Enhancing customer onboarding at scale

Table of Contents

Despite it being the norm, the thought of interval-led know your customer (KYC) every few years seems extremely outdated. Crime never sleeps and customers transact around the world at any time of day. Illicit payments and people can infiltrate the system at any point. Presiding over the comings-and-goings continuously is paramount to every modern financial institution.

At least, that’s why compliance requirements for KYC are increasing to those that can afford it, and those that cannot. That’s a tricky business, particularly for market startups breaking new ground with products to democratise finance and make it accessible for more digital customers. But in ignoring regulatory measures due to rising expenditure, they leave themselves open for risk. In South Africa alone, the estimated annual spend on KYC totals $1.4 billion; a sizeable chunk contributing to around $37.4 billion spent on anti-crime compliance all over the world, and counting, with rising threats from transformative digital crime innovations.

On the one side, there’s greater technology-driven financial solutions and customers eager to get on onboard. Elsewhere, there’s criminal sophistication, and the global and local compliance watchdogs ensuring that anti-fincrime controls keep up. There’s a battle at play making it feel impossible to grow business; but competitive advantage and strong client relationships is all possible when KYC is made secure, fast, and continuous through regulatory technology (RegTech).

Why greater customer trust lies with KYC

Everyone that’s tried to open an account or request a mortgage offer or a loan with a new financial institution (FI) will have experienced difficulties. Initial KYC checks have traditionally been slow, no matter if the customer on the receiving end had no convictions or ill intent. Analysts had to cross-reference photographic evidence with national records. It could have taken up to 26 days, as found in one report, enough to drive away the most patient of customers. After this stage, infrequent periodic reviews using inflexible legacy systems remain prone to risk from sanctioned or politically exposed individuals.

How a customer gets onboarded can have great ramifications for an FI. With building trust comes reputational fervour, and the ability to gain more business. This is especially true for those trying to find their way into the market with a sturdy and loyal customer base. In that sense, KYC is not just a legal requirement, but an operational benefit to deliver innovations to more people in the safest way.

For startups (such as neobanks, peer-to-peer payment solutions or buy now pay later products) that may see increased demand due to their lower fees or slick interfaces, more stringent KYC is needed to accommodate greater numbers. This is a huge cost even to large global banks, who see the added challenge of catering to userbases anywhere in the world. Increased compliance expenses filter from services down to paying customers, creating another disconnect that can affect a business’ forward trajectory.

3 cutting-edge onboarding innovations, and how they work

Beyond the cumbersome operations and disparate data sources of legacy anti-money laundering (AML) systems, the fertile environment of AI-assisted financial crime poses increasing risk to sensitive customer data, then regulatory clampdowns, fines, and reputational loss. Each can have long-lasting effects on customers’ views of a bank, investment firm or fintech, where even costs to rectify them may not be enough.

Despite FIs’ commendable attempts to instil more secure authentication (two-factor, or identity verification) for KYC, there are greater threats. Deepfake technology utilising generativeAI (GenAI) can take stolen ID photos to mimic users and bypass KYC measures for hackers to launder money or otherwise. A majority of finance professionals have already experienced such scams (and many more falling victim), where real-world deepfakes cause automated detection tools to drop their accuracy by up to 50% – an extremely worrying figure.

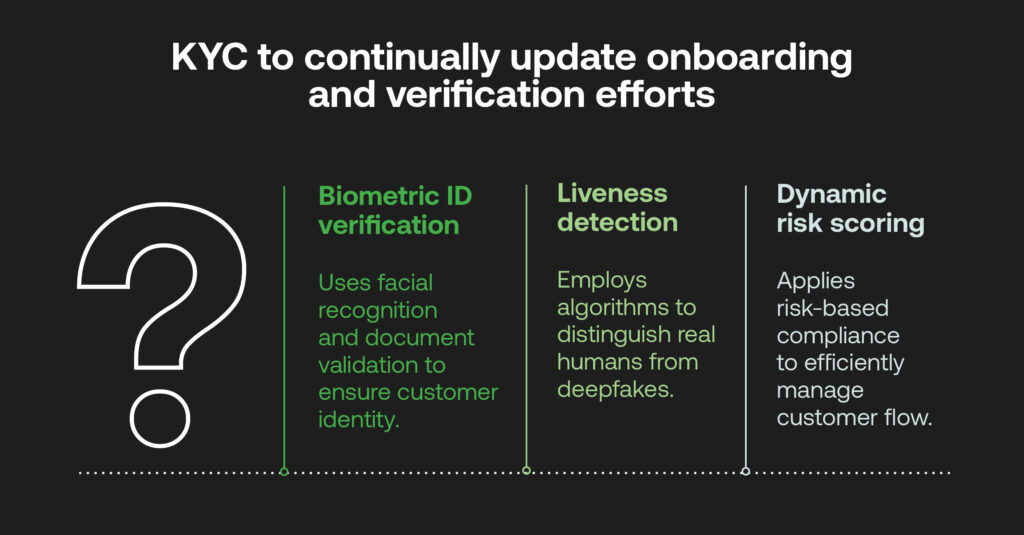

This is why cutting-edge KYC is the only way forward to continually update onboarding and verification efforts in line with what’s happening on the criminals’ side, for example:

- Biometric ID verification requires facial recognition technology to immediately validate customers against government-affiliated documentation, as well as scanning names or photos against adverse media lists and watchlists. These are nuanced in accordance with the jurisdiction the customer resides in. Identity verification (IDV) workflows need to be conducted in line with bespoke AML platforms to get customers onboarded and transacting as soon as possible without friction.

- Liveness detection utilises algorithms to distinguish real humans immediately, and can examine static selfies or videos for lighting, texture or depth anomalies indicative of deepfakes. This is difficult (although not impossible) for criminals at scale, who in a recent development can bypass cameras by feeding faked content into a verification system. However, AI works on both sides of the law, here providing safeguards even for emerging typologies to build trust in an FIs’ KYC methodology.

- Dynamic risk scoring relies on the increasing usage of risk-based compliance, as opposed to rules-based methods. Initial risk scores can be applied by analysts, where automated monitoring can analyse complex patterns for suspicious activity according to baseline datasets. High-risk alerts get escalated immediately, letting legitimate customers flow through the system, and investigations become efficient.

A combination of enhanced KYC technologies ensures manual errors are removed and greater throughput rates are achieved per customer. Applying AI for onboarding can also adapt to growing volumes of datasets due to its advanced processing capability. More customers can be analysed in a fraction of traditional times, for institutions of any size.

Adding perpetual KYC to your AML lifecycle

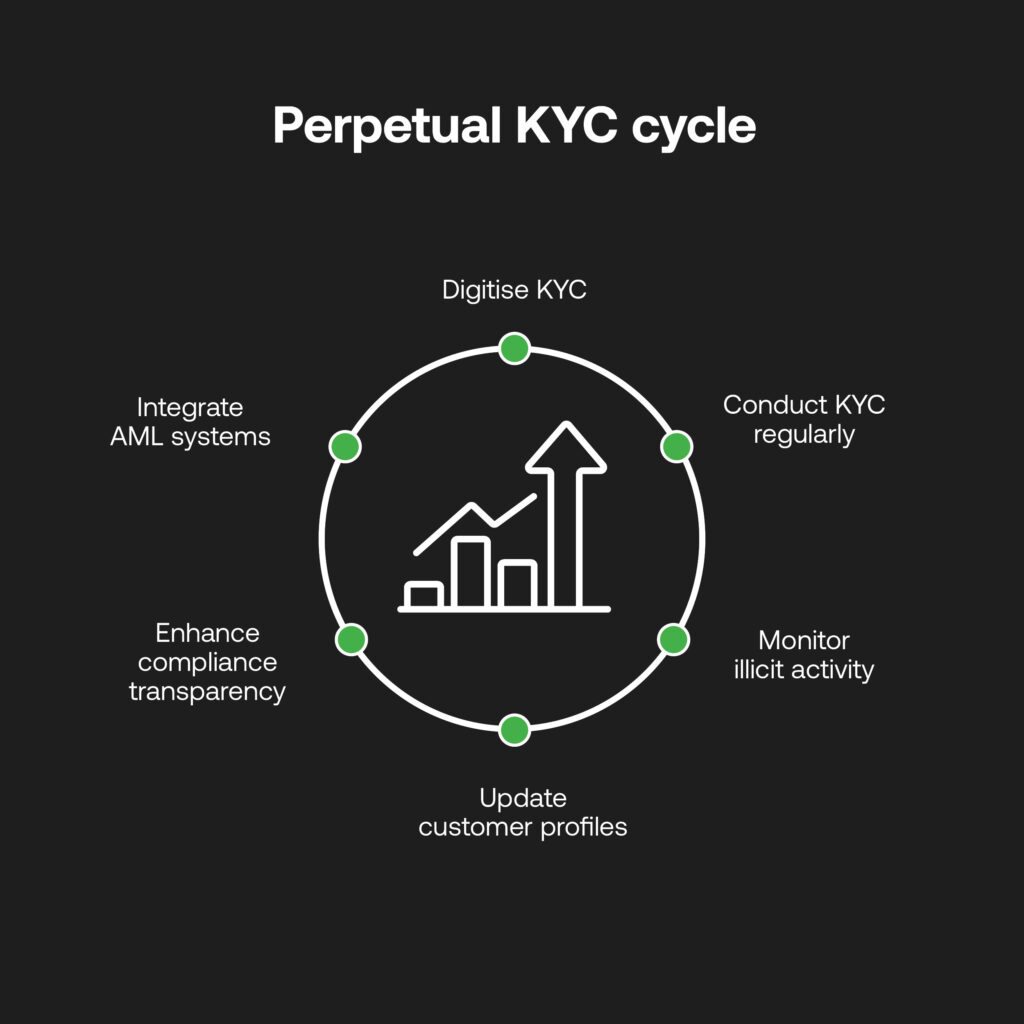

For any financial house to be sound in any regulatory audit and protect the identities of their customer data, KYC has to be digitised and conducted not only in regular instalments, but continually. This paves the way for perpetual KYC (pKYC) to likely grow in stature as a way to spot potentially illicit activity among customers in real-time, as well as staying proactive to ever-changing ownership structures that are typically opaque.

pKYC, like the examples above, can also scale in that it reallocates resources accordingly, increasing the frequency of deliberate, targeted investigations and how easily legitimate entities and payments can continue to flow. It does however rely on a few key factors for it to be deployed effectively:

- Outdated or incomplete customer profiles need to be addressed to ensure data cleanliness and reduce the possibility of coverage gaps.

- Compliance teams should employ transparency in what constitutes a high-risk KYC trigger through documented workflows.

- AML systems should be integratable with external partners, databases, and third-party solutions for accurate IDV, screening and validations.

Liminal identifies that pKYC is already being used at 38% of large organisations, a bigger percentage compared to small to medium-sized enterprises. This is indicative of immediate compliance priorities and resource allocation over advanced KYC automations.

In which case, while pKYC is cost-effective in being scalable and sustainable in an AML ecosystem for FIs that can afford integrations, smaller market entrants may phase their adoption through RegTech partnerships. These can instil necessary components into digital onboarding for the required user base – IDV, liveness checks, and dynamic scoring for instance – and scale pKYC and overall AML practices as customers continue to sign up.

Changing tomorrow, today

Customer onboarding was once a simple requirement that’s been transformed by a digital frontier arming launderers with more apparatus to infiltrate the financial ecosystem. By enhanced capabilities with AI-powered monitoring that’s always vigilant, FIs and solution providers can close exposed KYC gaps left by legacy systems––all with innovative biometric validations that are safe and swiftly evolving in line with the criminal technology.

Modular and manageable steps toward electronic KYC (eKYC) as a basis, then eventual pKYC, will be paramount to proactive risk management and the development of auditable AI-driven systems to detect and report any suspicious players. Regulators will see their efforts in maintaining global integrity rewarded, while the most groundbreaking financial products can go beyond serving and scaling their customers to positively change the financial world of the future – which we will explore further in the final entry into our KYC series, coming soon!

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.