RegTech in 2025: 6 key trends shaping the future of regulatory compliance

Table of Contents

Due to its innovative capabilities, the financial world has embraced RegTech for the past few years, and adoption is growing. So much so that in 2028, the global market is expected to reach 25.19 billion USD.

Much of this can be owed to the compliance burdens still faced by financial institutions. Appeasing strict regulatory watchdogs can involve a complete overhaul of legacy technology, including hefty costs and an administrative nightmare – all to stay ahead of highly evolved criminal typologies.

The annual RegTech100 list has been updated to include the world’s most innovative providers to help compliance officers retain operational efficiency, connect their data, and use advanced digitalisation to battle financial crime.

RelyComply is proud to have been announced as a key solution for giving FIs flexibility to streamline their AML processes in the face of an ever-changing regulatory landscape. In light of this announcement of the full list, we’ve delved into how this space is shaping up for 2025 and where the necessity for RegTechs such as RelyComply fits into the puzzle.

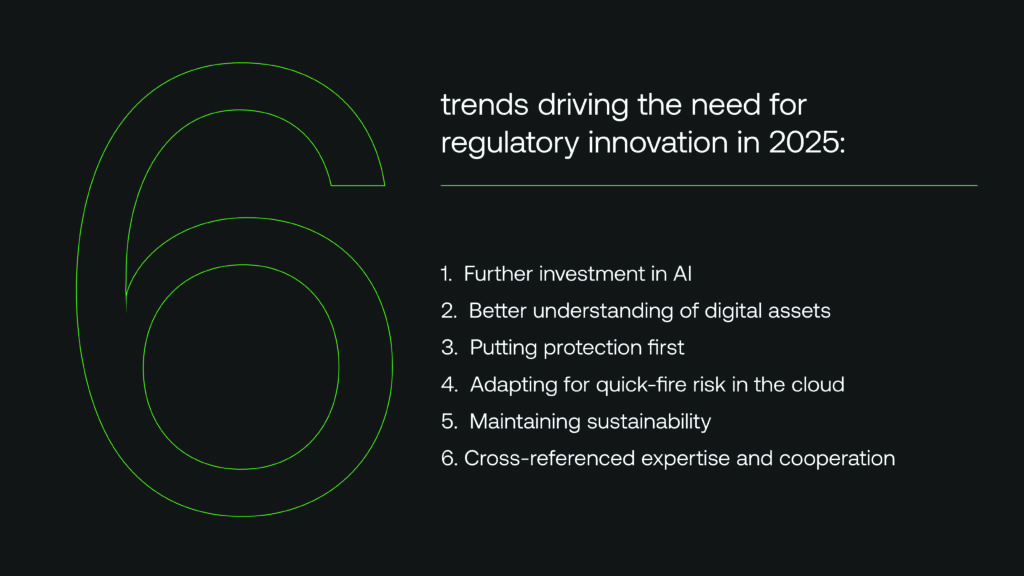

6 trends driving the need for regulatory innovation in 2025

1. Further investment in AI

Artificial intelligence is one of fintech’s hottest success stories: a word-of-mouth buzzword and sci-fi futurism that can automate lengthy processes and crunch vast amounts of data in seconds. RegTech receives less attention in the financial world than AI alone. Still, many platforms are underpinned by technology to allow companies to react to any potential threats to their business. Gartner reveals that more than half of compliance officers are looking to invest in RegTech, which AI will support next year.

For anti-money laundering and countering terrorist financing (AML/CFT), AI-backed automated monitoring can detect behaviour patterns in real-time to flag anomalous data indicating financial crime. It can also compile reports quickly and lower pitfalls resulting from manual errors, like high false positive rates.

Machine learning models’ use and training are only improving, with more experts joining financial institutions to assist in this tricky compliance area. In capable hands, scepticism around AI is lowering, so long as transparency and ethical concerns around its usage are considered and biases are accounted for. The AI Act regulation in the EU looks to provide a framework to address AI usage.

2. Better understanding of digital assets

The use of cryptocurrencies and other virtual currencies has also been met with scorn in the past. Due to a lack of regulation of grey-area commodities, financial institutions have been put off venturing into blockchain technology or the metaverse where these sorts of transactions take place.

Then again, by 2027, the World Economic Forum predicts that tokens stored on the blockchain could make up 10% of global GDP. For instance, the UK looks to recognise and classify such assets as non-fungible tokens and cryptocurrencies.

Given crypto’s poor reputation for money laundering and other criminal risk, 2025 will see more regulations surrounding Bitcoin and digitalised finance, which flexible RegTech platforms can adhere to in line with existing AML processes.

3. Putting protection first

RegTech platforms and AML/CFT protocols rely on quality data to work accordingly. With so much customer data to handle, regulations such as the EU-wide Markets in Financial Instruments Directive (MiFID II) and the General Data Protection Regulation (GDPR) encourage standardised ways to ensure transparency around protecting it.

Customer and information data are at risk from hackers and other security risks, which calls for RegTech platforms to remain robust in their infrastructure and the rollout of strong risk management programmes for corporate compliance and strict banking regulations. Effective due diligence on customers and their networks also requires innovation in verification techniques during onboarding. Valuing and safeguarding data is a key RegTech priority now, but more so in the coming years.

4. Adapting for quick-fire risk in the cloud

FIs must adopt a risk-based approach to AML compliance to monitor for high-risk individuals or payments continuously. Unlike traditional rules-based processes, real-time checks work around the clock to alert anything indicative of risky behaviour, allowing compliance teams to investigate only the right flags and allow legitimate payments to flow.

RegTech platforms that employ a risk-based framework can manage compliance and reporting more efficiently. This framework drives down costs and mitigates anything that could cause concern from local and global watchdogs. At the forefront of RegTech innovation is the move to the cloud, where regulatory data can be stored securely and analysed in one place, scalable to the demands of ever-changing regulations, and integrated with successful legacy systems.

5. Maintaining sustainability

Environment, Society and Governance (ESG) principles have never been more valued in this modern world, particularly for FIs and where they invest their customers’ money. Sustainable finance comes with its own set of regulatory trapdoors, where falling foul of ESG risks can lower integrity in the public eye. Organisations can use cutting-edge RegTech solutions to identify, analyse, and report data to assess their ESG commitments.

6. Cross-referenced expertise and cooperation

Partnerships between financial houses and RegTech providers are forged to improve control over compliance, data management, AML, cybersecurity, and more. These links are helping large-scale institutions standardise their processes to adhere to global regulations.

In addition, that streamlined interoperability extends to greater cooperation between governmental bodies, regulators, and businesses to impose actionable policies to battle the risk of criminality. The sharing of expertise through focus groups, events, and state-approved bodies will strengthen the understanding and role of RegTech on a larger scale.

Public-private partnerships remain a key hurdle in AML, but a more connected world will make compliance efforts even more pertinent, in addition to the Financial Action Task Force’s Recommendations.

Given that the financial sphere is open to these prevalent trends, some clear steps exist to improve the use of flexible, effective and groundbreaking technology. The RegTech100 provides a comprehensive view of solutions that can tackle the largest hurdles in maintaining compliant protocols, ultimately leading to staying one step ahead of the very real risks we all face.

About RegTech100

The RegTech100 list is a prestigious compilation of the world’s top 100 companies that demonstrate exceptional innovation and impact in regulatory technology.

About RelyComply

RelyComply is a single AML platform committed to battling financial crime and empowering the whole financial industry – from fintech to traditional large-scale banks – to save time and costs in the ever-changing landscape of anti-money laundering compliance. With innovative, automated workflows, financial institutions gain the flexibility and efficiency they need to drive investigations around the clock, adapt to regulatory shifts, and strengthen defences against sophisticated criminals.