Operational efficiency at scale: lessons for fintechs

Table of Contents

The introduction of fintech – an umbrella term for a range of payments providers, lenders, non-banking services, and more – has seen a proliferation of accessible finance in local and global markets. Fintech has created a whole new market, rocking the status quo of the financial space.

Fintech’s continuing uptake has meant dominant financial institutions (FIs) had no choice but to adapt their business models, diversify product ranges or take the plunge to partner with these ‘rival’ innovations to develop more intuitive customer experiences. Now, banked or unbanked individuals can have more control and confidence with their finances, and technological development across the board drives FI’s operational capabilities ever further.

However, growing consumer bases bring further problems for early-stage fintech teams. Regulatory scrutiny is strong, attempting to weed out clever and ever-changing financial crime typologies that can infiltrate the system through lax anti-money laundering (AML) and know your customer (KYC) checks.

These are a base requirement for FI at all levels; no questions are asked. Only those adaptable to tough operational burdens can survive and thrive in the modern diversified ecosystem with AI-driven automated compliance at their side.

How fragmented workflows prevent fintechs from scaling efficiently

One of fintech’s points of difference is its commitment to customer experience. Not just through developing products targeting specialised needs that were once out-of-reach or complex (mortgage lending or monthly loan payments, for example), but creating trust over time through intuitive, mobile-first applications and a communication level far more direct than traditional brick-and-mortar banks.

Consumers, therefore, continue to seek fintech to solve various problems. However, they cannot continue to bring inclusive products to market without regulatory approval. To hit the ground running, many startups may have purchased third-party vendors for proposed KYC benefits, splitting customer data across platforms.

When multiplied over each integral stage of end-to-end AML under intensifying regulatory watch from the Financial Action Task Force (FATF) down to non-standardised local levels, a lack of end-to-end oversight means overdone or repeated manual tasks fraught with errors. It’s perhaps unrealistic to assume that fintechs can adjust to banking-level compliance controls, but a shift to cohesive single platforms provides an exceptional groundwork.

This is because disparate systems are notoriously inefficient, wasting budgets and contributing to investigations into low-risk entities. Resultant false positives can allow higher-risk profiles to bypass verification unchecked and weaken security. With onboarding slow and even prone to illicit entities, consumer trust and the possibility of scaling with global users get compromised, and these innovative companies fall by the wayside.

Automated operations: compliance as a strategic advantage

Today’s high cost of compliance has small or midsized fintechs between a rock and a hard place. With added spending to craft frictionless KYC protocols, this only increases fees to customers who expect simple, cost-effective ways to improve their financial lives.

This demands one-view onboarding technology without data siloes, which is both proactive to risk and prioritises the customers’ sign-up experience. Therefore, the view of initial and continuous KYC as a regulatory hoop to jump through can be turned on its head to achieve this dual-purpose AML.

Consolidated AML systems powered by AI-driven automation enable document checks and watchlist screening at a scale far beyond what a small compliance team could manage manually. They’re also effective at flagging high-risk behaviours for escalation and enhanced due diligence – all within the same platform. But while AI improves speed and scale, real-world results show that around 40% of cases still require human review. Automation is only as effective as the data quality behind it, and oversight remains essential to avoid false positives, context gaps, or missed risk signals.

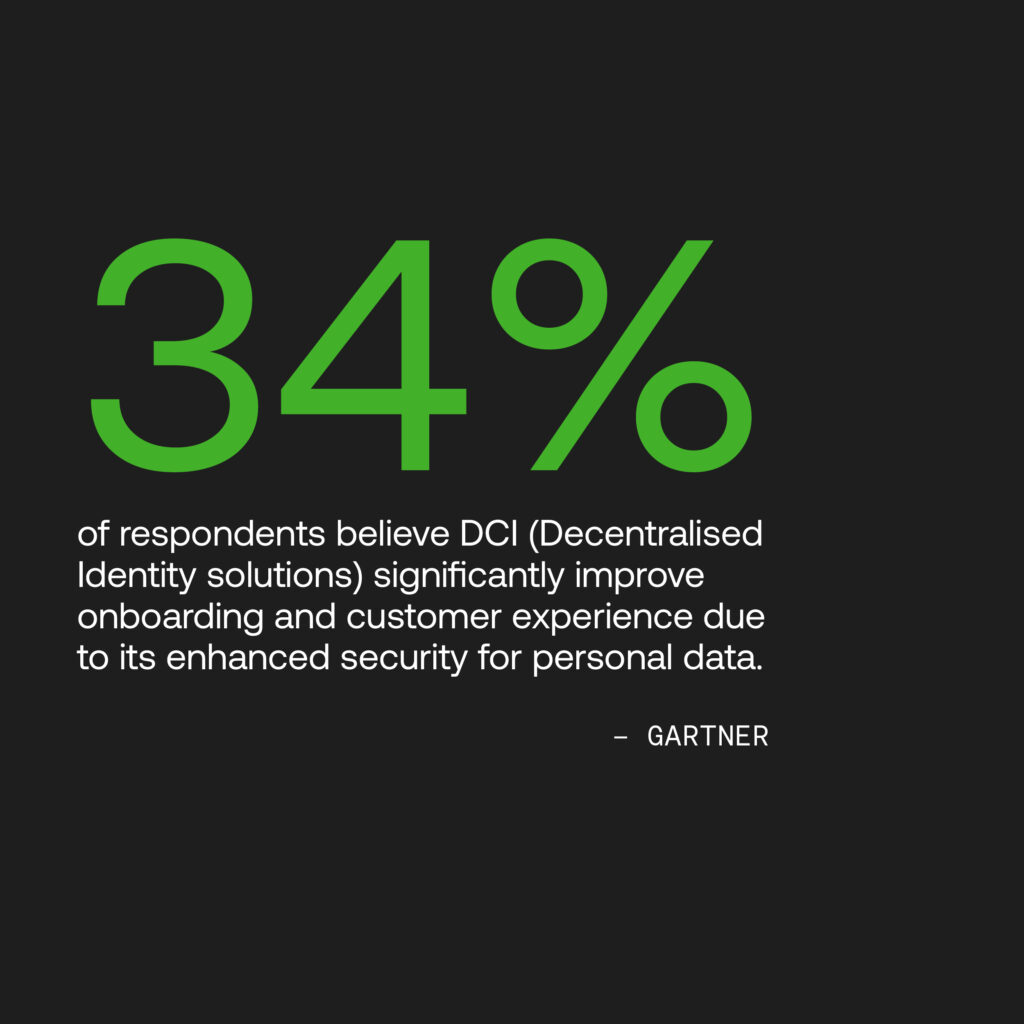

Automation also grants startups a cutting-edge edge by implementing real-time digital identity screening and validation for KYC workflows. Furthermore, Decentralised Identity (DCI) solutions are on the rise; 34% of respondents to a Gartner KYC survey recognised them as significantly improving onboarding and customer experience, considering their enhanced security for personal data in light of widespread regulations such as GDPR.

It indicates where KYC is heading and why there’s a growing need for digital-native onboarding solutions. Many countries have adopted national digital identity systems, such as Sweden’s BankID. The UK has now enacted a stronger digital identity trust framework, while South Africa’s Department of Home Affairs has upgraded its digital verification system for the public and private sectors.

Each automated stage creates a more thorough risk assessment from start to finish. Burgeoning companies’ onboarding can be fast and compliant for end users, not limiting their growth as they reach out to new customers.

Adopting a human-in-the-loop AI approach to compliance operations

Many fintechs will look to reach more consumers after facilitating automated KYC. As banks juggle subsidiaries or region-specific products in different regions, AML platforms have to be able to support market entrants in reaching audiences across borders. When clients and specific countries’ regulations (and therefore risk thresholds) change, configurability is highly necessary.

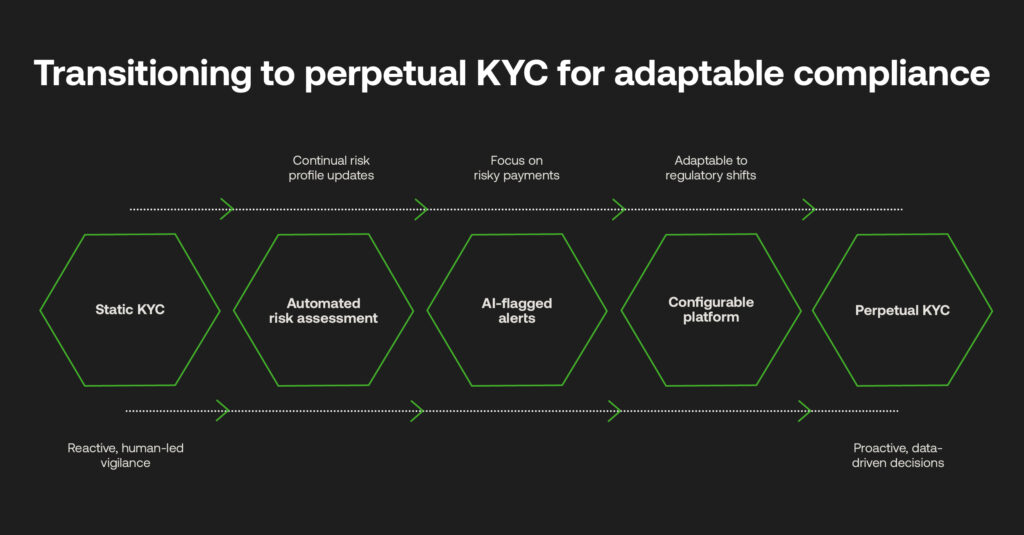

The idea of user-set configurations means a solution can remain adaptable to these shifts at the hands of a compliance team whose onboarding workflows are smoother, with AI flagging only risky payment alerts that require immediate attention. This is not just humans and AI working to improve each other’s efficiencies and run down costs; it’s transforming KYC from static, reactive compliance to proactive, smart data-driven decision-making.

The traditional methods of KYC are fading fast. Around 70% of large financial institutions plan to adopt perpetual KYC (pKYC) for continual risk assessment and automatically update customer profiles. Smaller businesses like fintech should consider pKYC to ensure their information is current and more likely to pass regulatory audits without requiring constant human-led vigilance. Traction with this hybrid approach will be powerful in making products adhere to customer expectations and remain alert to regulatory shifts over time.

Achieving Fintech and Regtech Harmony

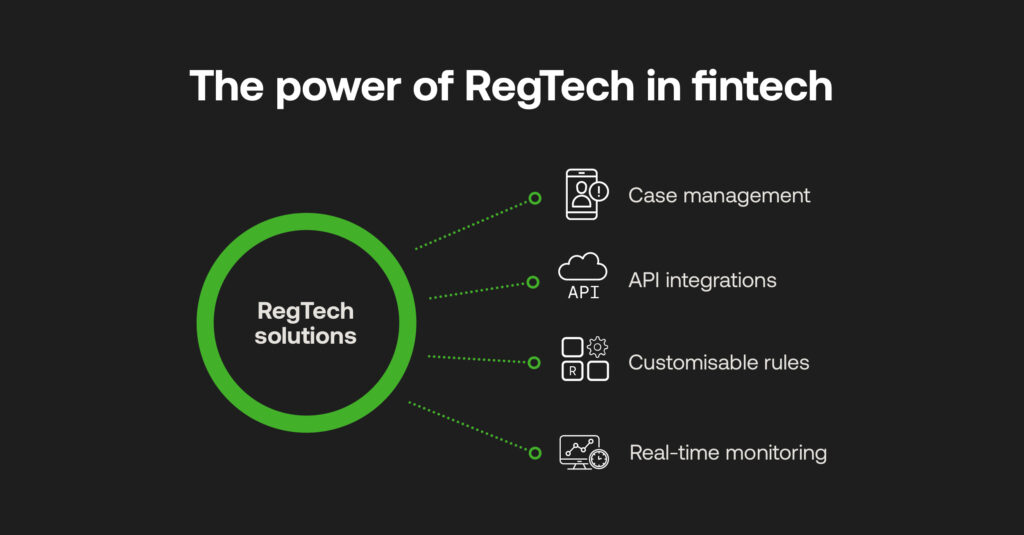

For fintechs under pressure to adapt their KYC processes cost-effectively, integratable regulatory technology (RegTech) platforms offer a smart solution. By plugging into existing systems via APIs, they centralise data without the need for a full AML overhaul, enabling a seamless evolution into real-time, cross-border risk management.

But successful implementation goes beyond just tech. It hinges on careful configuration, precise data mapping, and proper team training to ensure the system delivers both compliance and operational impact.

Partnerships with RegTech are becoming a staple to kickstart scaled onboarding from a solid framework. Fintech compliance teams can be trained over time for consistent and adaptable platform know-how, which largely focuses on key workflow areas:

- Case management: Automated investigations and entity profile reviews account for potential high-risk behaviours and lower false positive rates.

- API integrations: the ability to embed stringent KYC and AML with existing data and financial product ecosystems.

- Customisable rules: set risk-based configurations to escalate only the alerts that matter, reducing manual inefficiencies.

- Monitoring in real time: Screen and identify suspicious and anomalous behaviour, maintaining the pace of legitimate onboarding to scale KYC operations.

When consumers look to fintech banking alternatives, they expect low fees and easy sign-ups to open an account or have a loan approved. That’s impossible with legacy systems slowing onboarding to a crawl and missing vital risks that could jeopardise market entry entirely.

Compliance and fincrime shifts may be adding operational burdens, but automation is the way forward, indeed upward, with cutting-edge financial solutions able to service more satisfied and safe customers.

This is the second in a series of articles about scalable KYC, a key component of the financial ecosystem’s success. Next, we’ll explore the role of technology in scaling successfully.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.