Leveraging AI for Continuous KYC Monitoring

Table of Contents

Concerning anti-money laundering (AML), financial institutions face increasing pressure to stay ahead of sophisticated financial crime tactics and stringent regulatory requirements. Traditional periodic know-your-customer (KYC) reviews are no longer sufficient – customer information can become outdated quickly, leaving institutions vulnerable to financial crimes and non-compliance risks.

Enter perpetual KYC (pKYC), also known as continuous KYC monitoring, a game-changing approach that leverages artificial intelligence (AI) to revolutionise the efficiency and effectiveness of customer due diligence (CDD) processes around the clock.

Perpetual KYC: The Evolution of Customer Monitoring

Perpetual KYC represents a paradigm shift from the conventional “one-and-done” approach to KYC reviews associated with initial customer onboarding.

Instead of relying on scheduled periodic checks, pKYC employs advanced AI and machine learning (ML) technologies to continuously monitor and validate customer data in real-time before any human intervention is necessary.

This proactive approach ensures that customer information remains accurate and up-to-date, enabling financial institutions to identify and respond to anomalies or risks swiftly.

The Power of AI in Continuous KYC Monitoring

As the driving force behind pKYC, AI provides a powerful set of tools that boost the precision, speed, and overall potency of customer monitoring procedures.

1. Enhanced Data Analysis

One of the core strengths of AI lies in its ability to rapidly ingest and analyse immense volumes of data from diverse sources. This empowers financial institutions to comprehensively understand their customers’ profiles or spot any aberrant activities or suspicious patterns that may warrant enhanced due diligence (EDD).

AI algorithms continually evolve and refine themselves through ML methodologies. As new financial crime tactics emerge, these self-learning models can adapt their detection parameters, enhancing their effectiveness in identifying illicit activities while minimising false alarms.

2. Automated Customer Due Diligence

AI-powered systems can revolutionise the KYC workflow by automating critical tasks such as customer identification, verification, and risk profiling.

Leveraging cutting-edge technologies like biometric recognition, intelligent document scanning, and data corroboration, these AI solutions can precisely validate customer identities while adhering to regulatory mandates.

The automation capabilities don’t just expedite customer onboarding; they also cultivate a superior user experience. By minimising manual interventions and fortifying security measures, AI-driven KYC processes reduce friction and instil confidence in the digital journey.

This seamless, frictionless experience fosters trust and strengthens the bond between financial institutions and their clientele.

3. Operational Silos in the KYC Process

When operational silos manifest due to fragmented systems, financial institutions encounter significant hurdles. These siloed approaches foster departmental isolation, hinder efficient operations and cause potential opportunities to slip through the cracks.

Consequently, regulatory risks escalate, as gaps in customer onboarding capabilities can have severe ramifications, from diminished customer satisfaction to non-compliance with regulatory mandates.

By leveraging advanced technologies like ML and Natural Language Processing (NLP), systems can seamlessly integrate data from disparate sources to create a unified view of customer information across departments and functions.

This interconnected approach breaks down silos to promote collaboration and enable financial institutions to maintain a cohesive, streamlined, and efficient KYC compliance framework.

4. Adverse Media Screening

Traditional adverse media monitoring tools often need to catch up. Their limitations stem from a reliance on keyword-based searches and proximity matching, which can overlook nuanced context and fail to capture the full breadth of relevant information, leading to inefficiencies, frustration, and a lack of confidence in the results.

In contrast, AI-powered solutions, particularly those leveraging NLP, offer a transformative approach to adverse media screening. NLP technologies transcend the constraints of keyword searches by deciphering, analysing, and emulating human language with contextual relevance and purpose.

However, integrating AI and machine learning can also empower businesses to proactively identify emerging and potential risks. By continuously learning and adapting to new patterns, intelligent systems can anticipate and flag potential threats before they manifest, enabling better-informed decision-making and robust risk management strategies.

The advantages of AI-powered adverse media screening extend beyond enhanced accuracy and efficiency. Through the automation of time-consuming manual processes, these solutions free up valuable resources, allowing compliance teams to focus on higher-value tasks and strategic initiatives.

Additionally, the increased confidence in the screening results fostered by AI-driven technologies can strengthen overall compliance programs and mitigate regulatory risks.

5. Continuous Compliance Monitoring

AI-powered compliance monitoring platforms can continuously oversee AML processes where humans cannot, ensuring ongoing compliance with regulatory requirements and industry best practices.

By automating audit trails, generating compliance reports, and flagging potential issues or deficiencies, AI algorithms can help financial institutions identify areas for improvement and implement corrective measures proactively, reducing the risk of non-compliance and associated penalties.

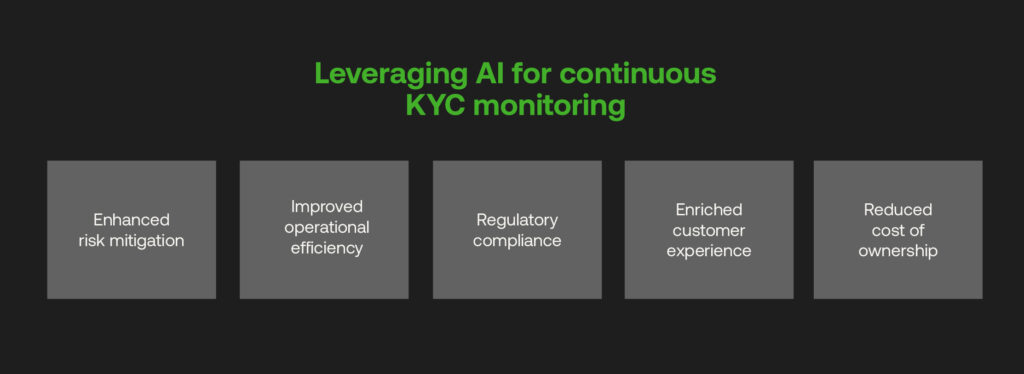

Benefits of Leveraging AI for Continuous KYC Monitoring

The integration of AI into perpetual KYC processes offers numerous benefits for financial institutions, including:

- Enhanced Risk Mitigation: Financial institutions can proactively identify and mitigate potential financial crime risks by monitoring customer data and behaviour continuously.

- Improved Operational Efficiency: AI-powered automation streamlines KYC processes, reducing manual efforts and enabling financial institutions to allocate resources more effectively toward core operational areas.

- Regulatory Compliance: AI-driven tools can expedite the interpretation of intricate regulatory documentation, vastly enhancing efficiency within compliance operations.

- Enriched Customer Experience: AI-powered pKYC streamlines the onboarding process and ongoing monitoring, minimising hurdles and bolstering security measures. This frictionless, secure experience increases customer satisfaction and nurtures long-lasting, trust-based relationships.

- Reduced Cost of Ownership: Cutting-edge KYC identity verification solutions that harness the power of automation offer a two-pronged advantage: saving precious time and reducing operational costs. By digitally transforming previously analogue processes, these solutions enable businesses to handle vast volumes of intricate data with enhanced accuracy and robust security measures. Seamless automation minimises the reliance on labour-intensive manual intervention, translating into substantial cost savings that bolster the bottom line.

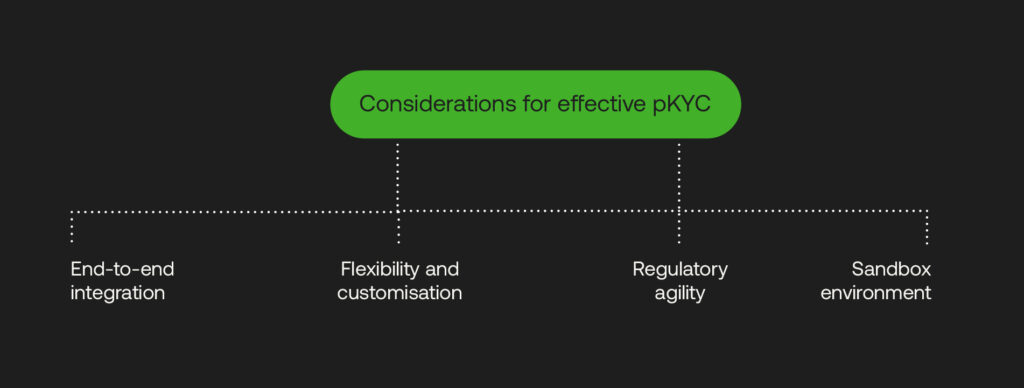

Considerations for effective pKYC

When evaluating an AML partner for continuous KYC solutions, it’s vital to assess their ability to provide the following key attributes:

- End-to-End Integration: To realise the full potential of continuous KYC, a single view of the customer is essential. Siloed systems can lead to information fragmentation and inconsistencies. An effective AI vendor should offer end-to-end capabilities that seamlessly integrate data from various sources, fostering a comprehensive and cohesive customer profile.

- Flexibility and Customisation: The ideal platform should empower the company to take ownership of its digital onboarding process. After all, who understands their customers better than the company itself? The vendor should provide a flexible solution to accommodate any desired setup, layout changes, or modifications to digital onboarding channels and form layouts. This level of flexibility ensures a tailored experience that aligns with the company’s unique needs and customer base.

- Regulatory Agility: Compliance with ever-evolving regulations is paramount in the financial sector. Your AML platform should be agile enough to adapt to regulatory updates without disrupting established process flows. While change should be seamless, it should not compromise the integrity of existing operations. The ability to update regulatory requirements without affecting other areas of the platform is a critical requirement.

- Sandbox Environment: Innovation and continuous improvement are essential in the dynamic world of KYC compliance. Your platform should provide a dedicated sandbox or staging environment that allows users to test and validate new process flows without impacting the live production environment. This testing capability ensures rigorous quality assurance before implementing changes, minimising risks, and a smooth transition to new or updated processes.

By prioritising these attributes, financial institutions can select cutting-edge continuous KYC solutions that provide the flexibility, integration, and agility required to maintain a robust and compliant customer onboarding and monitoring process.

Key Points

Regulatory oversight is becoming increasingly stringent, and AI-powered pKYC is a significant asset for financial institutions committed to maintaining a proactive compliance posture.

By leveraging the power of AI, financial institutions can streamline customer due diligence processes, enhance risk mitigation capabilities, and maintain a competitive edge within the AML landscape.

To experience the benefits of RelyComply’s intelligent KYC solutions, consider booking a demo to explore how our cutting-edge offerings can streamline customer onboarding.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.