3 essential AML pillars of Travel Rule compliance 2025

Table of Contents

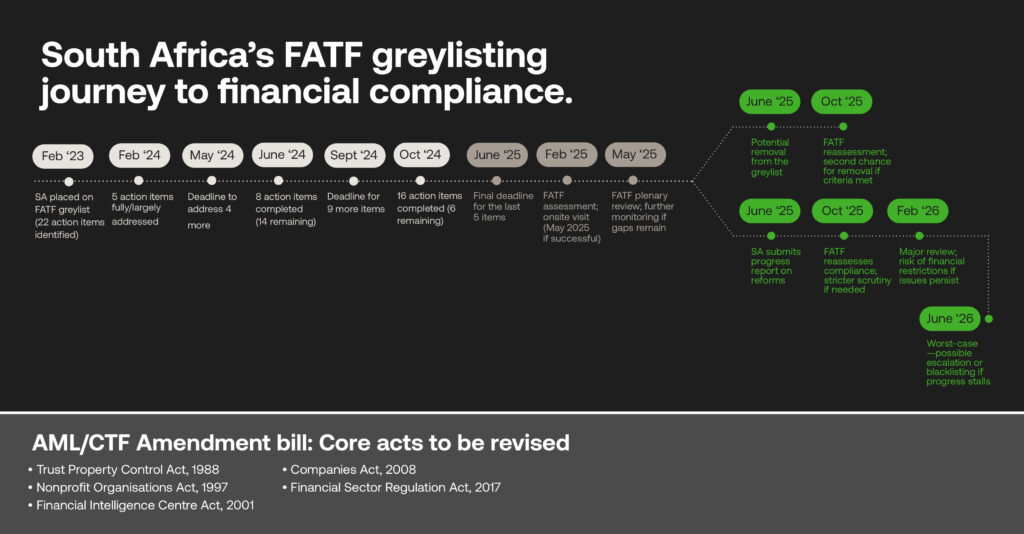

The crypto industry in South Africa has reached a fork in the road. While previously a grey-area sector with a dubious regulatory reputation, the recent introduction of the Travel Rule by the Financial Action Task Force (FATF) provides a lifeline in standardising the ways that crypto asset service providers (CASP) and adjacent entities share user data with other financial institutions

AML compliance and digital assets

Bringing the digital asset world under compliance control can assist South Africa’s commendable efforts toward removal from FATF’s greylist, despite posing cost concerns for smaller CASPs looking to disrupt and innovate the financial playbook for digital-first customers.

Stronger regulation often burdens compliance expenditure, trickling down to consumers and stunting market growth. Financial inclusion and attitudes to digital finance tools are still lacking in South Africa and do not assist the crypto world. At the same time, big exchanges have taken compliance seriously, as many have not.

The South African regulatory field

Our regulatory field has not done enough with payment changes, so crypto has been heavily on the radar of FATF, the Financial Intelligence Centre (FIC) and the South African Reserve Bank (SARB) for the past few years.

It has all led to the Travel Role to grant integrity to the burgeoning space and foster transparency in a collaborative financial ecosystem, all intent on bettering anti-money laundering (AML) practices to stay ahead of financial criminals and bring underrepresented peoples into the formal economy.

For positive financial disruption to flourish, CASPs, banks, and fintechs require regulations to catch up, rein in criminal exposure, and maintain integrity. The Travel Rule can kickstart this by boosting public trust, advocating for market development, lowering compliance costs through RegTech partnerships, and promoting greater data sharing.

Pillar one: data

History has not been kind to South Africa’s approach to data protection. Multiple high-profile data breaches do not showcase brilliant AML approaches, nor does FATF’s greylisting. Crypto is especially under fire, often associated with new typologies for laundering, stealing identities, and committing fraud that financial institutions struggle to battle.

Without regulatory structures, such as e-wallets, addresses and personal data, the future for new asset classes without legislation is precarious. Data privacy laws are already harsh in finance, with most companies likely worried about sharing data with any third party, in the crypto space or otherwise.

For a holistic way to manage customer data in accordance with AML requirements, cross-collaboration with privacy or regulatory technology (RegTech) platforms, where data security is integral to their architecture, is required.

Following the Travel Rule’s push for instant, pre-payment data sharing between entities conducting crypto transactions, this encourages all crypto-adjacent services to jointly invest in technical platforms that are better operational tools for storing and securing data.

RegTech exists to maintain data integrity and facilitate safer connections between crypto asset players – payment providers, regulators, major banks, telecom providers, and even social media and messaging platforms often exploited by financial criminals – in more streamlined, cost-effective ways.

Pillar two: speed

Globalisation means anyone can request or make a payment worldwide, dramatically impacting consumer behaviours (and how regulators and financial providers react). Crypto adds another layer here – speedy payments are expected, where new entrants look to solve issues that traditional banks struggled with, often thinking that their brick-and-mortar services on a mobile app could solve the problem.

However, bringing new products to market should not be stifled by compliance. Regulators are caught between a rock and a hard place in keeping pace with fincrime movements and regularly changing regulations.

This means few institutions can adapt without flexible AML systems. In crypto’s case, there are multiple licenses and provider sizes to adhere to, and it’s irrational to think a startup in the sector will have bank-level anti-money laundering measures to hit the ground running.

Risk-based approaches to AML are growing, as is the interoperability between banks, fintechs, CASPs and more. The Travel Rule can assist this development: advanced monitoring systems are needed everywhere when every accountable entity is required to maintain transparency and ensure swift data transfer..

Standardised regulation can take some investment, but it provides a framework for service providers to engage in effective AML partnerships. It may help SARB achieve its goal of levelling the playing field for the digital payments system and providing such services to underbanked areas of South Africa’s population.

Pillar three: trust

Accessibility to financial services is hampered by financial or technological literacy, which is further affected by distrust in the system. In South Africa, many do not have access to a bank account or a smartphone and rely on cash, making them all the more susceptible to criminal exploitation.

There’s a cultural attitude towards both digitally native and fully digital financial payment products that needs to change. Consumers must feel safe that their data is protected and that service providers can assist with financial goals, wants, needs and challenges with care and attention. It’s tricky for the crypto industry when news around decentralised finance or blockchain technology usually refers to scams.

The enactment of the Travel Rule will facilitate digital asset circulation with less risk of falling into the hands of sanctioned entities or regions. By identifying and reporting such actors through AML processes (assisted by RegTech providers and the FIC’s goAML feature), CASPs can boost their reputations, being held accountable by global and local watchdogs.

In turn, this can better South Africa’s cases for prosecution, showcasing the financial ecosystem’s proactive commitment to stopping financial crime and improving the public’s attitude to the digital finance boom.

Putting the broader financial industry into perspective

Of course, a diversified financial system is excellent for solving ever-growing technical challenges and serving more people. However, every single player needs to be on the same wavelength regarding standardised compliance frameworks and the investment in AML platforms to adhere to them.

The Travel Rule regulation may target the crypto asset industry. Yet, it highlights that bridging a compliance gap also counts on symbiotic relationships between other institutions – fintechs, regtechs, legacy banks, payment providers and more.

Lateral partnerships and collaborative forums will facilitate innovation to make South Africa’s financial system the best it can be: compliant, sound, providing cutting-edge products to all levels of society, and committed to protecting consumers’ data. In that way, a catch-all regulation like the Travel Rule is a welcome addition to reframing how we move regulation forward, and not just for the crypto space.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.