The hidden cost of prepaid gifting: are you risking it all for love?

Some time ago, Valentine’s Day vouchers would never have been considered a conduit of crime. Today, these small gestures of affection are also small steps belying elaborate laundering schemes.

Even still, prepaid gifting is such an under-the-radar risk that banks and retailers are often not aware of the extent to which criminals can capitalise on purchases of instant experiences. Hotel spa days, cooking classes, meals out or getaways can be displays of affection as much as they help move around proceeds from illicit gain, as, with many fincrime methods, digitalisation has twisted the use of convenient e-card gifting for nefarious means.

Even more scarily, the heightened emotion involved at Valentine’s Day means criminals are even more brazen in targeting victims through romance scams – a blindspot for AML investigations, being more tied to fraud cases, where scammers can carry out the recruitment of money mules or frivolously drain people’s savings on the sly.

To combat this, financial institutions and retailers must do far more than raise awareness for the general public. Instead, they must identify which typical alerts should be raised through integrated AML systems to put these opportunistic scam networks behind bars.

The intersection of love and laundering

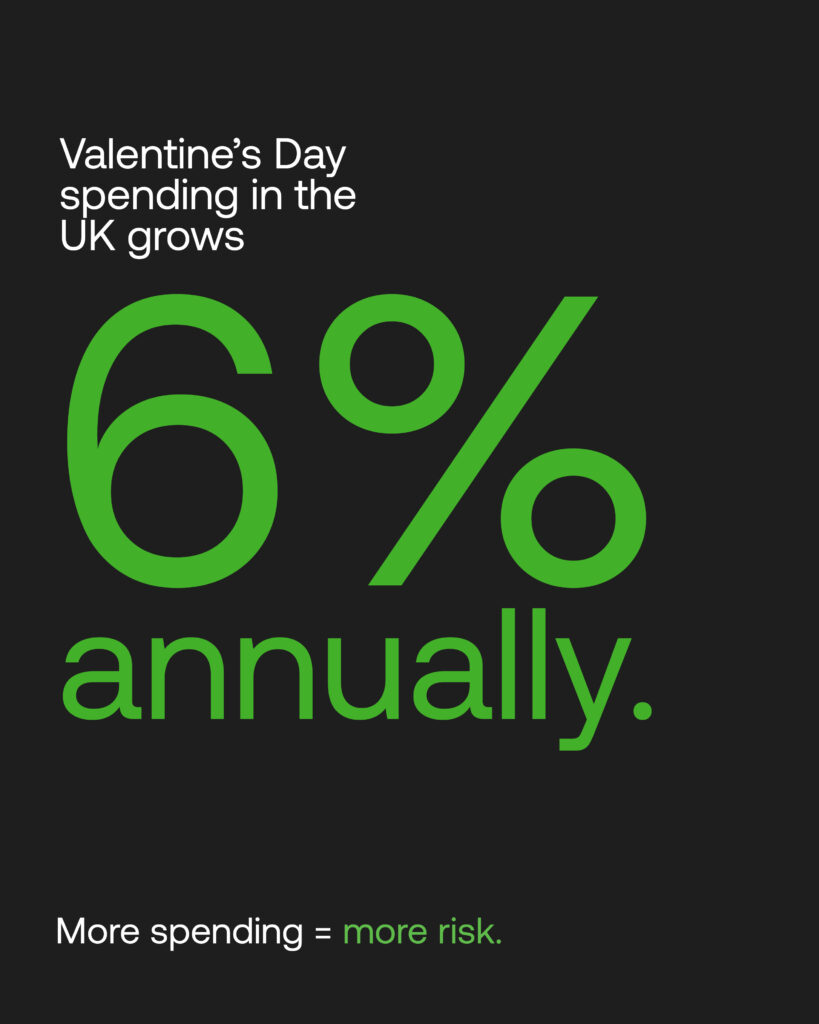

Gift cards and e-vouchers have made it simpler than ever to purchase thoughtful experiences for loved ones (besides a last-minute box of chocolates). Without hitting the high street, consumers can browse dedicated sites for digitalised packaged deals, with giants such as Amazon and Etsy capitalising on the trend that reaches greater heights on Valentine’s Day. Total spending on the day has grown 6% on average in the UK every year since 2017.

Now romantic gestures have shifted drastically from physical gifts to digital tokens, quiet routes into the financial system have been opened for criminals. And given these tokens’ convenience, February spending volumes provide more ample camouflage.

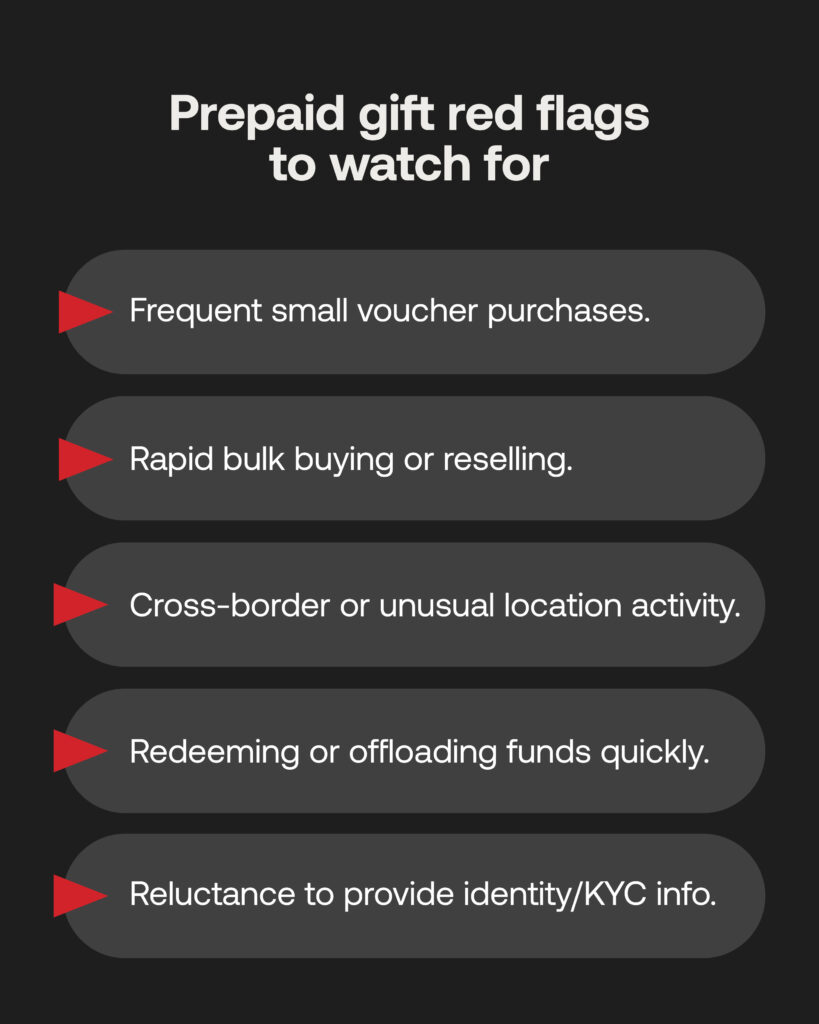

Such vouchers are considered low-risk payment tools: a type of prepaid instrument that can be added to digital wallets, topped up, and spent within closed company systems, or with various businesses. This means that retailers have little to no KYC requirements for who purchases them, including organised groups that re-sell them or exploit those buyers on grand scales. They play a key part of romance scams too, one of the most highly publicised schemes (from TV shows like The Tinder Swindler) that costs victims a whopping £106 million in 2024, according to the FCA.

Through online channels and dating apps, criminals pose as potential partners and play the long game. Often without having to meet in public, trust gets built with ever-vulnerable people tasked with buying and sending gift cards and vouchers to ‘prove’ their love, or to help with a fake emergency. The same urgency tactic works via WhatsApp messages, with scammers posing as friends or relatives in such situations. 85% of these start online, demanding gift cards as the only payment to start laundering victims’ funds instantly.

Beyond romance victims: The risk at retail level

Retargeting scams are also becoming more common, whereby scammers essentially double down their operations on victims that have already been duped. Today’s global criminal networks comprise various specialties (front line fraudsters, hackers, laundering specialists) that can perform various attacks when the individual’s guard is down – through psychological trauma, embarrassment, blackmail, or even from an individual feeling they have a duty to continue assisting their exploiters.

Muling is one targeted example, tasking witting and unwitting scam victims to buy, redeem and sell gift cards sporadically to gain commission. This ensures that the money trails of these already near-anonymous vehicles are very tough to detect, often splitting sums across hundreds (or more) accounts.

Banks and retailers already have a difficult job for spotting suspicious transactions among huge datasets of financial flows, and e-vouchers provide another digital asset typology exposing any gaps in their investigative processes, on top of these threats:

- Bulk-buy and laundering: using stolen or laundered funds, criminals will buy up a large amount of gift cards from sellers, then resell them at a discount rate to convert them into clean money.

- Cross-platform schemes: bought gift cards can be exchanged for other grey-area non-fiat assets such as NFTs and gaming credits, which can also be resold for cryptocurrency to halt their trackability.

- Fake gifting sites: pop-up stores or advertisements will collect digital payments for experience vouchers that do not exist, then simply shut down operations with the victims’ money already claimed.

When cryptocurrency mixers and tumblers work with assets that are either unregulated or blur the lines between legitimate and illegitimate transactions, digital gifts fall into this category, and force financial institutions to think well beyond basic KYC requirements for opening bank accounts.

5 Controls to safeguard prepaid systems

The FCA has seen more commitment from banks to battle romance fraud. But the financial world can do better to install AML systems that are able to account for prepaid instruments, and identify suspicious behaviours from high-risk customers and those displaying signs of money muling – including the inability to supply KYC data, frequent small outgoings, and sudden offloading to third party accounts.

The technology is there, where a greater appetite to adopt RegTech can bring together fraud and AML investigations to assess risks commonly associated with prepaid gifting and romance schemes. Scattered financial information from vouchers, e-cards, and assets across digital wallets can therefore be centralised within end-to-end solutions, which screen and detect any suspicious wrongdoing in their early stages, and therefore before romance scams, muling, and extortion efforts escalate:

- Integrate prepaid data: this type of transaction should be tagged accordingly and treated with the same risk scrutiny as another payment instrument.

- Use enhanced KYC: every onboarded merchant, third party and customer should be screened and continuously monitored to maintain transparency on who issues, sells and accepts prepaid gifts.

- Track voucher lifecycles: a retailer or financial institution should record audit trails of any purchases, where they are redeemed, activated, or even resold.

- Conduct entity resolution: platforms can connect buyers and redeemers through logged data around shared devices, communication platforms, and IP addresses.

- Utilise AI-driven intelligence: spot and raise anomalous spending patterns, quick bulk purchases, frequent cross-border activity and inconsistent redemptions.

With better compliance training to understand and spot red flags, and customer and transaction data integrated across AML from onboarding to reporting, prepaid flows become far more visible. There’s a misconception that these tricky-to-identify means of shifting money are untraceable; it’s more that real-time risk-based monitoring has not been prioritised, and that AML and fraud has long remained unconnected compliance function.

Prepare for prepaid AML progress

Valentine’s Day may put the onus on romance fraud and niche prepaid vehicles for financial crime, but these continue at all times outside of peak gifting seasons. It is becoming rapidly integral to attune proactive AML systems to the very specific dangers of prepaid gifts, where even subtle risk alerts can halt the progress of wider scam artists and their overlords.

With more widespread adoption at retailers and the banks to utilise RegTech, and bridge gaps between AML and fraud teams, thoughtful e-gifting can continue in its upward trajectory. Legitimate money and love can both make the world go round – in a way that’s more safe for consumers, and more challenging for criminals that think they’re impervious to being caught.