Advanced KYB techniques for AML professionals

Table of Contents

- The Limitations of Traditional KYB Methods

- Advanced Data Collection and Analysis Techniques

- Enhanced Due Diligence for High-Risk Entities

- Cross-Border Risk Assessment

- Continuous Monitoring and Dynamic Risk Scoring

- Leveraging Network Analysis in KYB

- Overcoming Challenges in KYB Implementation

- Integrating KYB with Broader AML Strategies

- Conclusion

In today’s rapidly evolving financial landscape, the sophistication of money laundering schemes has reached unprecedented levels. As Anti-Money Laundering (AML) professionals, we face an ongoing challenge to stay ahead of criminals who constantly adapt their methods to exploit weaknesses in compliance systems. Traditional Know Your Business (KYB) procedures, while foundational, are no longer sufficient to uncover the complex web of hidden risks that modern financial criminals create.

This article examines advanced KYB techniques that leverage technology and innovative approaches to enhance risk detection and strengthen AML compliance. We’ll also explore how RelyComply, a leader in AI-driven AML compliance solutions recognised in the FinCrime Tech50, RegTech100, and AIFinTech100 lists for 2024, addresses these challenges for enterprise-level organisations.

The Limitations of Traditional KYB Methods

Before we explore advanced techniques, it’s essential to understand the shortcomings of conventional KYB approaches:

- Reliance on static data: Traditional methods often depend on point-in-time information, missing dynamic changes in business risks.

- Limited scope: Basic KYB checks may not capture complex ownership structures or international connections.

- Manual processes: Time-consuming manual reviews can lead to inconsistencies, lengthy onboarding times and human error.

- Siloed information: Lack of integration with other data sources can result in incomplete risk profiles.

These limitations create blind spots that sophisticated criminals exploit to conceal their activities.

Advanced Data Collection and Analysis Techniques

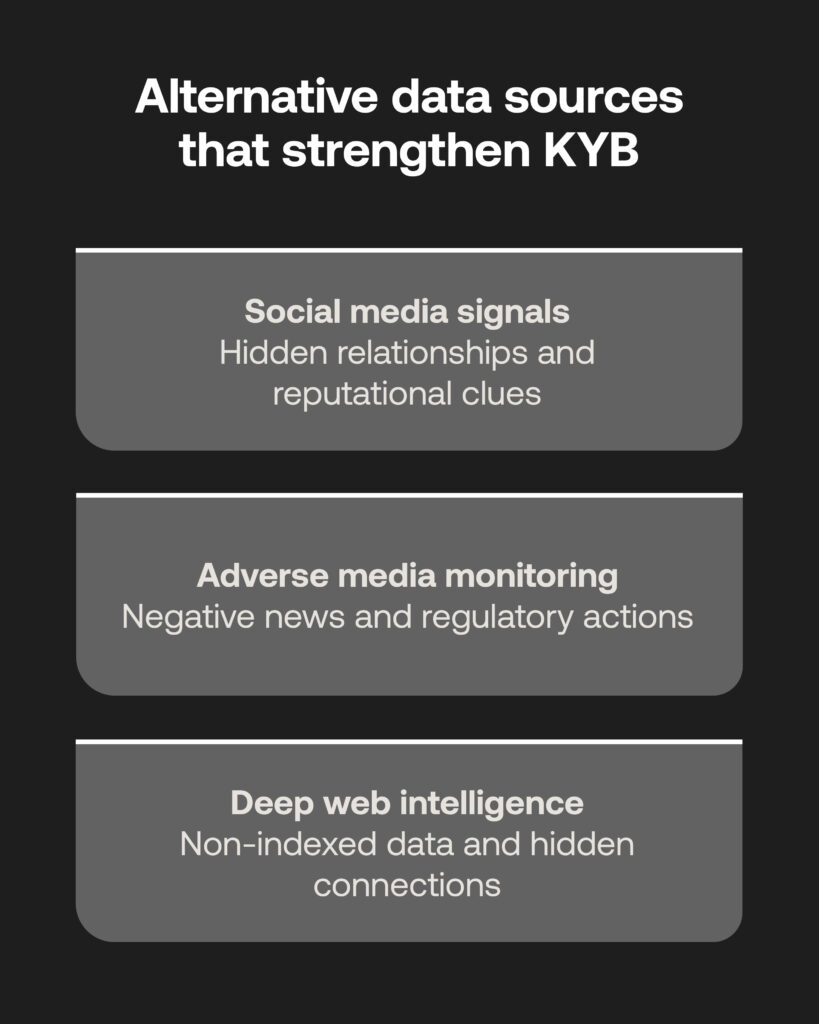

Leveraging Alternative Data Sources

To build a comprehensive risk profile, AML professionals must look beyond standard business registries. Advanced KYB techniques incorporate:

- Social media analysis: Monitoring social platforms can reveal undisclosed business relationships, lifestyle inconsistencies, and reputational risks.

- News and media monitoring (Adverse Media Screening): Adverse media screening, also known as negative news screening, is a critical component of advanced KYB processes. It systematically monitors news sources and media outlets for negative information about a business entity or its associated individuals. This includes:

- Global and local news sources

- Industry publications

- Regulatory announcements

- Court records and legal proceedings

- Watchdog reports and investigative journalism pieces

- Involvement in financial crimes or fraud

- Regulatory violations or sanctions

- Environmental scandals

- Labour disputes or human rights violations

- Reputational issues or public controversies

Adverse media screening is crucial as it provides real-time, contextual information that may not be captured in official records or databases. It offers valuable insights into a business’s reputation, ethical standing, and potential hidden risks.

- Deep web searches: Exploring non-indexed internet content can uncover hidden connections and activities.

RelyComply’s advanced AI algorithms continuously scan and analyse diverse data sources, including social media, news outlets, and deep web content, providing a comprehensive risk profile for each business entity.

Enhanced Due Diligence for High-Risk Entities

Beneficial Ownership Investigation

Uncovering the actual beneficiaries of a business is crucial for effective risk assessment:

- Multi-layered ownership analysis: Advanced tools can map complex corporate structures, revealing hidden ultimate beneficial owners (UBOs).

- Cross-referencing with global databases: Automated systems can check ownership against PEP lists, sanctions databases, and other risk-relevant sources.

- Continuous checks: Tracking changes in ownership over time can reveal suspicious patterns or attempts to obscure true ownership.

RelyComply’s platform offers visualisation tools for mapping complex ownership structures and automatically cross-referencing findings with global risk databases, providing a clear picture of beneficial ownership over time.

Transaction Pattern Analysis

Advanced KYB goes beyond static business information to examine financial behaviour:

- AI-driven transaction monitoring: Machine learning models can analyse historical transaction data to establish standard patterns and flag anomalies.

- Network analysis: Visualising transaction flows can reveal connections between seemingly unrelated entities, potentially uncovering shell company activities.

- Behavioural analytics: Advanced systems can identify changes in transaction patterns that may indicate new risks or criminal activities.

RelyComply’s end-to-end AML solution integrates transaction monitoring with KYB processes, offering holistic risk assessment through advanced network analysis and behavioural analytics. Plus, with its integration with the goAML feature, Suspicious Transaction Reports (STRs) can be pre-filled with accurate data automatically and then submitted to the regulator in just a few clicks, creating timely and comprehensive audits for any risky payment behaviour.

Cross-Border Risk Assessment

In an increasingly globalised economy, effective KYB solutions must account for international complexities:

- Geopolitical risk integration: Advanced KYB solutions incorporate real-time geopolitical risk data to assess the impact of global events on business risk profiles.

- Regulatory mapping: Navigate the complexities of different regulatory environments, ensuring compliance across jurisdictions.

- Data-specific nuances: advanced machine learning algorithms can learn contextual differences in spelling and language for matching purposes, negating the risk of false positives from regional variations.

Continuous Monitoring and Dynamic Risk Scoring

Static periodic reviews are no longer sufficient. However, advanced KYB solutions employ:

- Real-time risk assessment updates: Continuous monitoring systems adjust risk scores as new information becomes available.

- Event-based enhanced due diligence: Automated systems can initiate deeper investigations based on predefined risk indicators or score changes.

- Adaptable risk approaches: Customisable risk assessment calculations help to monitor business activities against regional KYB regulations no matter what country you operate in.

RelyComply offers continuous, real-time monitoring and dynamic risk scoring, automatically triggering enhanced due diligence when needed.

Leveraging Network Analysis in KYB

Understanding the broader context of a business’s relationships is crucial:

- Entity resolution: Advanced techniques can identify when the same entity appears under different names or contexts.

- Relationship mapping: Visualising connections between businesses, individuals, and transactions can reveal hidden networks of high-risk entities.

- Centrality analysis: Identifying key nodes in complex business networks can highlight entities that pose systemic risks.

RelyComply’s network analysis capabilities visualise complex business relationships, helping enterprises identify key risk nodes and hidden connections.

Overcoming Challenges in KYB Implementation

While powerful, these techniques come with their own set of challenges:

- Data privacy compliance: Ensure all data collection and analysis methods comply with regulations like GDPR.

- Managing false positives: Implement human oversight and refine AI models to reduce false alarms.

- Skill gap: Invest in training AML professionals to use and interpret results from advanced KYB tools effectively.

- Technology integration: Ensure new advanced KYB systems can be accommodated alongside an existing AML infrastructure.

RelyComply is designed with data privacy regulations in mind, ensuring compliance with global standards. Our AI models are continually refined to minimise false positives, and the user-friendly interface reduces the learning curve for AML professionals. Moreover, RelyComply offers seamless integration with existing enterprise systems.

Integrating KYB with Broader AML Strategies

Advanced KYB is most effective when seamlessly integrated with other AML processes:

- Holistic risk view: Combining KYB data with transaction monitoring, sanctions screening, and other AML processes provides a comprehensive risk assessment.

- Feedback loops: Information from ongoing monitoring and investigations should inform and refine KYB processes.

- Cross-functional data sharing: Breaking down silos between processes enhances the overall effectiveness of risk detection.

As an end-to-end AML compliance solution, RelyComply integrates KYB with other AML processes, providing a unified platform for comprehensive risk management and facilitating cross-functional collaboration.

Conclusion

As financial crimes become more complex, AML professionals must evolve their KYB techniques to stay ahead. Advanced KYB techniques, powered by AI and comprehensive data analysis, are crucial for uncovering hidden risks and maintaining robust AML compliance.

RelyComply stands at the forefront of this evolution, offering enterprise-level organisations a state-of-the-art, AI-driven AML compliance solution. By leveraging RelyComply’s advanced capabilities, businesses can significantly enhance their risk detection abilities, streamline compliance processes, and stay ahead of emerging financial crime threats.

Evaluate your current KYB processes against the advanced techniques discussed in this article. If you find gaps or areas for improvement, consider how an end-to-end solution like RelyComply could enhance your AML compliance strategy.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.