Employee screening: a comprehensive how-to guide

Table of Contents

Complying with the Financial Intelligence Centre’s (FIC) 2023 Directive 8 on employee screening is mandated for accountable institutions. It formalises compliance for employment purposes while assessing for money laundering, terrorist financing, and proliferation financing risks.

Digging deeper into who you have hired should be a given. Knowing how to do it thoroughly is a whole other matter. This may bring up qualms about the practical implications compliance officers must follow, but understanding when, what, and how to screen is the first step and how automated tools can help streamline manual processes with ease.

Understanding the Employee Screening Requirements of Directive 8

Directive 8 from the FIC mandates that accountable institutions screen prospective and current employees for competence and integrity and scrutinise their information against targeted financial sanctions lists. This includes assessing employees’ skills, qualifications, criminal records, and potential associations with high-risk individuals or entities.

Companies must adopt a risk-based approach, with more frequent and stringent screening for high-risk employee roles, such as senior management or decision-makers in anti-money laundering processes.

The FIC is clear that every accountable institution, including banks, payment providers, fintech, currency traders, wealth managers, lawyers, estate agents, and car dealers (to name but a few) are obligated to screen employees as follows:

Competence

Screening can ascertain if an employee has the correct skills for a particular role (qualifications, accreditations, etc.), but enhanced due diligence into employment history and character references is a critical stage to check whether they’re ideally qualified for the job at hand.

Integrity

Understanding an employee’s ethical grounds and honesty is essential alongside criminal checks. For those in higher-risk roles, such as compliance officers, further scrutiny of past positions may be necessary, as well as mapping connections to Politically Exposed Persons (PEP) and possible terrorist and proliferation financing.

Targeted Financial Sanctions

Screening employees against sanctions lists provided by the FIC can safeguard against engaging in relations with individuals under financial prohibition due to illicit activity.

Compliance with Labour Laws and Privacy Regulations

Notably, these compliance measures necessitate striking a delicate balance between employee screening and labour law. Firms must maintain compliance with labour laws, anti-discrimination legislation and privacy regulations. An example of this includes the Protection of Personal Information (POPI) Act.

Digital onboarding must ensure that sensitive data (of which there is plenty) is handled with ethical care and enterprise-grade security.

The Challenges of Manual Employee Screening

Traditionally, employee screening has been time-consuming and resource-intensive, often involving manual checks of various databases and sources. With large volumes of data and frequent updates to sanctions lists, the potential for human error and inconsistencies increases, leading to compliance risks.

Additionally, companies must navigate the complexities of labour laws and privacy regulations listed above, ensuring that sensitive employee information is handled appropriately.

When to screen employees

Frankly, screening every employee for AML and CTF is necessary for pre-onboarding and once a person becomes employed. As recommended by FIC, risk-based approaches should be considered, whereby senior company figures may need to be scrutinised more than administrative personnel, as the greater the implicated risk, the more frequent and intense the screening.

In keeping with transparency initiatives, the FIC also requires thoroughly recording screening measures, an element now critical to a company’s overarching risk management and compliance programme (RMCP). As these records may be requested at any time, it is best to comply with immediate effect, as avoidance could result in a fine or, worse, a ban

RelyComply’s AI-Powered Digital Onboarding Solutions

Our end-to-end anti-money laundering compliance solution offers a comprehensive and intelligent approach to employee screening, leveraging advanced artificial intelligence (AI) and machine learning algorithms. With these AI-powered digital onboarding solutions, enterprises can streamline and automate their employee screening processes whenever necessary, reducing operational costs and mitigating risks.

RelyComply also recognises the importance of maintaining compliance with labour laws, anti-discrimination legislation and privacy regulations. Our platform follows best practices and adheres to strict data privacy and security standards for handling sensitive employee information responsibly.

Key Features and Benefits

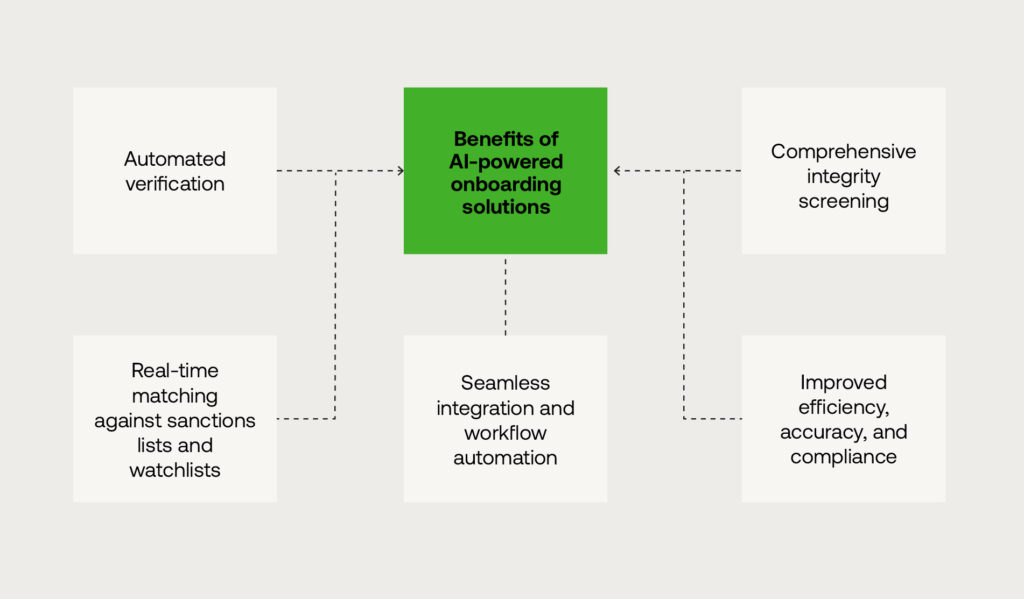

To address the hurdles of employee screening, our digital onboarding solutions provide a range of powerful features and benefits, notably including:

1. Automated Verification of Employee Competence: Our solution automatically verifies employee qualifications, accreditations, employment history, and references, ensuring a thorough competence assessment.

2. Comprehensive Integrity Screening: Advanced algorithms screen employees for criminal records, associations with high-risk individuals or entities (such as politically exposed persons), and potential involvement in financial crimes or adverse media coverage.

3. Real-Time Matching against Sanctions Lists and Watchlists: Employee information is monitored and matched against the latest targeted financial sanctions lists, watchlists, and adverse media sources, ensuring up-to-date risk profiles.

4. Seamless Integration and Workflow Automation: RelyComply’s solutions integrate seamlessly with existing HR systems and workflows, enabling efficient and automated screening processes.

5. Improved Efficiency, Accuracy, and Compliance: By leveraging AI and automation, companies can significantly enhance the efficiency and accuracy of their employee screening processes, reducing the risk of non-compliance and associated penalties.

In an era of increasing regulatory scrutiny and heightened risks of money laundering, terrorist financing, and proliferation financing, companies must adopt robust and efficient employee screening processes. RelyComply’s AI-powered digital onboarding solutions offer a comprehensive and intelligent approach, empowering accountable institutions to mitigate risks, enhance compliance, and safeguard their operations.

To learn more about RelyComply’s cutting-edge solutions and how we can streamline your employee screening processes, arrange a demo today.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.