RelyComply takes the fight against financial crime to UK

Why the UK is the next frontier in the battle against financial crime

RelyComply launching in the UK marks a new milestone for us, and is the first of many to come.

With our beginnings in South Africa, we started out with a simple, albeit ambitious mission: to reduce, and ultimately end financial crime through a unified compliance platform that supports financial service providers with their KYB/KYC/AML processes.

The country, with support from regulators, government and fintechs such as ourselves, is working hard on exiting the greylist imposed in 2023 for failing to implement international AML and combating the financing of terrorism standards in an effective manner. All signs point to a positive outcome over the coming months. It’s also why we know, firsthand, how financial crime can impact a country and its residents. The result is not pretty for all involved, yet it is preventable.

On the other side of the world, what we’re seeing in the UK is a continuous rise in financial crime, with substantial fines being imposed onto both banks and neobanks for their failure to prevent bad players taking advantage of both the systems, and of those who rely on these institutions to safeguard their money.

That’s why, after experiencing success and collating our learnings from Africa, we believed that the UK was the next natural step for us to continue our mission.

As RelyComply’s CEO, Bradley Elliott was quoted as saying in multiple publications such as Fintech Global, Business Cloud and Financial IT:

The UK is becoming a hotbed for financial crime and desperately needs modern solutions. The sector is slowly facing the reality that fintechs are now operating at the same scale and risk level as traditional banks, but are still playing catch-up.

Bradley Elliott, CEO

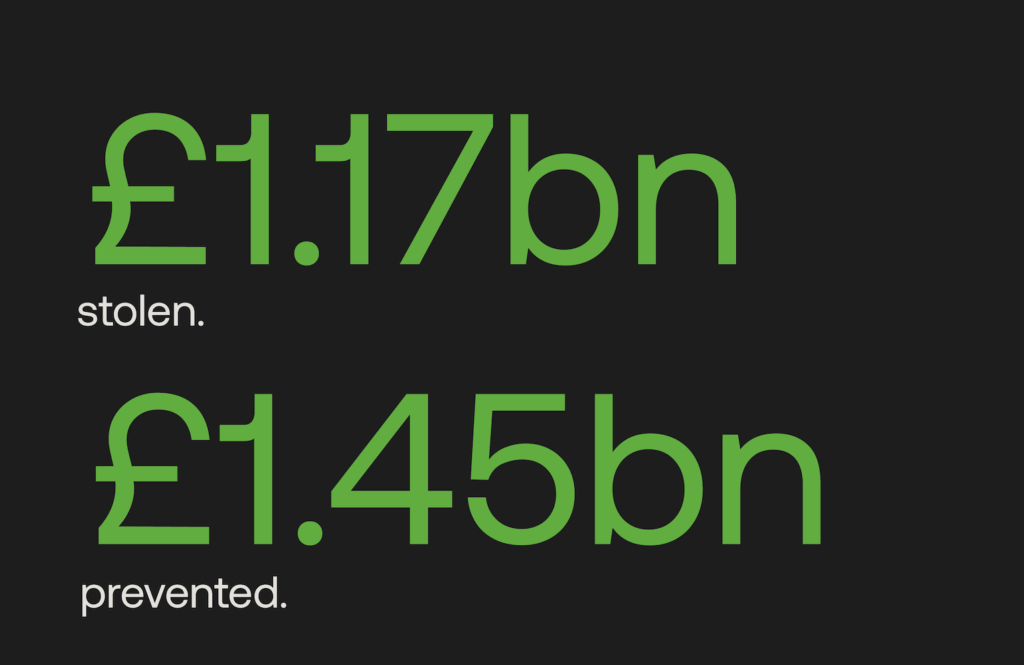

In 2024, criminals stole £1.17bn through fraud, and outside of that figure, banks prevented £1.45bn. The FCA has responded by implementing regulations such as Failure to Prevent Fraud, APP Fraud Reimbursement Regime and Consumer Duty which have all rolled out over the past 26 months, and whilst regulation is not necessarily the topic of choice over breakfast or evening drinks, the increase in column inches dedicated to fines proves this notion wrong, with concerns in the UK around improper AML and KYC piquing people’s interest more widely. Poor compliance has taken a global stage in recent years, with an influx of well-known television and podcast series focusing on individuals committing financial fraud, deriving from criminal activity (including RelyComply’s very own financial crime podcast – Laundered).

These case studies, statistics and country-specific challenges proves that financial crime isn’t something that should be just relegated as an afterthought; what can seem like a small piece of the puzzle is proving to be a very big piece of a wider global problem – one that can be fixed with preventative measures and more proactive discussion around a once-overlooked area within finance.