RegTech is crucial for banks navigating DeFi disruption

Table of Contents

Traditional retail banks are facing more competitive heat than ever before. Innovative fintechs and neobanks offer alternative customer experiences that damage their margins, lure customers away, and challenge the long-rooted dominance of large banking brands you’d see on the high street.

These newer players wield cloud-first tech stacks and nimble digital infrastructure as their competitive weapons. At the same time, established banks with monolithic architectures and legacy platforms struggle to match their new competitors’ instant service and flexible offerings.

The rise of DeFi

The rise of decentralised finance (DeFi) throws new threats into the mix, not just to disrupt financial services, including payments and loans, but compliance protocols too.

Hosting outdated AML systems will only hold financial institutions back in the wake of DeFi, particularly as cryptocurrencies and other digital assets grow. Many attempt to ‘layer’ additional technology to cover up their older, inadequate processes.

Instead, the conversation needs to turn toward configuring AML with ‘NextGen’ regulatory technology (RegTech) providers – AI-powered solutions designed to handle real-time risk detection, evolving financial crime typologies, and cross-border compliance where legacy systems cannot.

What is DeFi?

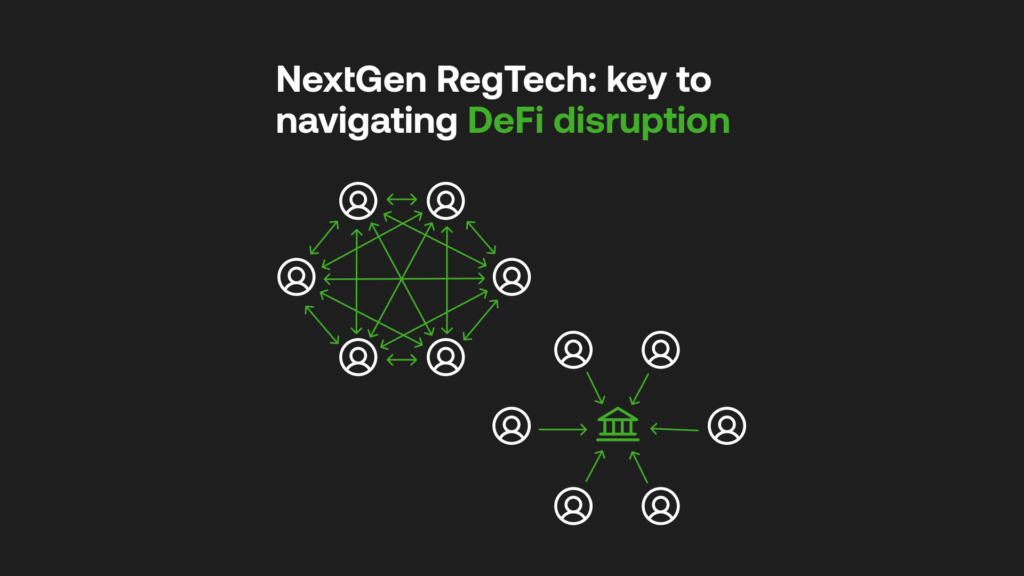

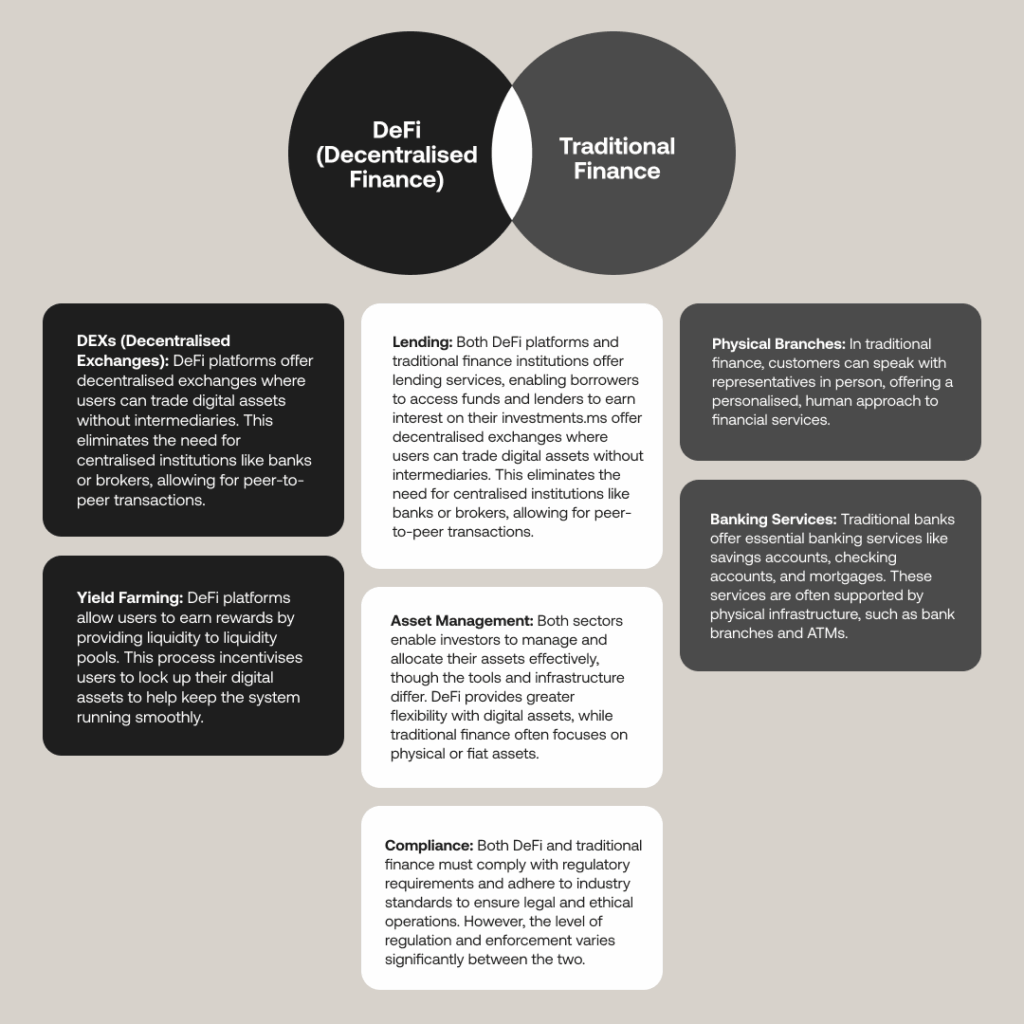

DeFi refers to a financial system that uses distributed ledger technology (DLT, such as the blockchain) and smart contracts to enable peer-to-peer transactions. DeFi applications provide services such as lending, borrowing, trading, and asset management in a transparent, open, and permissionless manner.

Transactions can flow through the blockchain rather than the national payment systems in most countries or, in the case of cross-border transactions, over existing networks, including SWIFT. Open-source protocols, like Aave or Uniswap, already allow for borrowing or lending crypto or real-world assets.

Compliance grey areas

This is all well and suitable for competition in the market, but the compliance side is still in flux:

- The EU’s Markets in Crypto-Assets (MiCA) legislation only came into force at the end of 2024.

- The SEC in the US flip-flops over its measures since the introduction of a dedicated Crypto Task Force.

- The Financial Action Task Force (FATF) actively monitors DLT, which could be described as a compliance ‘wild west’.

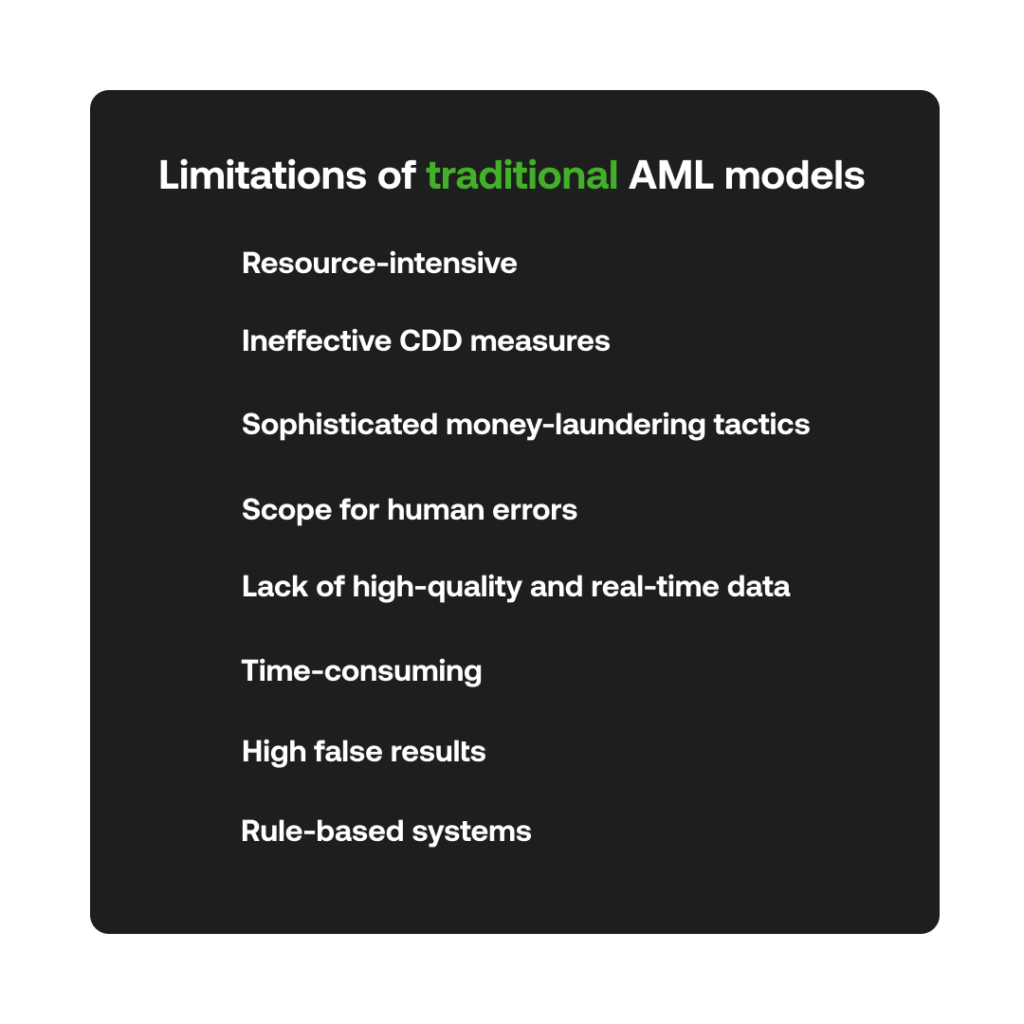

Traditional financial institutions are already at risk from this compliance grey area. With legacy systems mired in rules-based AML and Know Your Customer (KYC) processes, they remain inflexible and unable to proactively assess any incoming financial crime typologies that DeFi, mainly operating in an unregulated space, could encourage.

Failures from local banks to implement stringent AML measures befitting the requirements of the Financial Sector Conduct Authority (FSCA) or the Financial Intelligence Centre (FIC) prove this, all before DeFi becomes more commonplace.

Banks may have opportunities to work with crypto payment processors to allow users to convert fiat into crypto and vice versa. Some may see opportunities to offer regulated products such as digital asset custody or clearing for DeFi transactions. However, the risks, costs, and potential for product innovation are still significant, and in-house compliance is strict to maintain and evolve.

Fuelled by South Africa’s FATF greylisting, NextGen RegTech offers informed partnerships to strengthen governance, facilitate growth opportunities within the financial services sector, and remain adaptable to compliance and fincrime’s shifting cat-and-mouse game.

RegTech solutions to DeFi challenges

Integration with NextGen provides a lightweight, cost-effective avenue to solving DeFi compliance challenges. JP Morgan acquired OpenInvest in one instance to advance its ESG investing capabilities. Still, many RegTech firms specialise in blockchain analytics, smart contract auditing, and on-chain transaction monitoring–real-time AML capabilities that revolutionise how institutions can track and flag custom risk alerts.

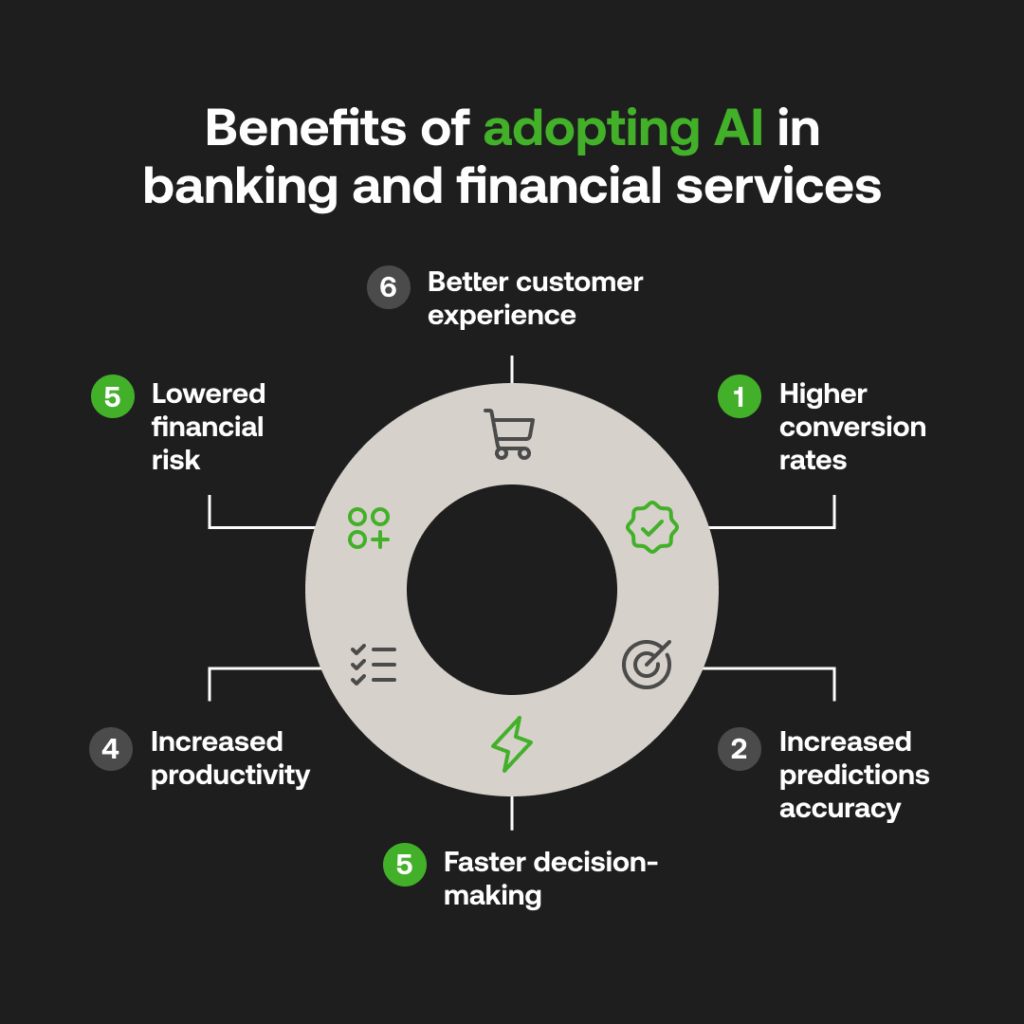

RegTech teams can work with banks to augment their existing AML or KYC systems with NextGen architecture: cloud-based systems comprising automated AI-driven processes that onboard trusted customers, and detect and raise risk around the clock across various jurisdictional payment formats or contexts. Such integrations can go far in scaling institutions that are taking advantage of the rate of digitalisation:

- AI-backed analytical tools enable banks to provide hyper-personalised solutions for their customers.

- Greater AML capabilities enable seamless digital onboarding and payment verification, matching fintech expectations and increasing regulatory demand for instant payments.

- Banks can even add fintechs’ capabilities to their infrastructure, leveraging Banking-as-a-Service (BaaS) platforms, increasing customer accessibility and cooperation within the financial ecosystem.

Given the changing nature of digital assets, fincrime methods and the regulatory bodies catching on, it’s now a base requirement for the diverse field of banks, neobanks, payment services providers (PSPs), and other institutions to be adaptable before disruption strikes their inefficiencies.

NextGen RegTech solutions, from embedded finance tools to AI-powered analytics, are invaluable in this context.

DeFi is just one trend reshaping financial regulations, and institutions must decide whether to resist or adapt.

Those that successfully embed modern risk management into their operations through NextGen RegTech partnerships will be better positioned to remain relevant, even as new business models and technologies take hold.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.