of technology proficiency to enhance the professional curiosity that jointly weeds out suspicious activity effectively.

Linking investigations for anti-fraud aid

So where does the UK stand in bolstering their AML defences? Fittingly for the nation’s headfirst foray into advanced financial technology, there’s a lot that it’s doing correctly, including national compliance strategies, and specialised fraud agencies such as Action Fraud facilitating awareness reporting and public protection.

However, there are certainly legal and operational barriers already hindering progress while regulatory oversight gets stronger. The UK could see greater scrutiny from Companies House surrounding ownership structure transparency, as well as more standardised and high quality AML oversight at accountable institutions. There’s still gaps between reporting and enforcement which, when improvements are made in each pocket, a collective body will benefit when sharing data around fraudulent activity.

The rapid identification of activity through Suspicious Activity Reports (SARs) – then submitted to the UK Financial Intelligence Unit (UKFIU) – offers one route, pooling units through evidential data that leads to action being taken. These help police build evidence, carry out investigations, and disrupt illicit flows moving. SARs could improve the cooperative plans of the FCA, targeting intelligence collaboration outside of the financial industry and across borders through data-led detection capabilities, TechSprint events and anti-fraud campaigns. The NCA and the National Economic Crime Centre (NECC) are also pursuing serious cases through public, private and third party sectors – sure signs that fraud avoidance is being heeded by citizens and leading organisations including the Home Office.

The appetite to curb AI-enabled fraud, social engineering scams and identity fraud through digital AML and cybercrime detection is there, and it’s of national importance that they get implemented. That will take the vast network of financial institutions and agencies at play sticking to strategic frameworks and putting their cooperative motives into action.

As we know, that’s certainly what the criminals are doing at a rapid rate. That’s why financial crime in the UK should never get out of hand, or in its partnering and surrounding nations, especially when we do indeed have the digital tools to safeguard our increasingly macroeconomic system.

Learn more from a former City of London Police detective on our latest episode of Laundered