Why PEP screening matters: trends for AML compliance

Table of Contents

- The rising importance of PEP screening in financial crime prevention

- Lessons learned and harsher regulatory crackdowns

- The next steps: AI-driven tools for financial crime prevention

- AI-driven AML compliance solutions in 2025

- Best PEP screening practices for 2025

- Preventing financial crime in a digital-first world

With global regulators enforcing stricter guidelines, businesses that fail to implement advanced PEP screening solutions risk multi-million-dollar fines, reputational damage, and operational setbacks. Compliance teams must embrace automated identity verification, AI-driven risk assessment, and real-time transaction monitoring to stay ahead.

The rising importance of PEP screening in financial crime prevention

Financial criminals can take many guises. As their methods also reinvent themselves, being able to spot complicit individuals is getting trickier. One of the biggest challenges for financial institutions and regulated businesses is identifying high-risk individuals, particularly Politically Exposed Persons (PEPs).

Given their influential roles, PEPs pose a higher risk for involvement in money laundering and corruption, making PEP screening an essential component of modern AML compliance solutions.

Let’s explore the major trends shaping PEP screening and AML compliance in 2025.

Lessons learned and harsher regulatory crackdowns

The assumption that PEPs’ public visibility grants them credibility is a dangerous misconception. Inadequate PEP due diligence has resulted in severe financial scandals, regulatory fines, and loss of public trust.

Recent investigations have exposed corruption and bribery cases implicating businesses in major financial scandals. With national and global reach, this can lead to extraordinary reputational harm.

High-profile AML failures

- Guaranty Trust Bank (UK) (2014-2019): The bank repeatedly failed customer risk assessments, leading to a three-year ban on onboarding new customers.

- UK National Bank (2015): Fined £72 million for conducting low-risk due diligence on high-net-worth PEPs.

- Bank of Baroda (South Africa): Fined R11 million and forced to exit the South African market due to links to the Gupta family and R4.5 billion in suspicious transactions.

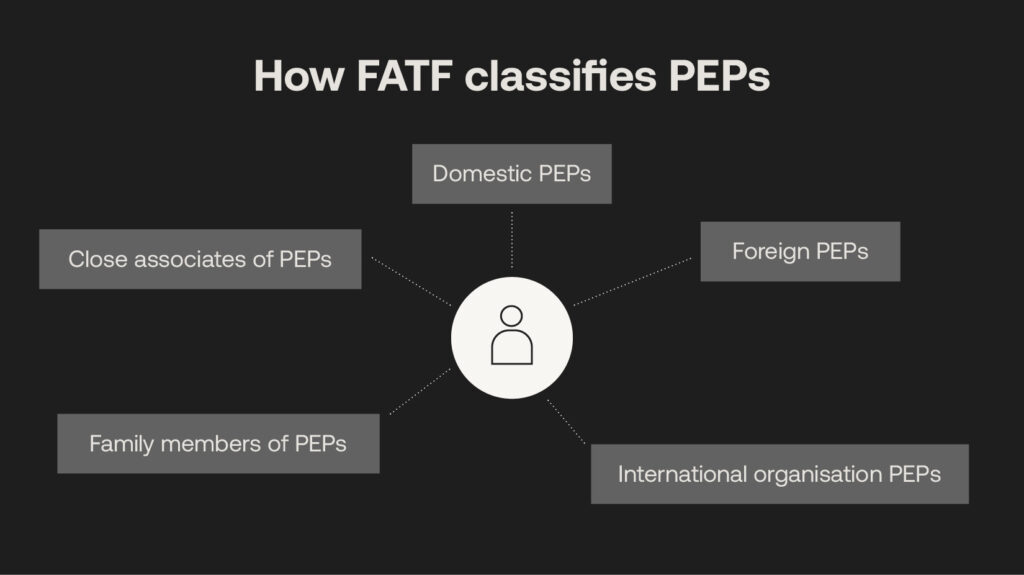

These real-world examples highlight the dangers of inadequate risk detection, outdated systems, and poor compliance oversight, which have knock-on effects on the globally connected financial system. That’s why we see action being taken by leading regulatory bodies—frameworks such as FATF’s Recommendations for AML compliance processes are tailored for businesses worldwide, while data protection legislation such as GDPR in the EU offers widespread, standardised rules.

Such compliance factors evolve to penalise businesses that fail to identify high-risk individuals linked to money laundering, PEPs included, from onboarding and throughout the business relationship.

Considering financial institutions’ role in handling customer payments, they’re coming under increased scrutiny for lacking the following AML compliance measures:

- Automated regulatory reporting is now essential to meet growing compliance demands in a timely fashion with accurate audited documentation.

- Sanctions screening is required to detect newly blacklisted entities instantly against trusted global lists, with recent UK and EU regulations now mandating daily checks instead of periodic reviews to ensure real-time compliance.

- PEP database integration allows for real-time updates on customers’ risk status, helping businesses continuously monitor and update profiles for their customer base.

- AML case management systems provide a unified view of a customer for more accurate risk detection.

- A risk-based approach ensures businesses assess PEPs or other related threats in real-time.

The next steps: AI-driven tools for financial crime prevention

Manual watchlist checks have stifled the ability for advanced PEP screening: missing vital matches, taking hours of investigative time and reducing operational efficiency. When this is applied to Know Your Customer (KYC) checks, slow onboarding can lower rapport with potential customers, while verifying sanctioned individuals or PEPs is a more significant, more harmful issue that can lead to regulatory clampdowns. Manual PEP screening is no longer sufficient.

Key challenges in traditional PEP screening

Compliance teams struggle with:

- Time-consuming watchlist checks lead to operational inefficiencies.

- False positives, overwhelming analysts with unnecessary alerts.

- Slow KYC onboarding, frustrating customers and impacting business growth.

- Outdated data sources increase the risk of missing newly sanctioned entities.

AI-driven AML compliance solutions in 2025

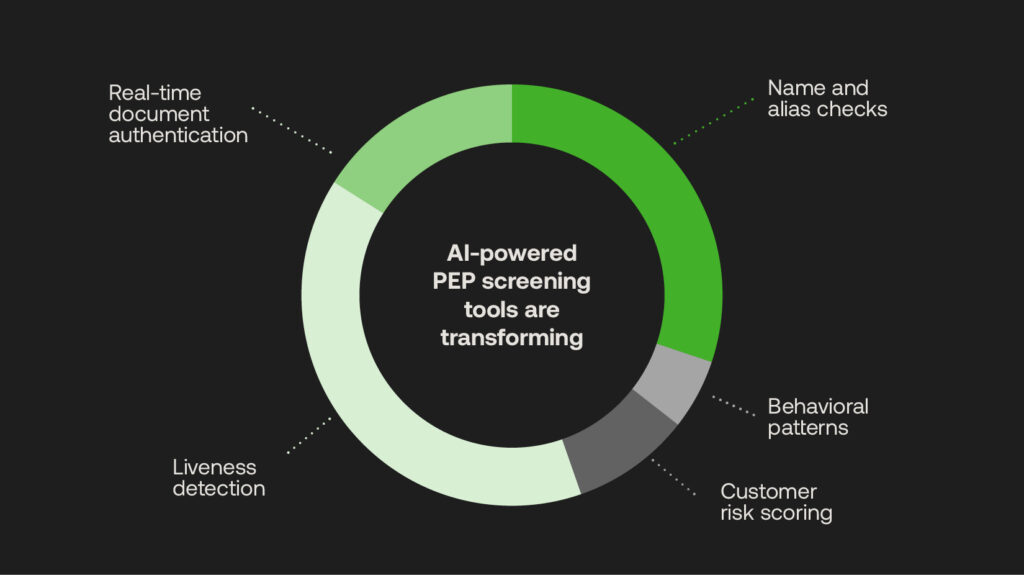

AI-powered PEP screening tools are transforming AML compliance by:

- Cross-checking names, aliases, and behavioural patterns in real-time.

- Automating customer risk scoring based on transaction history analysis.

- Enhancing liveness detection to prevent identity spoofing and deepfake fraud.

- Utilising real-time document authentication for maximum security.

By integrating RegTech solutions, financial institutions can streamline AML case management, automate regulatory reporting, and improve sanctions screening accuracy.

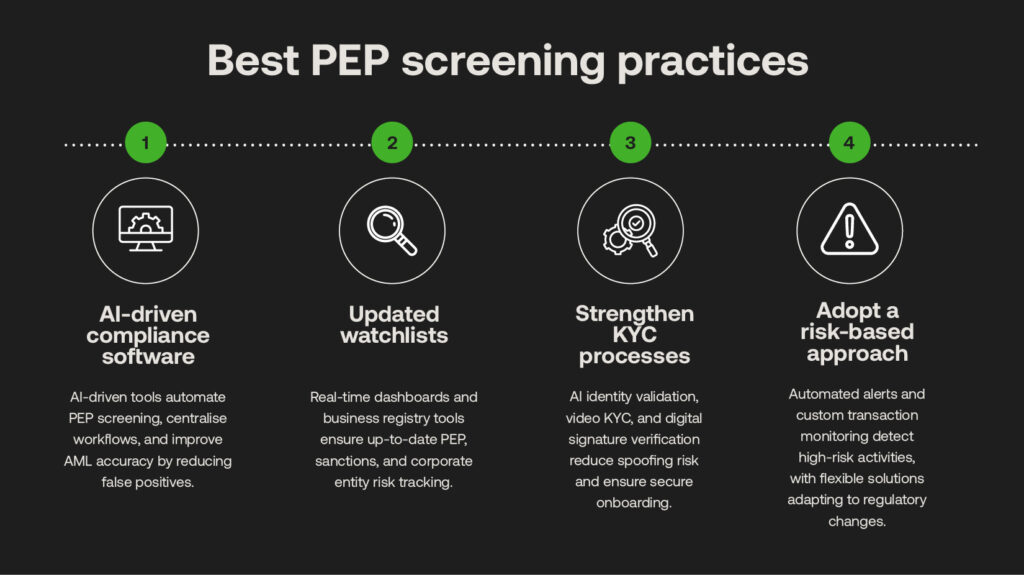

Best PEP screening practices for 2025

The increasing risks of sophisticated crime and ensuing penalties may loom strong, but with PEP screening capabilities offered through more proactive, technology-driven strategies, compliance teams can adapt their AML processes to accommodate automated KYC, KYB, regulatory reporting and more.

1. Upgrade to AI-driven compliance software

- Automated PEP screening minimises exposure to high-risk individuals.

- RegTech platforms centralise compliance workflows from onboarding to reporting.

- AI-powered AML tools reduce false positives for more accurate risk detection.

2. Keep watchlists updated

- Real-time compliance dashboards ensure instant PEP and sanctions screening.

- Business registry validation tools help track corporate entity risk profiles against trusted sources.

3. Strengthen KYC processes

- Integrated AI-powered identity validation and liveness detection technology reduce the risk of spoofing and deepfakes.

- Video KYC implementation tools provide high-risk customer verification.

- Digital signature verification can be deployed to ensure secure onboarding in line with official documentation.

4. Adopt a risk-based approach to AML compliance

- Automated risk alerts flag high-risk transactions before escalation.

- Custom transaction monitoring rules detect high-risk activities in real-time, preventing suspicious payment activities.

- Flexible AML solutions adapt to changing regulatory laws and requirements.

Preventing financial crime in a digital-first world

PEP screening is just one part of a comprehensive AML solution, but its importance cannot be understated. It isn’t just about avoiding fines—it’s about safeguarding your business, protecting customers, and stopping the spread of financial crime from country to country through sophisticated criminal networks.

Spotting past mistakes can help prepare for a future that is better equipped to nullify attempts by PEPs and organised groups to infiltrate the system. As trends this year show, businesses are turning more to AI-driven AML compliance solutions that can detect high-risk individuals and payments more accurately—from KYC and KYB automation at the outset to regular monitoring and reporting measures.

With more widespread RegTech adoption, financial institutions can better comply with regulators trying to stop financial crime at its source, maintaining the industry’s trustful reputation among a global base of customers.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.