Negative news screening

A fundamental component of AML compliance

Table of Contents

News travels fast, yet it’s always on the coattails of financial criminals carrying out money laundering, trafficking, exploitation, muling, and more. The same can be said for regulators, despite their excellent attempts to hold financial institutions accountable for facilitating the ease of crime while championing adequate screening against politically exposed persons (PEPs) and sanctioned individuals.

Even that is no longer enough for advanced anti-money laundering protocols. Instead, Negative News Screening (or Adverse Media Screening) is the forefront shield for spotting nefarious activity and identifying potential AML risks before they escalate.

What is AMS?

AMS (Adverse Media Screening) involves scanning a range of public sources (including news articles, official court records, blogs, social media posts, and whistleblower reports) for negative mentions of individuals or businesses.

This is important to the Know Your Customer / Business (KYC/KYB) end-to-end customer onboarding compliance phase to maintain integrity for your company.

Of course, ‘negative news’ is all-encompassing. For instance, a poor review of a movie somebody didn’t like could be included in that description. That’s none of a financial institution’s concern, who instead face huge risks in dismissing negative news screening, including cross-border payments to shell companies or businesses (or even whole nations) placed on sanctions lists.

AMS automation should instead scan risks specific to AML compliance, including:

- Financial crimes: Money laundering, insider trading

- Sanctions violations: Entities flagged by sanctions screening automation

- Terrorism & organised crime: Suspicious networks and affiliated entities discovered through PEP database integration

- Regulatory breaches: Companies held under scrutiny in AML case management systems

AMS flags any instance of these connections upfront with automated background check systems. For modern businesses, even more advanced AMS leverages AI-powered identity validation to filter out false positives (flags that spot legitimate behaviour rather than anything suspicious) and highlight very real threats in real-time.

The cost of ignoring negative news screening

Challenge 1: The data

The (now not-so-recent) phrase “data is the new oil” is still true. We’re extremely reliant on data to make informed decisions. But there’s also a lot of noise. There’s so much data out there that news spreads extremely quickly. Not all of this is true either, as fake news has proliferated recently, making it easier for criminals to hide in the shadows and evolve faster than traditional compliance methods can keep up.

Traditional watchlists are insufficient when criminals change names, locations, and affiliations faster than databases update.

Challenge 2: The regulators

Companies that fail to screen negative news properly are feeling the heat from global and local regulators, who are clamping down on the rise of financial crime and corporate misconduct. The global watchdog FATF can greylist, or even blacklist, whole countries whose financial crime controls fail systematic AML compliance checks, while the EU’s AML Authority and FinCEN represent other influential regulatory bodies.

Failing to implement compliance audit management systems can devastate doing business with high-risk entities; AML inadequacies have seen even large global banks like HSBC, JPMorgan Chase, and Deutsche Bank being fined billions. Beyond the money business, there are equally devastating penalties, such as losing loyal customers, huge reputational damage that’s tough to bounce back from, and even legal risks or potential criminal liability.

Smarter AMS counts on automation

Staying ahead of adverse media monitoring goes beyond meeting regulatory obligations to protecting businesses and customers from harm. Given the volume of worldwide data sources, doing so manually is impossible.

Instead, AI-powered AMS solutions now scan thousands of sources simultaneously, applying real-time risk assessment automation to filter out irrelevant data:

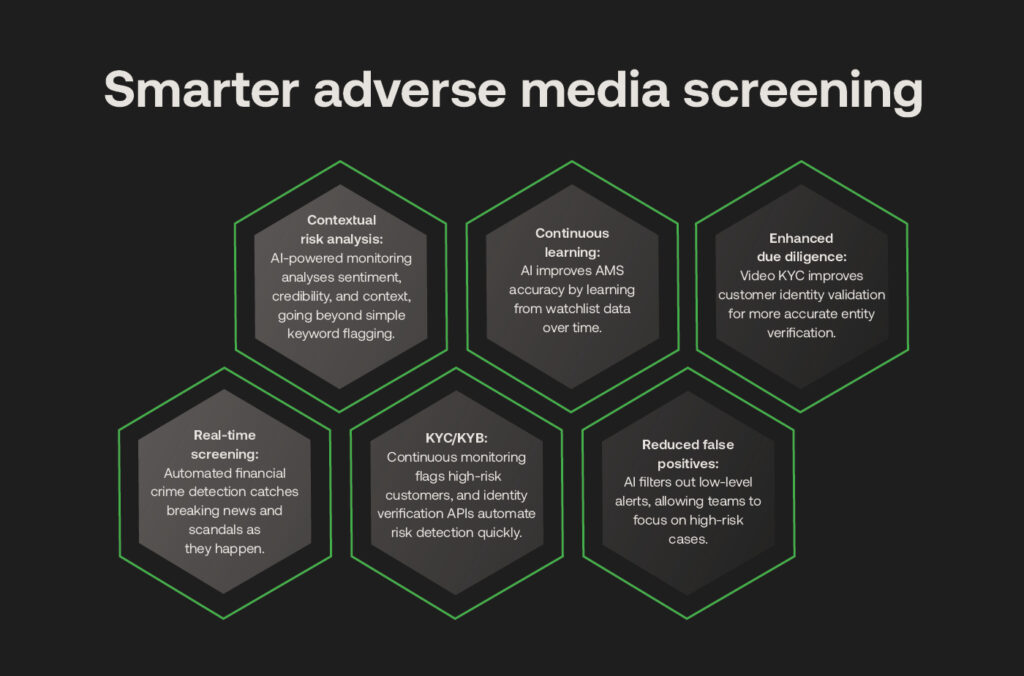

- Contextual risk analysis: Flagging every article with “bribery” won’t comb through the whole web of negative news that could affect a business. Instead, AI-powered monitoring analyses sentiment, credibility, and context from trusted news sources.

- Continuous learning: AI-powered verification can improve AMS accuracy over time with exposure to watchlist data.

- Real-time screening: With round-the-clock automated financial crime detection, every risky news item—a breaking news scandal, regulatory fine, or corruption case—can be caught as soon as it happens.

- KYC/KYB: Onboarding workflows are also sped up with continuous KYC monitoring tools that flag high-risk customers or businesses with negative affiliations, while identity verification API integrations automate risk detection in seconds.

- Reduced false positives: One of AML’s lengthiest and most costly human error results are false positives that waste compliance team time. Instead, AI’s accurate detection filters out low-level alerts to focus on truly risky cases that prioritise investigations into suspicious criminal activity.

- Enhanced due diligence: To further identify if entities are exactly who they say they are, video KYC implementation is available to improve customer identity validation.

The future of adverse media screening

Stringent KYC, identity verification detection, and real-time transaction monitoring are now industry standards that can be improved further with AI automation. The good news is that AI for negative news screening is only growing in capability to help companies avoid penalties and stay ahead of regulatory shifts.

We’re beginning to see predictive risk scoring algorithms that assess financial crime trends even before they happen, deepfake news & identity spoofing prevention systems that block misinformation in real-time, and corporate risk assessment platforms that map business relationships and shell company connections automatically – essential for identifying ultimate beneficial owners (UBOs).

Automated AMS is a great ally for businesses that are serious about AML compliance and corporate screening. It takes the burden away from compliance teams and surfaces only the high-risk news matches that can incriminate genuine financial criminals. It’s the only answer when criminals and regulatory moves happen so swiftly before they steer ahead of the financial system for good.

If you’d like to hear more about adverse media screening solutions for mitigating risk, contact RelyComply today.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.