How to unlock 2026 budgets to secure RegTech ROI

November is fully underway, and budgeting season begins. In order to truly get ahead of 2026, budgets must be allocated accordingly to enhance systems and create operational wins across the board; something valuable compliance tools can achieve with buy-in from the Chief Financial Officer and other key stakeholders.

Naturally the discourse around compliance revolves around its complex, ever-changing rules and how that affects a CFO’s budget. While the ‘cost of compliance’ headlines dominate, instead robust defenses do not have to be a draining cost centre; a regulatory technology (RegTech) provider can be a revenue generator providing consistent competitive gains for the future, even when customer bases, digital threats, and regulatory changes continue to ramp up pressure.

Proving these advantages can reframe how necessary funding for RegTech is, and ‘get back’ more than the CFO gives as the keyholder for 2026’s streamlined regulatory budgets.

Understanding a CFO’s compliance dilemmas

The compliance function has changed face over the past few years. Once a mandatory legal arm is now a highly technical investigative safeguard to ensure security and integrity. Duly, budgets have soared to accommodate legislative changes. In the UK, the annual compliance bill is around £38 billion – painting the concern as an unwieldy money drain by budget allocators. With regulatory scrutiny increasing and less money to absorb associated costs, a CFO can find themselves between a rock and a hard place.

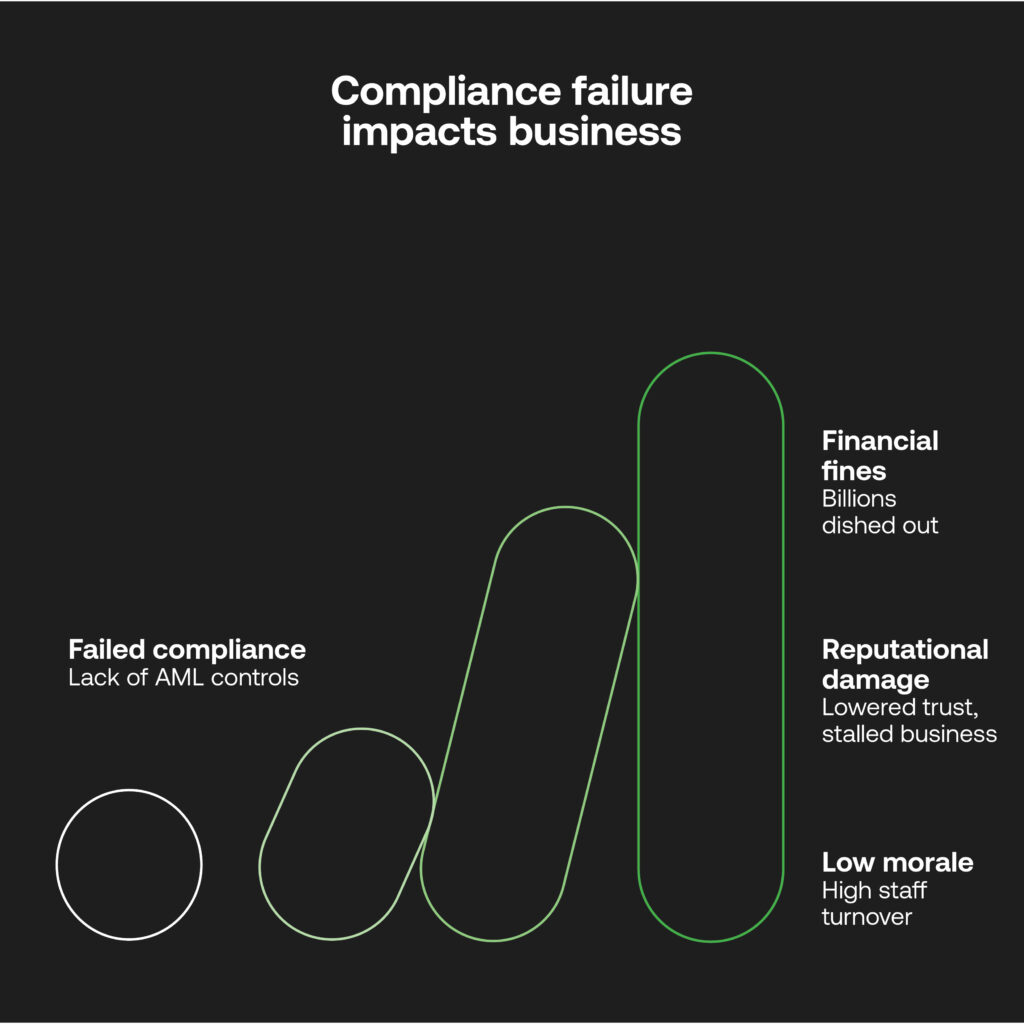

What’s often left out of the equation however is how modern compliance’s flexibility can generate ROI rather than diminish it, especially through mitigating financial crime risks that are far more detrimental to the bottom line. If a business is found guilty of failed anti-money laundering (AML) controls, for a lack of systemic changes or tech adoption, billions may be dished out in fines.

Plus, that reputational damage is tough to shift in the public eye, lowering trust, stalling new business, and causing low staff morale and high turnover. Compliance is a major contributor to loss prevention in many ways; albeit difficult for a CFO to account for without evidence of a platform’s empirical efficiency gains, or (in more harrowing cases) after experiencing spiralling restorative costs from non-compliance.

Making the case for RegTech solutions

UK advisory firm Grant Thornton has found three major concerns when investing in newer compliance technology: the overall costs; how easy it is to use; and operational effectiveness. The same study also discovered how a whopping 86% felt the level of communication between compliance departments and stakeholders could be improved.

Therefore, a first step toward RegTech buy-in means creating an open dialogue with compliance heads taking a seat at the budgeting table. As the hands-on users of an AML platform (in conjunction with a RegTech’s support team), they’re not only able to communicate how systems can become operational cost-savers beyond their necessary role in fincrime prevention, but display that through auditable logs matched against a CFO’s key business metrics in the following areas:

- When AI-driven monitoring surfaces only suspicious alerts, evidence of fewer false positives proves less monetary burden from inefficient investigations, with time saved for compliance workflows that matter.

- Automations work around the clock to identify potentially high-risk behaviours and transactions against timely watchlists. This eliminates ‘afterthought’ investigations that risk non-compliance and fines, and sets a proactive risk-based framework into action to reap ROI rewards from the start.

- An initial investment into an elastic architecture enables firms to reduce or scale up a modular AML platform to fit changing regulatory needs and budgets, away from fixed offerings and static rules-based systems whose ‘complete overhauls’ delay deployments and the chance to gain a competitive advantage through technology.

“Technology can be an answer to many budget allocators’ concerns, albeit knowledge around its real-world improvements for the bottom line need to be stressed,” says James Saunders, CTO at RelyComply. “This starts with sector-wide expertise sharing, and more practically involves partnerships to develop bespoke AML solutions that contribute to business’ inflows as much as prevent crime.”

3 Reasons to justify CFO buy-in

Traditional legacy systems and compliance workflows are far from what’s needed to achieve strict compliance protocols today, where adaptable Regulatory Technology enables firms to take a considered future-proofed stance toward onboarding, monitoring and reporting.Initial investment in a service provider should establish a successful long-term partnership, and not a quick fix unable to last the test of time – as follows:

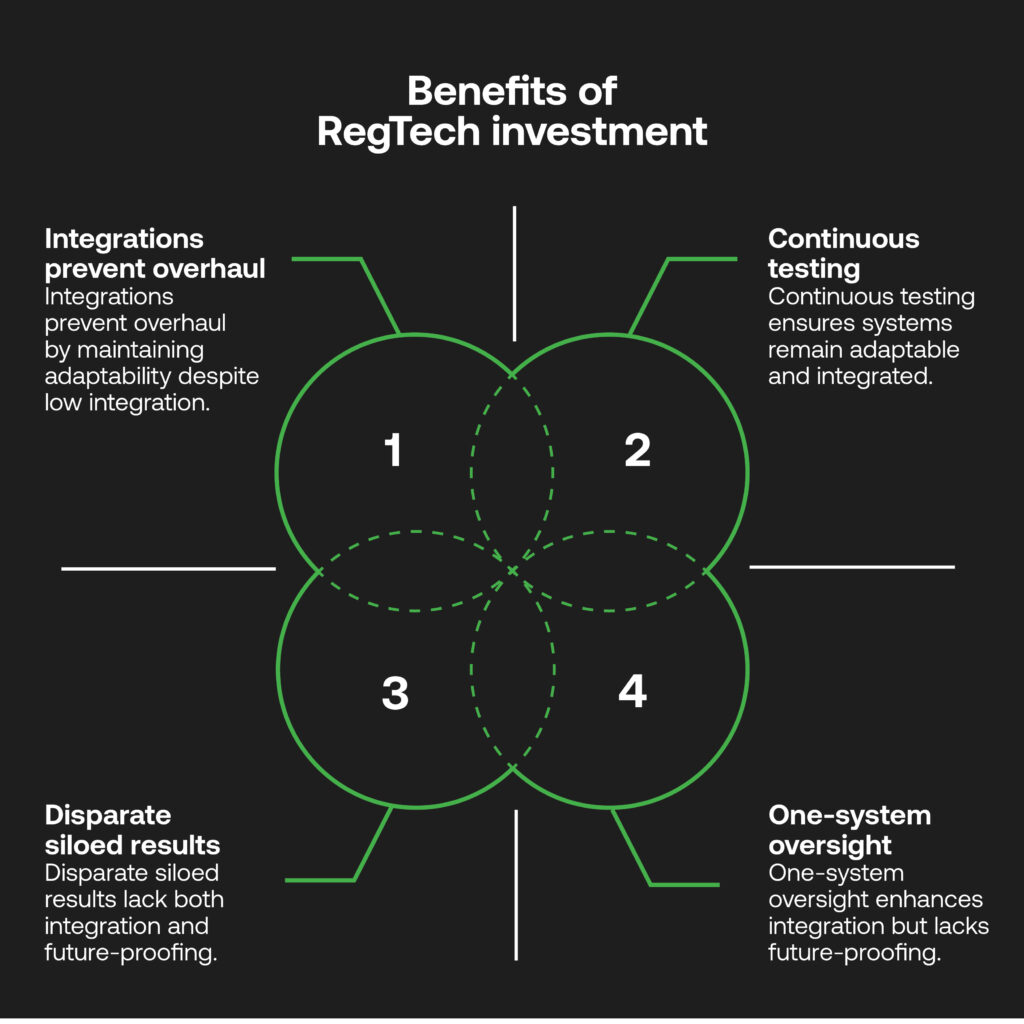

1. Integrations expand current ROI-friendly tech.

A cloud-native platform can complement a pre-existing IT stack, pulling together historical data and processes using APIs for an end-to-end compliance ecosystem that can grow with customer bases.

2. One-system oversight reduces friction.

Disparate siloed results in duplicate workloads, where end-to-end AML can instead be raised through one secure platform, protecting revenue and increasing the interplay between relevant compliance authorities.

3. Continuous testing keeps systems future-proofed.

RegTech solutions offer support teams and live-data sandboxes to roadtest new configurations, all without compromising customer data or amounting technical debt.

“Collaboration is at the heart of what RegTech providers do,” continues Saunders. “Policies, platform, and process all need to be worked out together in a way that’s cost-effective and relevant per company, to ensure initial ROI goals are trackable towards measures of operational success.”

Developing an action plan

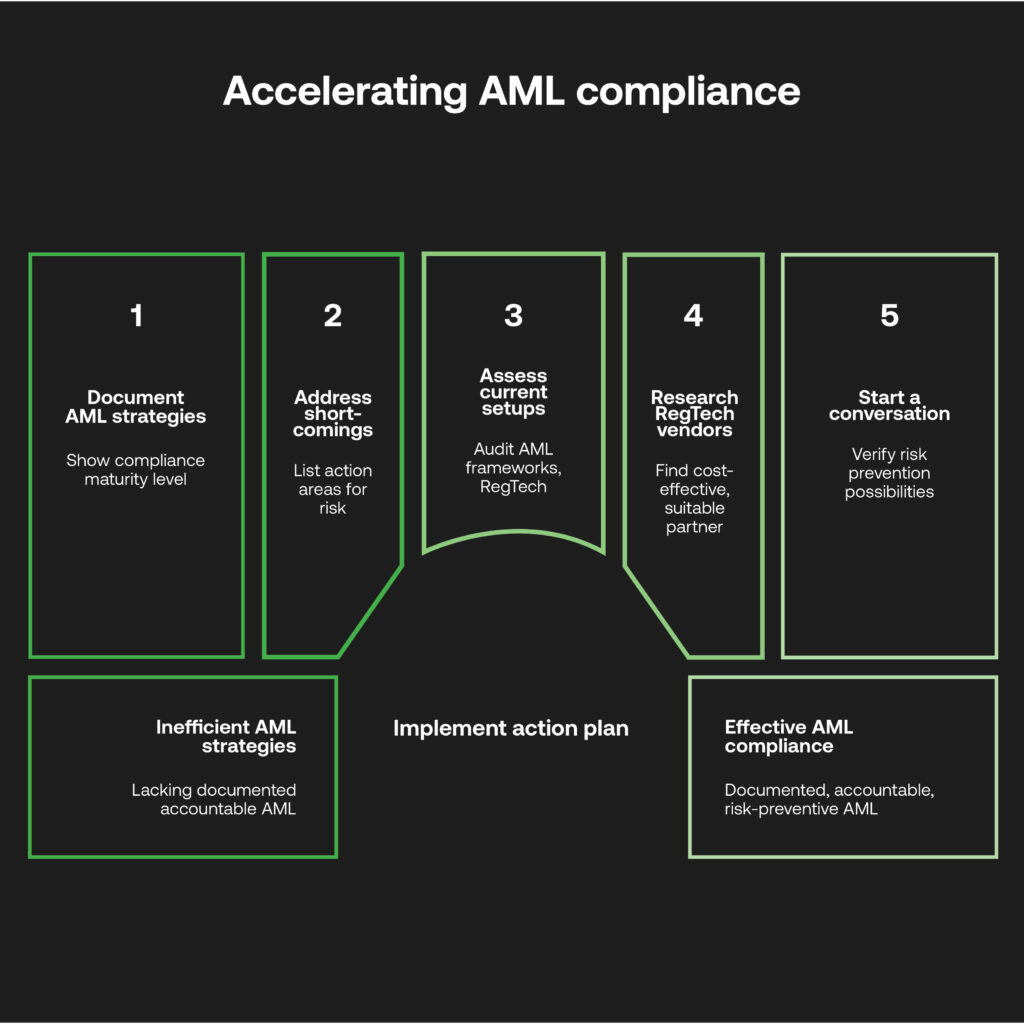

Of course every business has specific AML needs according to their size and resources. This is why a little internal research can accelerate the conversation around compliance budgets toward actionable change across the next few months:

- Document your AML strategies. This shows the levels of your business’ maturity in maintaining compliance culture, proving accountability that trickles down to the experiences of end customers.

- Address any shortcomings. According to the recommendations of local and global regulators, make a list of action areas that may be liable to AML risk.

- Assess current setups. Conduct internal and external audits on AML frameworks and RegTech to determine where systems and data can be consolidated, and overheads can be lowered.

- Research RegTech vendors. Solution capabilities and build complexity can vary, where a cost-effective partnership with a suitable partner should be able to determine operational blind spots and offer guidelines for adopting a bespoke development roadmap.,

- Start a conversation. RegTechs can verify where better risk prevention is possible in line with your current set up, and according to your CFO’s budgets for compliance.

Invest now, and secure a compliant future

Compliance budgeting is a constant demand involving various internal and external factors. However, falling behind in AML capabilities can do enduring damage to business assets and public perception, especially when instilling next-generation compliance functions can prove to be so fruitful as a returns-generator in a complex regulatory landscape.

Smarter RegTech investment now can not only avoid higher costs and repercussions down the line, but kickstart a sophisticated, adaptable and practical framework – so long as compliance teams and their budget holders instill a cooperative approach to anti-fincrime culture and become acquainted with RegTech’s positive competitive advantages that can prove a world of difference for compliance teams across the financial ecosystem.