Risk and compliance reporting

Table of Contents

Why legal practitioners aren’t above the law

In recent months, directives from the Financial Intelligence Centre (FIC) to accountable institutions have not gone unnoticed. As efforts to combat financial crime have scaled in light of the country’s greylisting, businesses across the financial field have felt the added compliance load. Legal practitioners are no exception, where Directive 6 mandates Risk and Compliance Reporting to the FIC, with its detailed data requirements, causing law firms to feel the heat.

As a profession exposed to financial transactions and sensitive client information, legal practitioners are inclined to err on the side of caution. Anti-money laundering (AML) and counter-terrorist financing (CTF) measures are consequently mostly welcome. However, questions arise on the practical front as legal firms strive to ensure compliance in a regulatory environment under near-microscopic scrutiny.

With time of the essence, luckily, legal firms can join forces with the right tech partner to maintain their Risk and Compliance Reporting and remain on the front foot.

AML Compliance checklist for law firms

Legal firms face several regulatory hurdles that are more than check boxes, including:

- Establishing a risk management and compliance programme (RMCP): Implementing such a strategy should include robust internal controls, policies, and procedures to govern customer due diligence, transaction monitoring, and reporting of suspicious behaviour. Firms can look to the LASA Law Association of South Africa for a helpful template.

- Undertaking rigorous customer due diligence (CDD): Knowing your customer (KYC) is not optional but integral to an effective compliance framework. Beyond initial KYC, ongoing monitoring is required to ensure every client is routinely authenticated and the nature of their business is thoroughly assessed.

- Suspicious behaviour and cash threshold reports: Suspicious transaction reports (STRs) are raised when a client engages in conduct that points towards the possibility of money laundering, terrorist financing or other illicit activity. Cash threshold reports, on the other hand, are intended to monitor transactions of high value, as a means to assess dubious financial flows.

- Submitting a risk and compliance return: As the newly introduced framework in question, this comprehensive report details the risk backdrop of a business in terms of money laundering, fraud and terrorist financing, together with the combative compliance efforts in place.

Completing your Risk and Compliance Reporting, fast

Legal firms have multiple processes on their plates at once, without much time or the necessary resources to heap a heavy compliance burden onto the pile. Automation and artificial intelligence (AI) tools have created a seismic impact on the regulatory landscape, so for legal professionals, it simply makes sense to turn compliance over to the experts for smarter, smoother risk management and reporting.

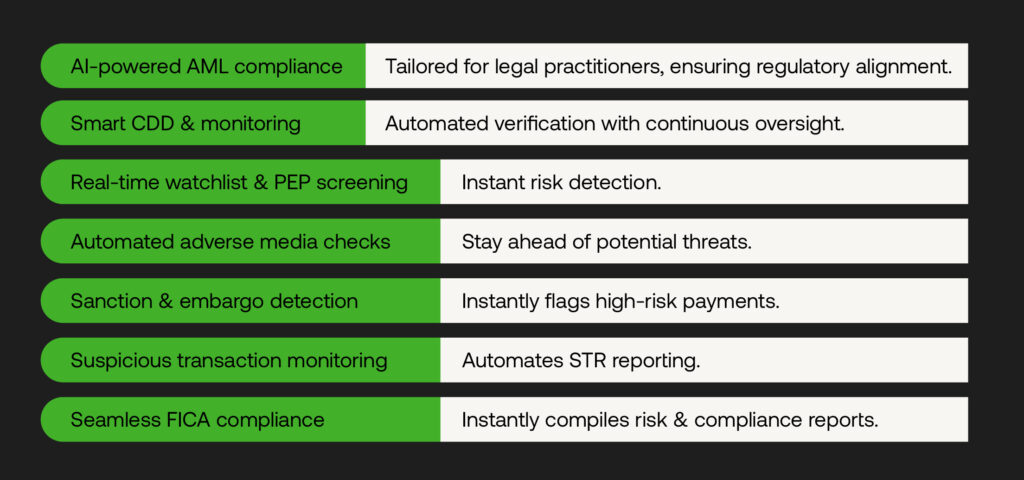

Our end-to-end AML solution is perfectly tailored to meet the needs of the legal practitioner, ensuring that all the right boxes are checked for the regulator. Get an AI-powered suite that:

- Intelligently carries out CDD through automated verification processes and enhanced ongoing monitoring

- Performs continuous real-time watchlist and politically exposed person (PEP) screening

- Automatically monitors for adverse media

- Detects sanctioned and embargoed payments instantly through advanced algorithms

- Monitors suspicious transactions and automates the compilation of STRs

- Aggregates and compiles all the data required for the FICA-mandated risk and compliance report immediately for an automated, complete return

By leaving AML and CTF risk management and reporting to a flexible, fast, and innovative tech platform, legal firms can focus their human attention on the relationships that matter. The RelyComply platform can provide all the much-needed information and data needed for the FIC Risk Return Report, leaving no stone unturned.

Have a chat with us or arrange a demo to see how our streamlined solution can address your end-to-end compliance needs, safeguard your processes, and ensure AI-driven financial crime prevention and instant risk returns for your FIC submission.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.