Unlock the Power of KYB with our Comprehensive guide

Table of Contents

Welcome to RelyComply’s comprehensive guide to help you unlock the power of KYB (Know Your Business). In this guide, we’ll cover everything you need to know and why it’s an essential part of your compliance program.

What is KYB?

KYB, or Know Your Business, is a process used by businesses to verify the identity and business information of their customers, it’s a critical component of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance programs.

KYB is necessary to prevent criminals and terrorists from using legitimate businesses to launder money and finance illicit activities.

KYB is similar to Know Your Customer (KYC) but focuses on businesses instead of individuals. This involves verifying the identity of the business, including the business structure, ownership, and management. It also includes the business’s activities, such as the products and services offered and the markets it operates in.

Why is KYB important?

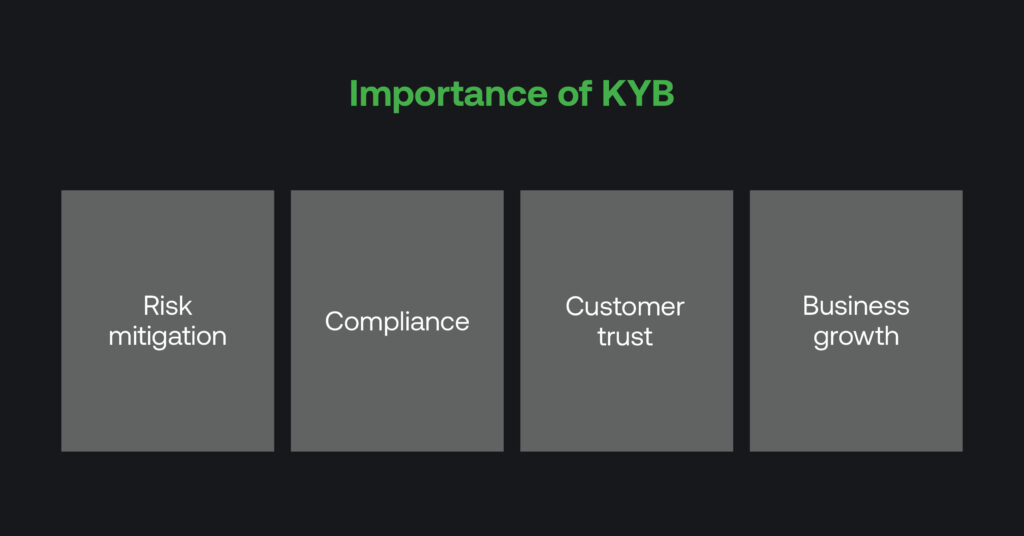

KYB is essential for several reasons, including:

Risk mitigation: helps businesses assess the risks associated with their customers and their activities. By verifying the identity and information of their customers, businesses can identify any potential risks and take appropriate measures to mitigate them.

Compliance: it’s a legal requirement in many jurisdictions, including South Africa, the United States, Europe, and Australia. Failure to comply with regulations can result in significant financial and reputational damage to businesses.

Customer trust: helps build trust between businesses and their customers. By verifying the identity and information of their customers, businesses can demonstrate their commitment to preventing financial crime and protecting their customers’ interests.

Business growth: can help businesses expand into new markets and develop new products and services. By understanding their customers’ needs and activities, businesses can identify new opportunities for growth and innovation.

How does KYB work?

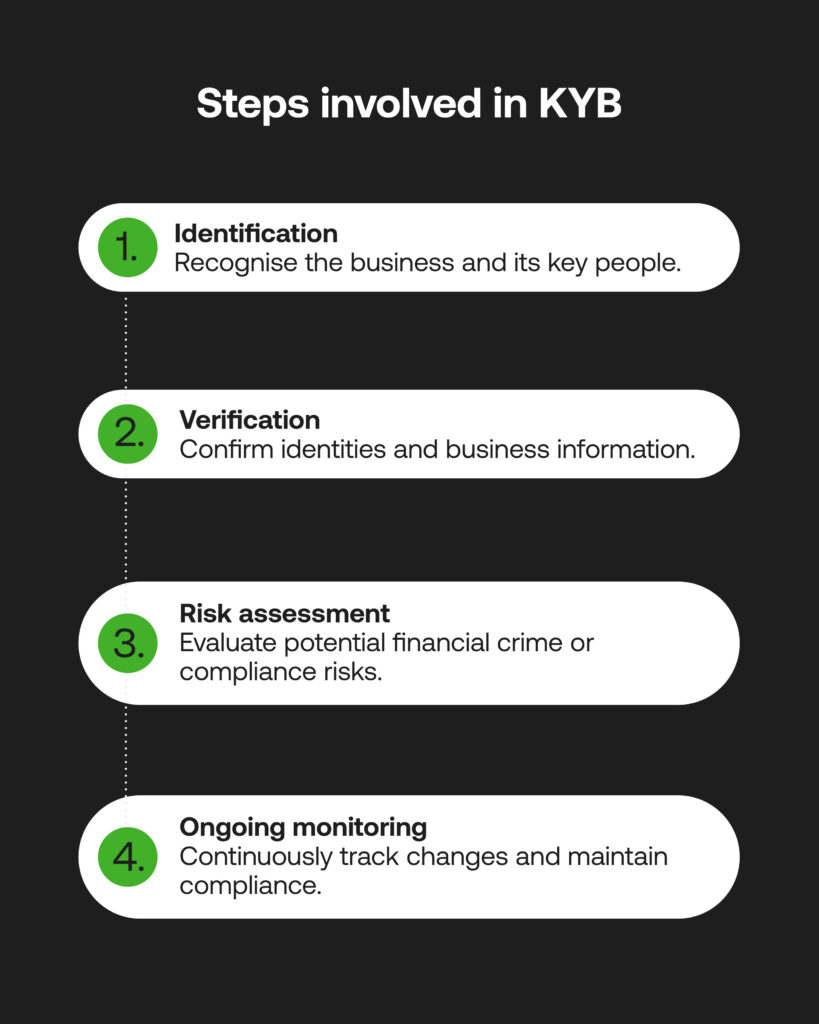

KYB involves several steps, including:

Identification: The first step is to identify the business and the individuals associated with it, such as the owners and management.

Verification: Once the business and individuals are identified, the next step is to verify their identity and information. This can be done through various methods, such as reviewing official documents, conducting searches on public databases, and contacting third-party providers.

Risk assessment: After verifying the identity and information of the business and individuals, the next step is to assess the risks associated with the business and its activities. This involves analyzing the products and services offered, the markets the business operates in, and any other relevant factors.

Ongoing monitoring: Finally, businesses must continuously monitor their customers and their activities to ensure ongoing compliance with regulations. This includes monitoring for any changes in ownership or management, changes in the business’s activities or products, and any other relevant factors.

How can we help?

We understand the importance of preventing financial crime and protecting businesses from reputational and financial damage. Our solutions can help businesses verify the identity and information of their business customers, assess the risks associated with their activities, and ensure ongoing compliance.

RelyComply’s AML solutions help businesses meet their KYB requirements and protect themselves from financial crime and reputational damage.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.