7 explosive trending scams in South Africa

Why everyone is at risk of online scams in South Africa

Our personal data is everywhere, and that’s proving problematic. Fraudsters know who we conduct personal finances with, mobile providers, and everyday emails and numbers to reach us on.

One day you could open your inbox and spot a subject line drastically urging action from, seemingly, your bank. Some recognisable branding, persuasive language is all it takes for one clicked link for scammers to gain even more sensitive account information. After that, life’s resources can be drained in seconds.

It can happen to anyone, no less at times when our guard is down. In the lead up toward the festive period, e-commerce activity ramps up and the criminals understand that. It’s best to be vigilant, and not contribute a chunk toward the $1.03 trillion that’s been scammed in the past year – where banking transparency and customer trust becomes the necessary cultural shift to stop scammers winning.

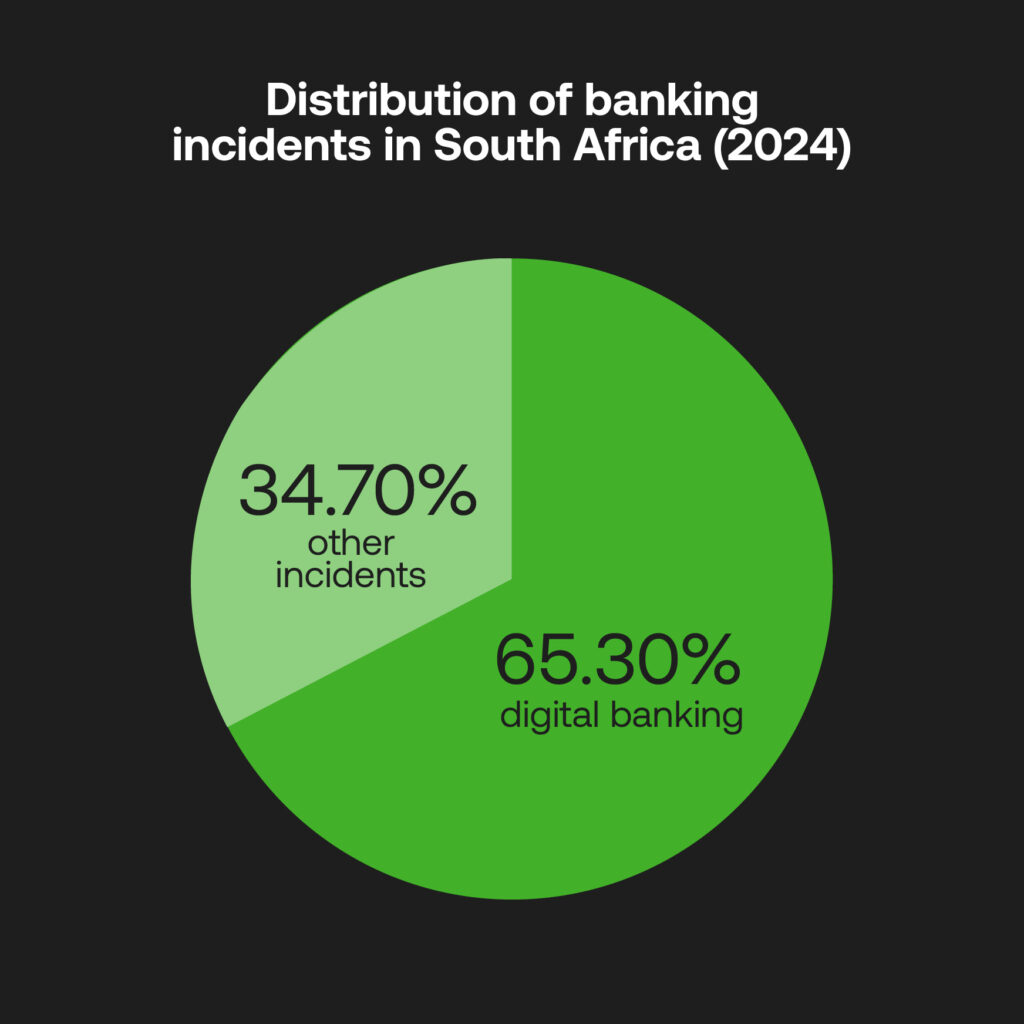

Digital banking in South Africa: a playground for fraudsters

Digital banking has been an innovative boon for mobile-first markets, particularly across Africa which has leapfrogged other regions’ efforts in recent years. In cruel backlash, the sector also ramps up fraud. South Africa’s Banking Risk Information Centre (SABRIC) notes that 65.3% of all 2024’s reported incidents were related to digital bankings, with losses exceeding R1.4 billion.

This is all despite efforts to enforce educational disclaimers. In the same year, the Financial Services Conduct Authority (FSCA) issued more than 100 public warnings around cyber-first threats that are increasing in scope and craftiness, making it trickier for anyone to separate faked banking communications from real ones.

Frighteningly, one individual was scammed out of more than R6 million in investments – one of the many rising online scams in South Africa – manipulated by individuals posing as bank employees on a fake app claiming to use the funds to trade on the Johannesburg Stock Exchange (JSE). In instances where banks can be mimicked, it duly creates a gulf of suspicion between institution and customer: the bond that’s integral to keep formal, safe finances flowing.

How scammers think and why that makes you a target

Being able to make vast sums in no time is attractive, a thrill to scammers that do not care for the devastating real-world effects on the other side of a screen, including loss of savings, emotional turmoil, relationship breakdowns, and lack of trust and heightened fear in public.

What makes criminals rub their hands more is the ease with which they can trick people regardless of their education, or financial standing. Older generations are often dismissed as vulnerable by younger, tech-savvy audiences that feel they’re impervious to crime. That’s not true, though. With advanced tools at scammers’ disposal, there’s no way they’re not going to use them.

Phishing scams are known persistent threats only becoming more complex. Emails and texts can spoof legitimate financial institutions through cloned logos, slyly altered characters in reply-to addresses, websites, and apps. They’re urgent and spark panic, leading to irrational decisions like handing over of personal information, in order to ‘settle’ the pressure cooker situation.

They’re one step ahead, even against the anti-fincrime agencies and networks that try to fight fire with fire. Deepfaked images and voices are near-perfect renditions of trustworthy individuals that can bypass the most advanced biometric identity verification checks. It’s not out of the question to feel a phone call from a family member needing money in a stressful situation is real, when it’s actually a fabricated vocal recording. So what are the trending scams we all need to be aware of:

The 7 scams South Africans are falling for right now

- Digital banking fraud

- Impersonation scams

- Deepfake-enabled scams

- Social engineering attacks

- Finfluencer and social media investment scams

- Crypto and fake trading platforms

- Investment apps

Banks and regulators fighting back against fraud

Elsewhere, digital assets are becoming massively troubling for banks attempting to stop fake traders or social media ‘finfluencers’ that champion cryptocurrency. South Africa is particularly affected by ill-used crypto; the huge Mirror Trading International (MTI) pyramid scheme defrauded investors out of over R8 billion – one of the most notorious online scams in South Africa to date.

The scamming problem is vast, evidently shown by how much Rand can be siphoned over and over again. So where are the institutions on the frontline here? The truth is there’s a gulf in anti-money laundering (AML) compliance adoption from large-scale traditional banks down to nascent fintechs, proving shortfalls in AI-driven monitoring, thorough due diligence and customer onboarding, and real-time reporting to authorities.

Regulators and banks together are looking to redefine their AML strategies to proactively identify suspicious behaviours before they proliferate – both to defend their bottom line, and to maintain reputational trust from customers, where data privacy remains a hugely valuable trait in financial services.

Why reporting scams builds safer banking in South Africa

Elsewhere however, there needs to be more promotion from banks around precautions, advice and the reassurance that reporting any instances of fraud (or ‘near misses’) are treated safely. Members of the public may be embarrassed to have been tricked, not having the confidence to know what to report, or who to. It’s unsurprising that South Africa’s reporting of incidents decreased to 65.1% in 2024/25.

In one study, even after 74% of scams were reported, another 57% noted no callbacks or actions being taken. That does not instill much hope that institutions are taking scams seriously, and wrecks credibility. Instead, transparently showing the impact of reporting crime through aggregated trends or stats also builds vital awareness, fostering the idea that reporting is worth doing to lead to change.

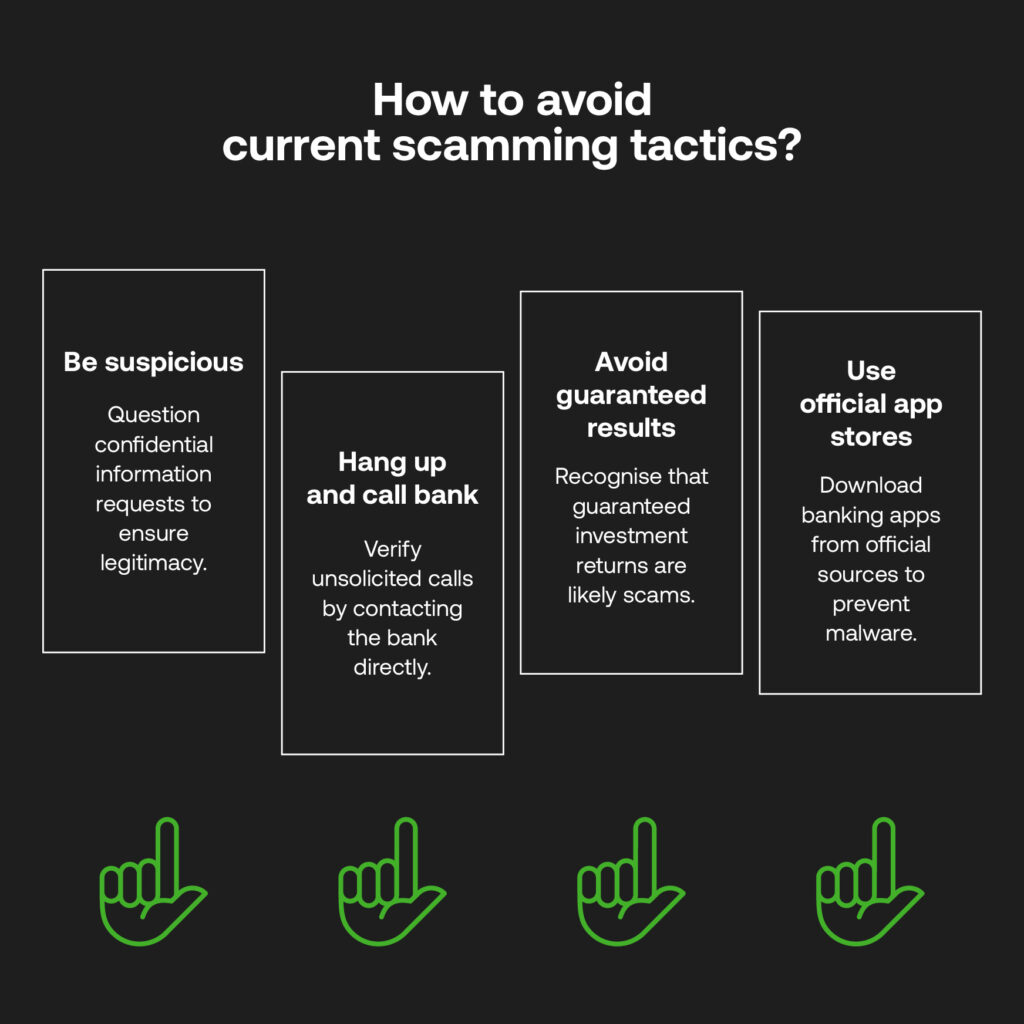

Protect yourself from scammers

As SABRIC outlines, there are many ways South African customers can stay abreast of criminal’s current scamming tactics:

- Be suspicious of anywhere requesting confidential information (ID photos, logins or PIN numbers) that legitimate banks would never ask for.

- Hang up if the call is unsolicited but urging action, and call your bank’s official number directly to check.

- Any investment opportunities guaranteeing returns is likely suspicious.

- Never download banking links through WhatsApp, Telegram, SMS, or email and use official app stores.

Beyond actions needed from the customer’s side, a bank needs to develop and nurture a direct communication line between reporters of suspicious behaviour and who they bank with, laid out in plain language and made easy to find across devices that their customers utilise.

Personal finance is a hugely sensitive topic that should be safeguarded by those we trust with our money. Only greater steps in utilising AML and educating consumers about evolving threats and reporting will create a feedback loop better suited to stopping such fraud types for good.