How to reintegrate your AML tech stack for success

Why 2026 demands a ‘less is more’ approach

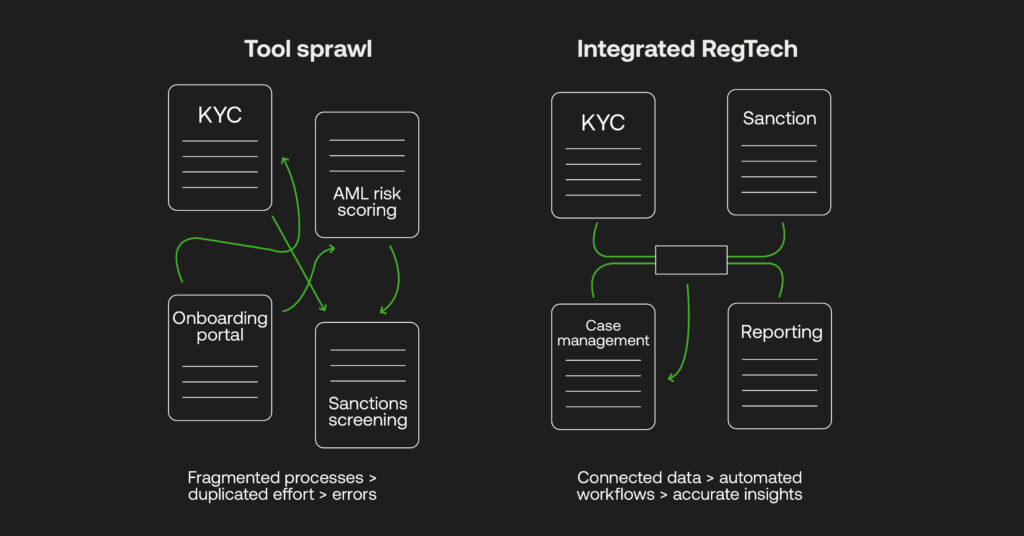

The AML tech stack has become a crutch for financial leaders. While the RegTech boom was reaching fever pitch, buying up disparate, single-function services felt essential for transforming compliance for good, almost fashionable. Fast forward a few years and the stack built from these point solutions has become too unwieldy to ignore. Siloed data, workflows, and capabilities have created confusion and, ultimately, pockets of non-compliance.

We believe 2026 is a true inflection point in reinventing how the AML tech stack is used. It is a moment that calls for a ‘less is more’ mindset: rationalising the most actionable parts of existing solutions, then intelligently consolidating them into one capable ecosystem. Beyond the platform itself, this includes how compliance teams can standardise recommended regulatory processes and restore the efficient control RegTech always promised, moving away from the past decade’s chaos.

Patching over individual problems

It’s easy to forget just how drastically regulation shapes entire business operations. Beyond instilling governance and risk reporting, it raises attention to data security, compliance culture and ethics, and sustainability protocols. Newly introduced laws can undermine the existing capabilities of an onboarding portal or a risk scoring system, and businesses have to adapt to avoid the red tape and subsequent hefty fines.

It’s understandable that this burning adherence pressure has led to a search for a spread of quick wins to cover anti-money laundering’s (AML) multi-tiered requirements. But when solution after solution layer on top of each other with no real connective tissue, digitally speaking, they become ineffective band-aids.

Even when RegTech vendors promise to straighten out compliance complexity, around 90% of businesses still think ongoing regulatory shifts convolute their ability to maintain IT systems. This creates a vicious cycle: operational hurdles and sheer volumes of customer or transaction data call for RegTech over manual compliance, causing spending panic, and achieving little by way of strategically implementing a complete AML system fit to task.

The effects of ‘RegTech bloat’

Now many financial institutions (FIs) are left manually reconciling fragmented platforms, data, and workflows. Extended efforts waste hours, and only exacerbates the negative idea of compliance technology as a mandatory cost centre rather than a way to push innovation forward.

This has created conflicting forces. Compliance and IT teams share the back-office frustrations of disconnected systems, and training fatigue from only short-lived products. Executives mount questions around why compliance continues to skyrocket despite investment in automations. CFOs demand evidence for technology’s ROI value; how it’s delivering outcomes based on upfront business decisions. And supervisory checks demand end-to-end auditability for AML protocols which are impossible when data is of poor quality and disparate, particularly after FIs may have scrambled to adopt and train advanced AI models for investigative purposes – yet more expertise-heavy tools.

The need, and want, to acquire more is out of the question in budget-strapped times. It does not mean that pre-vetted and implemented RegTech is now arbitrary. Far from it. Instead, there needs to be a renewed focus on optimising it to work for bespoke AML needs.

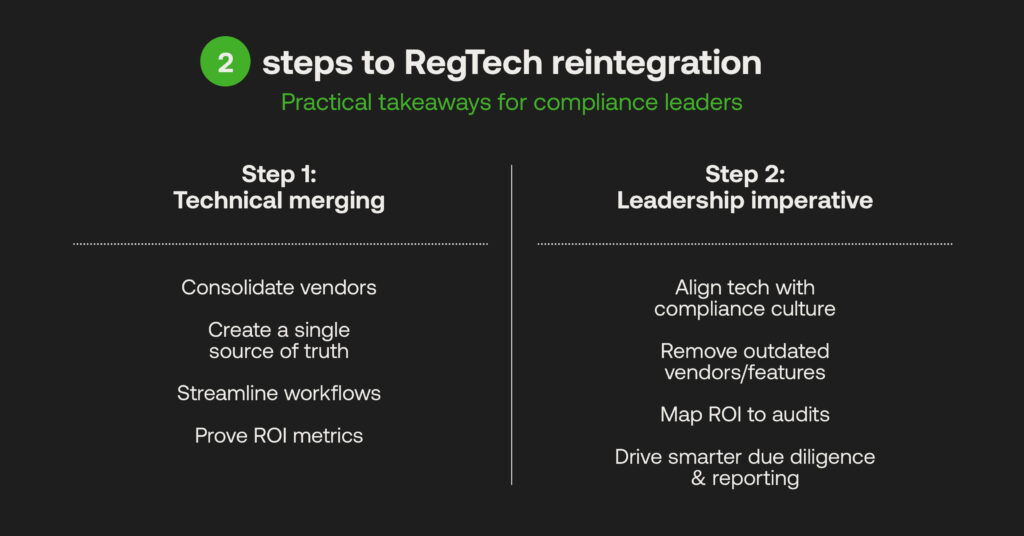

Step one: technical merging

FIs are still under the intense watch of regulatory powers in light of ramped-up laundering techniques and cybercrime. Only this time, the steps to ‘get RegTech right’ should be clearer by stripping away ineffective measures, and making the most of AML systems in the following ways:

- Consolidating vendors goes against the grain of constantly adding new KYC/AML tools. Rather, FIs should seek providers that are able to integrate pre-existing data pipelines, essentially merging any overlapping workflows into an interoperable platform that’s modular and adaptable to any future needs.

- Unifying a compliance function into an end-to-end flexible architecture crafts a single source of truth for compliance teams from onboarding to investigations to reporting. Duplicated work is removed, and automation lowers manual inefficiency, human error and false positive rates.

- Streamlining processes involves redesigning workflows around shared data models, where all areas of AML compliance will be connected including initial onboarding, sanction screening, and ongoing monitoring.

- Proving ROI for every tool within an AML stack is crucial to drive decisions about retention, with measurable metrics such as onboarding times, case closure hours, false positive reduction, and audit readiness showing accountability for RegTech investments.

Step two: the leadership imperative

Platforms and people are not islands in AML compliance; they’re complementary to each others’ success. Just as human leadership decisions can analyse and dictate how best to consolidate RegTech (as above), instilling a top-down compliance culture and a connected mindset around AML protocols showcases 2026’s role as ‘a year of tech discipline’.

Within this shift, compliance leaders should be far more proactive in assessing the functionality of individual services as part of the overall tech stack. When building integrated ecosystems, there should be greater effort to remove arbitrary features, ineffective measures or outdated vendor partnerships, and aligning procurement, technologists and investigative teams on shared goals.

This oversight needs to be consistent in mapping ROI results to historical audits, assisted when customer and transactional data in a RegTech system is connected, deployed and actioned. The future of compliance success is not measured by the number of tools, but a guided plan to secure a system with more accurate alerts, smarter due diligence, and insights that contribute to faster reporting – with evidence – to halt future instances of financial crime.

A multidimensional RegTech ecosystem

As the PwC Global Compliance Study states, 59% of Compliance Officers in financial services feel they hold significant influence in developing business strategy, and this is a positive sign for where compliance culture is aligning with more eager attitudes to the RegTech market. FIs understand they need stronger ecosystems built on cooperative platforms and people, enhancing solutions they have piled money into already rather than outsourcing more from scratch.

We’re increasingly seeing large institutions move toward partnership-based procurement, where multiple vendors collaborate to deliver a unified compliance base. It’s less about competition or who owns the platform and more about who can make it work harder together. Real progress involves sharing intelligence and jointly building out forward-looking AML fit to scale with regulatory shifts and growing customer volumes.

With cloud-based features plugged into existing architectures and added automated features integrated alongside a strategic co-vendor, platform interoperability is achieved alongside a trusted ongoing relationship – both bringing compliance clarity to an industry that’s suffered from over-complexity for way too long.