How culture can drive innovation for AML compliance

Table of Contents

Our world has been built by culture. It’s an inescapable part of humankind, comprising behaviours, communication systems, customs and schools of thought. Evolving cultures stemming from ancient civilisations all the way to the present day teach us about the various ways we can solve societal problems and progress.

In that regard, anti-money laundering (AML) compliance for businesses shares similarities. Rules help cultivate a collective mindset toward tackling criminals and fraudsters, and helps drive innovation for AML compliance, a matter which needs to be better understood as a real-world problem affecting all of our lives.

We are all governed by values to hold ourselves and others accountable – instilling that same behavioural code lies in the hands of business leaders and compliance officers, with the aim of making the world (business and otherwise) a better place.

Why values matter

We are more inclined to connect with people or companies that we agree with. It’s part of the reason why the world’s most recognisable brands are successful, making sure that their values seep into everything they do, from brand strategy to product marketing to charitable endeavours.

With a strong overarching message tying everything together, it’s easier to appeal to audiences that share the same values.

A brand’s culture comes from the top down. Not only does that take into account mandatory legal or regulatory matters that determine a certain ethical standard, but also an organisation’s value system, goals, and code of conduct towards who works for them and who they work with. Both are tied to each other closely.

For example, in the case of financial institutions that must adhere to compliance protocols, malpractice can have devastating effects and fuel trafficking, slavery, or money muling, all conduct that goes against the ethics held by most people.

The financial world seems to still be floundering in the face of swiftly-changing regulatory protocols. Since the financial crisis, banks have paid more than $204 billion in fines and settlements, examples of non-compliance in AML/CFT that can let criminal activity flourish worldwide.

If every employee bought into a shared culture that supports each other and takes a stand against real-life nefarious activity, compliance efforts may be increased. Sadly, as few as 12% of organisations feel that they are promoting the “right culture” in regards to communications, inclusivity and regular training.

The psychology of employee engagement

AML compliance culture adheres to both human needs and corporate needs. Even macro-business issues related to regulations (including cost pressure and hiring policies) have a knock-on effect on workplace culture too, such as the handling of sensitive data and employee retention. And no business exists without the people that make it happen.

Adhering to every social and psychological factor across the board may sound tough. But with poorly instilled values, nothing can be scrutinised and lead to behavioural biases in the workplace. Nurturing a comfortable working environment, promoting agreeable values, and allowing for individual talent and expression leads to positivity outwards.

Everyone conducts their everyday life and work according to their own moral code. We want to be rewarded for good behaviour and see bad behaviour or rule-breaking identified. These psychological matters highlight why formalised compliance protocols need to come into play – normalising good conduct in line with an overall value system can lead to better workflows and reduce widespread malpractice.

Going beyond AML compliance ‘on paper’

If psychology can be an abstract concept, AML compliance can instead document more tangible suggestions to follow, FATF’s Recommendations by example.

Compliance officers have the tricky task of keeping up with these ever-evolving advanced regulations, then conveying them in more simple terms throughout their organisation. But this is the important first step in reinforcing a positive compliance culture – AML risk assessments can help a company dictate their values, policies and protocols to employees from the very start at the onboarding stage, allowing innovation for AML compliance.

One major problem financial services face is its separation from real-world problems. The thought of criminal proceeds being flushed through institutions we all use goes by too easily, when it should be front-of-mind that faulty AML compliance can have drastic repercussions.

Company culture should include regulatory education, with diversified ways to assist this understanding. Guided training sessions, incentives and insightful keynote talks can all help to boost awareness of the impact of business values on everyday life. Compliance officers and HR teams should together foster inclusive, transparent discussions around how both workplace and compliance processes could work better.

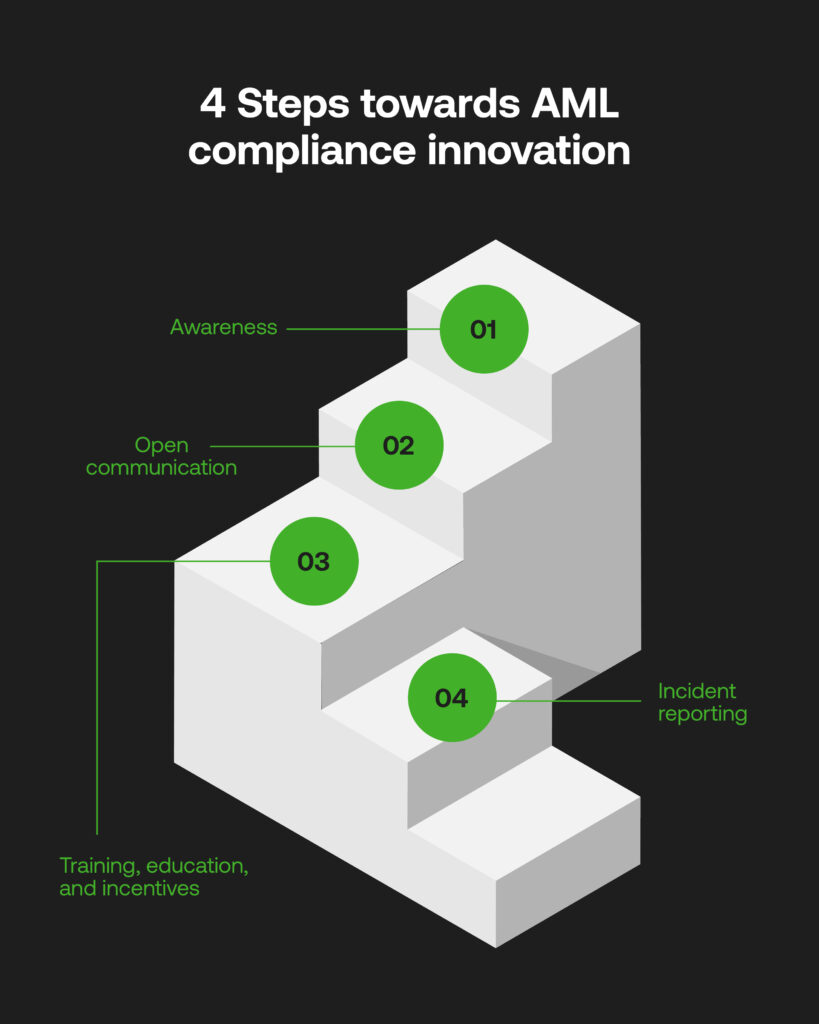

Stepping stones towards innovation for AML compliance

Ultimately, better employee engagement can start with four main steps:

- Awareness – Promote the values of business leaders

- Open communication – Create a comfortable forum for employees to voice concerns and praise

- Training, education, and incentives – Make compliance mean something to individual values in inventive ways, and convey compliance frameworks routinely

- Incident reporting – Use AML compliance tools to identify risk in an internal audit to determine any violations of company culture

With an overall compliance culture in place, and technology facilitating its implementation, an aligned workplace can be a major contributor to a more cohesive and powerful fight against financial crime when we need it most.

Learn more

Choosing the right technology partner for AML compliance can make for efficient workflows and invaluable reporting within and outside an organisation. RelyComply’s flexible AML compliance platform utilises an AI-driven approach for KYC/KYB, transaction screening, transaction monitoring and more for an end-to-end experience that can suit your business needs.

To see how RelyComply’s smart, powerful anti-money laundering platform can help you, contact one of our experts today.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.