Balancing growth and KYC/KYB compliance

Table of Contents

Diversity in the financial world has been unavoidable. Once, personal finance only meant opening bank accounts in person at a branch. Those days feel lost to the past.

Fintechs emerged to remedy various financial challenges and compete with traditional mortgage lenders and brick-and-mortar banks. They are moving with the times and emphasising digitalisation and customer experience. This growth shows no signs of stopping; fintech revenues saw an uptick of 21% in 2024, and McKinsey estimates that the sector’s annual growth rate could rise by 15% by 2025, three times that of the banking industry. Its success will be no secret to the wider financial spectrum.

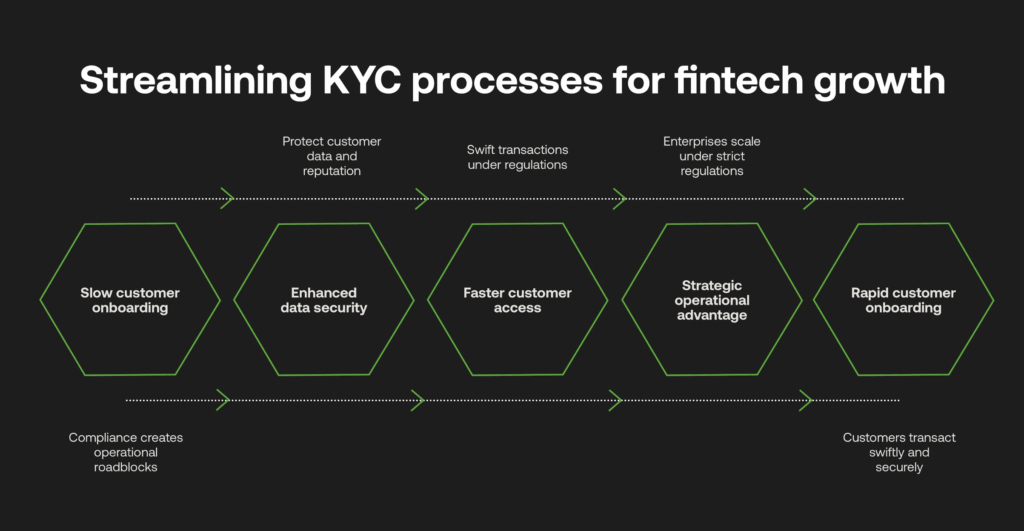

However, a “grow, grow, grow” mentality for financial business is hindered by compliance limitations such as Know Your Customer or Business (KYC/KYB) checks, often seen as operational roadblocks stopping customers from quickly gaining access to innovative financial products. If attempts to adhere to global or local compliance measures are insufficient, these gaps offer more chances for PEPs, sanctioned individuals or launderers to bypass the initial onboarding period.

Compromising customer data can ruin reputations and wreck a financial institution’s (FI) plans to scale, which are already tough in the face of growing customer expectations. Instead, streamlined KYC processes are the strategic operational advantage enterprises, fintech, and non-banking financial businesses need, helping today’s consumers start transacting swiftly under the shadow of strict industry regulations.

The consumer benefits of a diverse financial ecosystem

The only constant is change. Given rapid technological advancements, legacy FIs cannot rely solely on flagship products and the trust of decades-long customers. Thanks to disruptive market entrants, mobile payments, savings account applications, and instant insurance coverage have become more readily available to consumers all over the globe.

Fintech is a broad term covering peer-to-peer payments (P2P), buy now pay later (BNPL) services, insurtech, and crypto exchanges. These companies offer alternative products to banks, specifically targeting their customers’ financial goals. Over the past decade, standards have been raised for every player in this diverse field, and partnerships between banks and fintech have flourished.

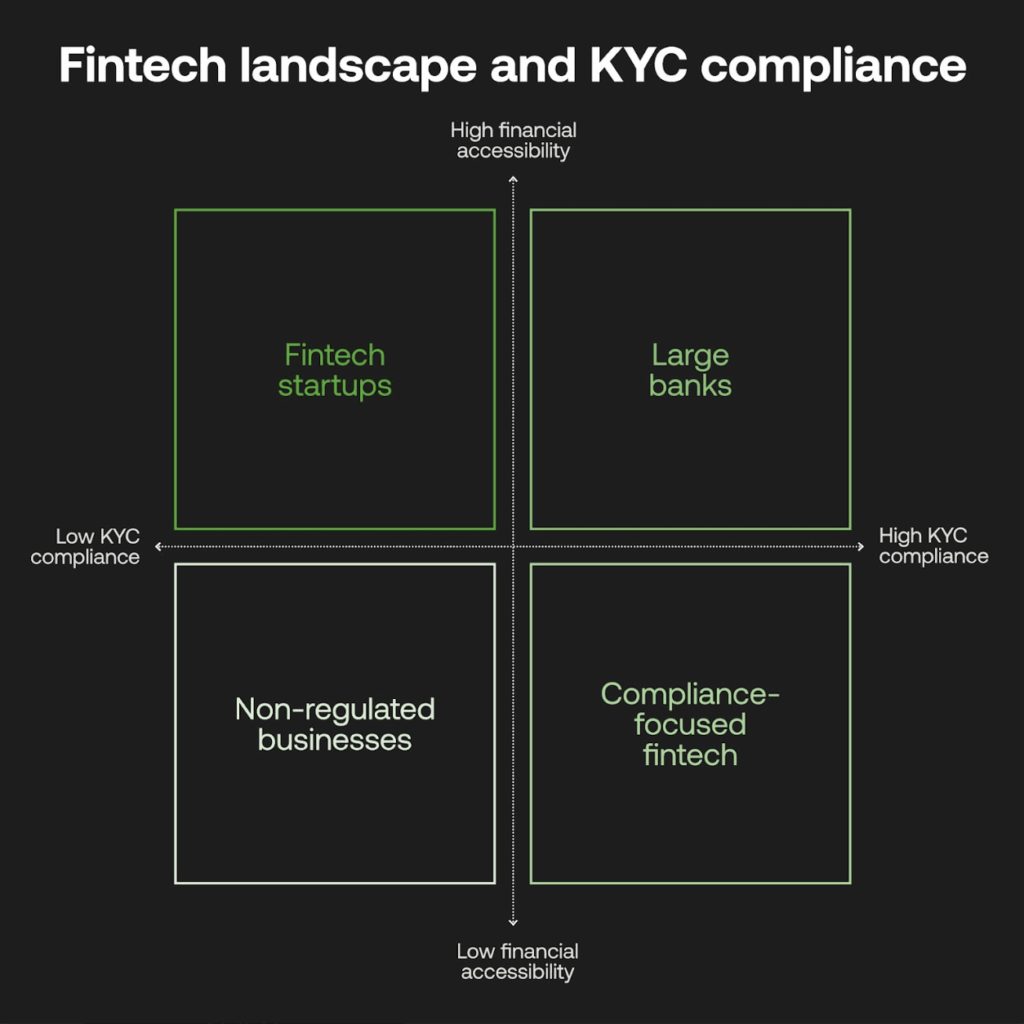

This healthy competition has seen a knock-on effect of well-designed financial instruments that make customer journeys seamless and safe beyond the onboarding stage. Particularly in areas where financial literacy is low but mobile use is high, non-banking companies offer an attractive gateway into the system–cheaper rates and simpler applications that make the formalised economy more inclusive while drawing unbanked customers away from non-regulated businesses.

However, proper KYC compliance underpins whether these FIs can immediately hit the ground running. Larger banks can potentially cover the hefty ‘cost of compliance’ and have the resources to scale their KYC operations. However, this could be too major an expense for budget-stretched companies, as they cannot contribute game-changing products to the financial ecosystem and make finance more accessible for their target market.

Customer acquisition pain points for market entrants

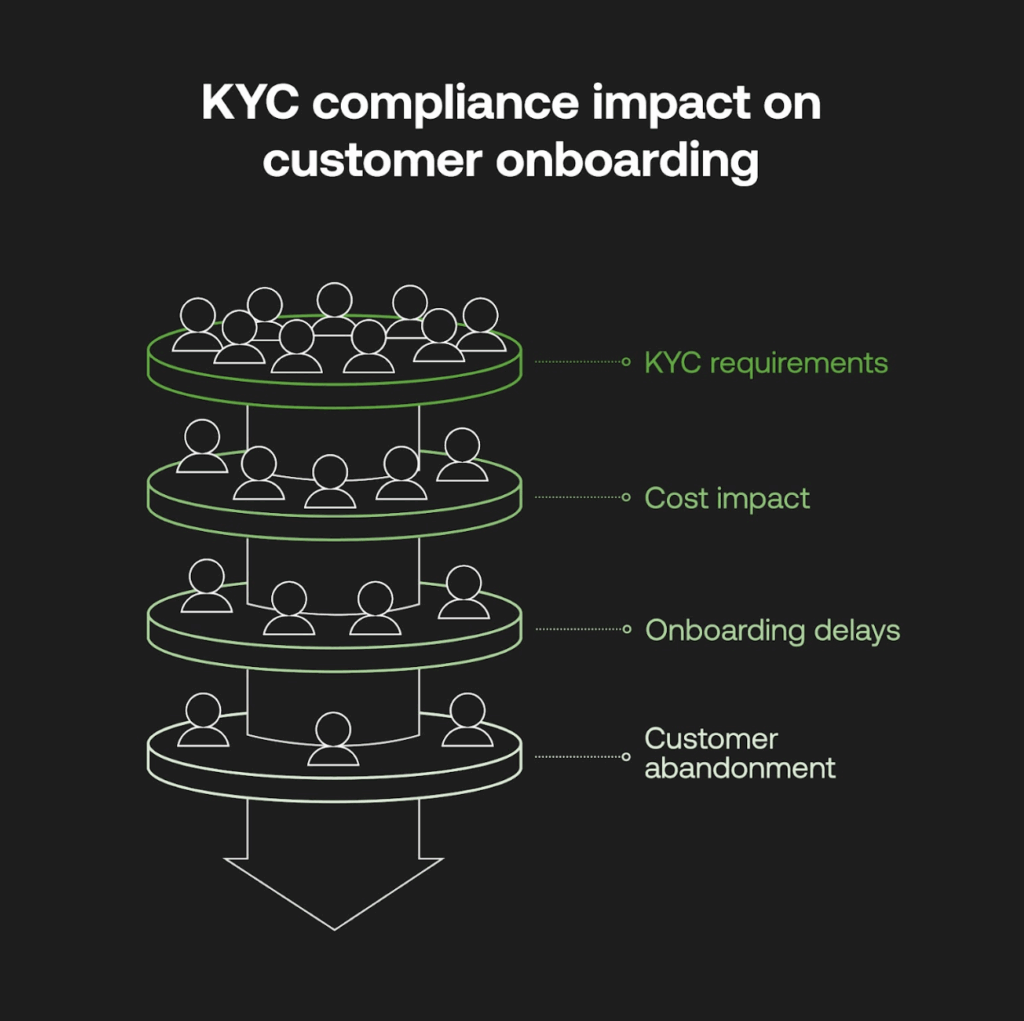

Where customers can be attracted to niche fintech products for their low-cost, no-fuss entry into the complex financial system, thorough KYC requirements can be damaging. Inflated verification costs trickle down to customer fees, abandoning the market entrant’s original, unique selling proposition. On the other hand, lax KYC compliance opens the floodgates to criminal risk. It almost creates a Catch-22 situation.

Likewise, relying on manual systems leads to cumbersome onboarding. Nobody appreciates weeks-long waiting lists to be approved for a new account, so much so that Deloitte finds 38% of new customers abandon drawn-out processes, or if it “demands more information than they are willing to disclose”, potentially from manual human-checked verification that significantly reduces growth.

Being a sustainable market player means analysing data rapidly. This becomes hugely difficult with high onboarding volumes that traditional KYC operations cannot process, and it is only exacerbated by increasing requirements to screen customers or third parties against sanctions lists and beneficial ownership registers instantaneously. Those without robust measures will simply be excluded from market access, including emerging markets that rely on these innovative products most.

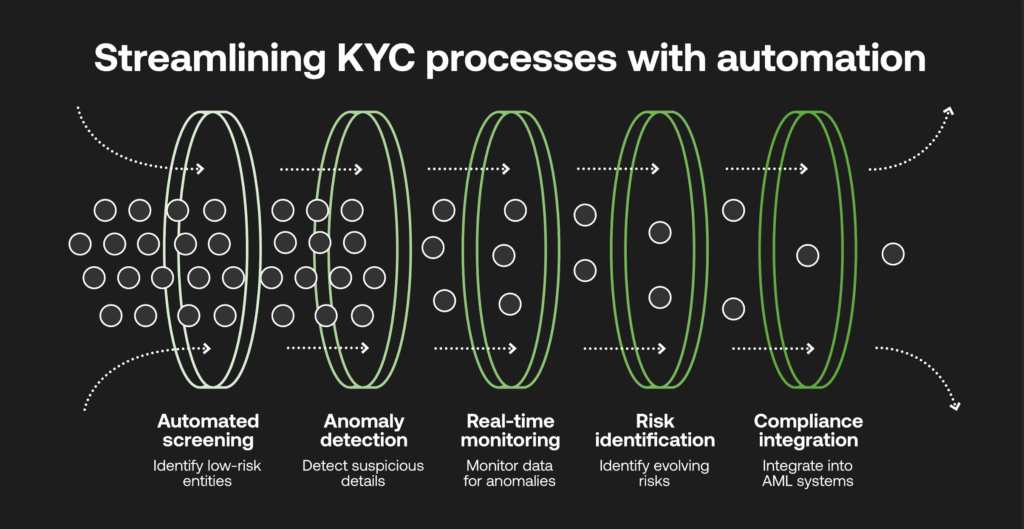

Why growing user bases call for perpetual KYC

The obvious answer to scaling KYC is to make the process far quicker without breaking the bank. Simply put, that is impossible without implementing automated identity screening and verification, which lowers human hours wasted on investigating low-risk entities while accurately pinpointing suspicious details. It also reduces false positive rates that heavily blight FIs’ operational efficiencies. Investigations to help file Suspicious Activity Report (SARs) can reportedly take almost 22 hours each, where an estimated 95% of false alerts contribute to growing global annual compliance costs of over $270 billion.

Any customer profile can alter over time, and all market players must move beyond one-time digital KYC to consistent periodic checks. Perpetual KYC (pKYC) is the next step, employing machine learning technology to monitor vast datasets in real time to determine any anomalies needing human intervention and update customer data accordingly. As pWc found, manual KYC times per each retail customer could be as high as 105 hours, as opposed to as little as 10 minutes with pKYC.

This automation is not just aimed at clawing back investigation hours here and there. It flips the idea of being reactive to high-risk individuals; pKYC is proactive in identifying critical threats instantly, even adapting to patterns of new behaviours that could indicate evolving risks that are highly likely considering financial crime’s continual evolution.

pKYC is, therefore, a necessary risk management tool that ensures all pertinent threats are weeded out and lets legitimate customers sign up swiftly. It’s a win-win for market players and their customers: it relieves operational conundrums, lowers bottom lines, and crafts a seamless and cost-effective onboarding experience.

Even though only 20% of smaller institutions have reportedly adopted pKYC so far, in many cases, pKYC can become an integrated tool into a wider anti-money laundering (AML) system without needing to install compliance platforms from scratch. This marks a drastic competitive advantage for entrants attempting to enter the market without compromising on sound compliance.

Pressing KYC/KYB areas for financial institutions

Risk-based due diligence is the best way to approach KYC compliance, facilitating business scale rather than hindering it. FIs of all sizes can benefit from systems customised to bespoke risk profiles and onboarding frequencies, even flexibly adapting to future growth.

Implementing automated verifications, real-time watchlist screening and pKYC are imperative to remain on the regulatory front. By utilising these tools now, even stretched resources can be used more strategically, ensuring that market-leading innovations and customer experiences are prioritised across the board.

The readiness to face risk is crucial to entering the market, surviving and thriving. In that sense, compliance should not be seen as a barrier; scalable and well-integrated KYC maintains integrity all across this connected financial ecosystem so each FI can continue revolutionising products for a safer, more inclusive financial life in their local markets and beyond.

- This is the first in a series of articles about scalable KYC, a key component of the financial ecosystem’s success. Next, we’ll explore compliance challenges for fintech and how efficient onboarding can unlock growth.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.