South Africa’s AML/CTF Amendment Bill: what matters most for accountable institutions in 2025?

Table of Contents

In December 2024, the South African Treasury published the draft AML/CTF Amendment Bill, now open for comment. This bill aims to harmonise five key acts and strengthen commitments to deter non-compliance, which has halted the country’s regulatory status on the world stage since February 2023.

Beyond that, this Amendment Bill assists South Africa in preparing for the next Mutual Evaluation Report (MER) from the Financial Action Task Force (FATF), which is expected in February 2025. The FATF Africa Joint Group will then authorise an on-site visit to confirm their assessment of the progress of all action items, which would happen around May 2025.

Existing acts range from old to recent updates and apply to various sectors, including the Financial Intelligence Centre Act (FICA), the Companies Act, the Financial Sector Regulation Act (FSRA), and the Nonprofit Organisations Act (NPO Act). While this amendment bill has yet to take effect, here are pointers beneficial for businesses, financial or otherwise, that must adhere to improved protocols.

The fundamental changes in this AML/CTF Amendment Bill

Following consultations with the Department of Social Development, the Financial Intelligence Centre (FIC), the South African Reserve Bank (SARB), and others, these are the most noteworthy changes to take effect regarding new compliance requirements, stricter clampdowns, and better regulatory power over emerging risks, threats, and technologies.

AML/CTF Reporting and Compliance obligations

- Risk management for new products must now consider developing technology pushing for more comprehensive risk plans.

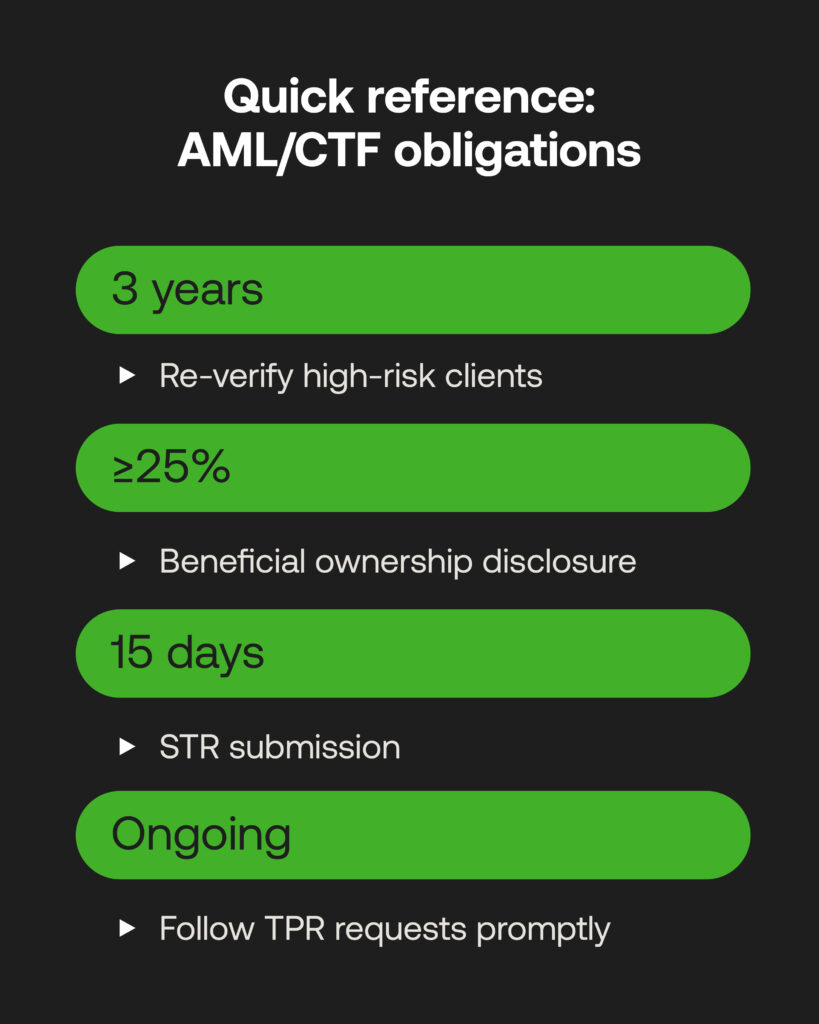

- Enhanced due diligence applies to all high-risk clients whose source of funds requires verification. Specific clients must be re-verified every three years.

- Beneficial ownership information for all companies and trusts must be included in a public register with administrative penalties for compliance failures. Those who ultimately hold at least 25% ownership or voting rights at a company must be disclosed by legal entities. This information must then be maintained for 5 years and provided upon request to relevant authorities.

- Suspicious Transaction Reports (STRs) should be submitted to the FIC within 15 business days after the identified activity – the bill makes many amendments to the emphasis on timeline adherence.

- Terrorist Property Reports (TPRs) have had their reporting obligations and responses more clearly outlined, emphasising meeting reporting obligations and requests from the FIC. Additional mechanisms to claim interest on Terrorist accounts (Before them being identified as such) have been added.

Governance and penalties

- The FIC can issue real-time compliance directives or unannounced inspections to assess AML/CTF adherence.

- Entities failing to report compliance face increased fines, which can reach R10 million or 10% of a company’s turnover if institutions repeatedly fail to follow the rules, like not submitting required documents or not reporting links to criminal or terrorist activities.

- Business securities registers are now more strictly required to be submitted, with late submissions attracting a possible R10 million fine.

- Assisting money laundering can lead to 15 years of imprisonment or fines determined by breach severity.

- Under the NPO Act changes, convicted individuals can face up to R1 million in fines, 5 years imprisonment, or both as maximum penalties.

- Anonymous clients with whom accountable institutions may not have established business relations are now more correctly referenced.

Recent developments

- Onboarding technology is encouraged for greater accuracy, e.g. biometric verification and e-KYC.

- An international cooperation framework calls for compliance information-sharing among international AML bodies.

- The FIC can now share information with the Public Procurement Office. Showing a trend towards collectively approaching AML

What this means for South African businesses

Bradley Elliot, CEO at RelyComply says:

Accountable institutions go beyond banks, PSPs, and fintechs to legal realms, automobiles, estate agencies, and non-profit organisations. However, all must take the same appropriate steps to adhere to these amendments and facilitate comprehensive and timely AML/CTF processes that are fully auditable to the FIC to reduce the risk of non-compliance. Maintaining oversight can be tricky, and employing compliance officers’ legal expertise can help close gaps in current AML/CTF solutions according to the following measures. Knowing that digital systems can be strategically upgraded according to priority, reducing risk and appeasing the authorities in question.

Management tools exist to assess better AML or CFT threats that individuals or companies pose. However, institutions must adopt a more comprehensive and proactive approach to researching emerging technologies, new delivery mechanisms, and potential partnerships. This includes considering the risks of new or developing technologies that may facilitate money laundering, terrorist financing, or proliferation financing activities. Institutions must also inform the Financial Intelligence Centre (FIC) of improved measures. A robust compliance program must continuously monitor user controls and customer risks as methodologies evolve, particularly in high-risk environments. For example, the FIC Act emphasises aligning risk and compliance measures with international best practices, such as the FATF’s Recommendations.

Reporting any cash transactions, assets, or property made or held by those with sanctions or terrorist affiliations must be immediate. Institutions are accountable for scrutinising clients thoroughly and routinely. The Amendment Bill has aimed, at least, to be more transparent about timelines or obligations involving varying circumstances.

Regulators are increasing supervision, with the right to investigate companies suspected of ill-compliance. Institutions must demonstrate AML/CTF processes and be transparent about beneficial ownership. Under the Companies Act, failing to submit securities or beneficial ownership registers for more than a year can simply be deregistered, while non-compliance can result in more significant fines than before – now capped at R10 million or 10% of turnover. However, a review by the Companies Tribunal can be requested to strengthen fairness in rightful enforcement.

The FSRA is also addressing licensing gaps. New financial entities not traditionally covered can arrange for appropriate licenses, as can those who operate in areas where regulation is uncertain—such as new financial products, delivery mechanisms, and services, now explicitly included within the regulatory frameworks. The FSRA still provides authority to pre-emptively address potential contraventions if they are suspected or likely to occur.

Bradley continues:

With the government’s steadfast approach to closing loopholes and increasing malpractice penalties, it’s a significant step to ensure companies know their obligations. This means maintaining oversight for onboarding, monitoring, screening, and reporting across every business—all paramount AML procedures that can be assisted through automated workflows.

But of course, the Amendment Bill’s intention to unite sectors under standardised compliance measures only works when compliance professionals, C-suite executives and relevant bodies coordinate their approaches. Innovation takes technological means to keep up with criminal typologies. However, innovation also means sharing findings in AML communities following any new legislation; this fosters the AML compliance-first culture needed to take whole nations to the right side of regulations.

With greater adherence to more resolute AML/CTF factors, international standards will be more likely to be reached, and future threats can also be diminished. We’ll keep an eye on the Amendment Bill’s introduction and effect on the greylisting status as the year goes on—so stay tuned!

Contact our team if you’d like to hear more about its impacts on AML compliance.