The Top 8 KYC Mistakes – Safeguarding Your Business and Customers

Table of Contents

- The Price of KYC Mistakes

- The Top 8 KYC Mistakes to Avoid

- Streamlining KYC with Automated Solutions

In today’s increasingly regulated world, Know Your Customer (KYC) procedures are no longer optional for businesses. KYC involves initial and continuous identity verification to help prevent financial crime and safeguard your customer’s data and your business’s reputation. But navigating the complexities of KYC can be tricky, and even small mistakes can have significant consequences.

This article examines the top 8 KYC mistakes businesses often make, providing actionable tips to help you avoid them and ensure robust compliance. Considering these, you’ll have the knowledge and tools to implement effective KYC practices that protect your business and customers.

The Price of KYC Mistakes

Before diving in, let’s highlight the potential pitfalls of insubstantial KYC:

Financial penalties: Regulatory bodies can impose hefty fines for non-compliance with KYC regulations. Recent penalties have reached millions of dollars, significantly impacting businesses.

Reputational damage: Reported KYC failures can erode customer trust and damage your brand image. In today’s digital age, negative news travels fast, and regaining trust can be challenging.

Operational disruptions: Inadequate KYC processes can delay onboarding customers, processing transactions, and fulfilling legal requirements. This can hamper business growth and efficiency.

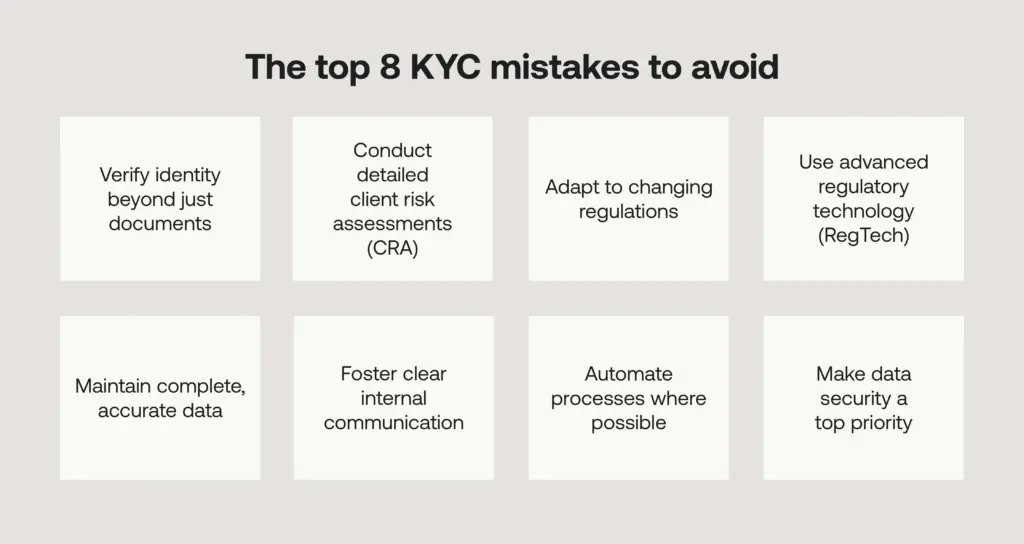

The Top 8 KYC Mistakes to Avoid

Now, let’s explore the eight most common KYC mistakes and how to avoid them, with specific action points for each:

1. Relying Too Heavily on Documentation

While collecting passports or driver’s licenses is crucial, relying solely on documentation is a recipe for disaster. Remember, KYC is about understanding your customer, not just verifying paperwork.

Implement a comprehensive Customer Identification Program (CIP) that gathers crucial details like the source of funds, business activities, and ultimate beneficial ownership (UBO).

Monitoring customer activity over time for suspicious transactions and conducting risk-based due diligence can paint a complete picture of who you’re doing business with and an individual or account’s more comprehensive network of money movements.

The key is not to treat KYC as a tick-box exercise focused on documents that do not build an audit trail of activity. Having an in-depth and continuous identity verification process is necessary to remain compliant.

2. Conducting Poor Risk Assessments

Assigning accurate risk ratings in KYC is crucial for effective resource allocation and compliance. Here’s a comprehensive list of red flags to analyse when assessing customer risk:

Customer Information & Behaviour:

- Inconsistent or incomplete personal information: Mismatched names, addresses, dates of birth, or contact details.

- Lack of supporting documentation: Inability to verify information with official documents.

- Unexplained wealth: Sudden spikes in account activity or large transactions with no apparent source of funds.

- Unusual transaction patterns: Frequent small transactions to avoid reporting thresholds, transactions to/from high-risk countries, or activity inconsistent with declared business activities.

- Multiple accounts held by the same individual: Especially across different institutions or with suspicious activity patterns.

- Links to Politically Exposed Persons (PEPs) or sanctioned entities: Business associations, family ties, or transactions involving PEPs or sanctioned countries warrant scrutiny.

- Negative news or media mentions: Adverse publicity associated with the customer or their business activities.

Business Activities & Operations:

- High-risk industries: Businesses operating in sectors prone to money laundering, like gambling, real estate, or precious metals.

- Complex corporate structures: Shell companies, opaque ownership structures, or numerous subsidiaries can be used to disguise illicit activity.

- Cash-intensive businesses: Businesses dealing primarily in cash, with limited paper trails, raise concerns about money laundering opportunities.

- Geographic location: Operating in countries with weak AML/CFT regulations or high money laundering risk.

- Rapid business growth: Unusually rapid expansion can be a red flag, predominantly when funded by unclear sources.

- Unusual customer base: Clients from high-risk jurisdictions or with suspicious profiles.

Transaction Information:

- Structuring: Breaking down large transactions into smaller ones to avoid reporting requirements.

- Layering: Moving funds through multiple accounts or financial institutions to disguise the origin.

- Trade-based money laundering: Using trade transactions to move illicit funds across borders.

- Unexplained wire transfers: Transfers with unclear purpose or beneficiaries in high-risk locations.

- Use of anonymous accounts or virtual currencies: Transactions occurring through anonymous channels or using cryptocurrencies with limited transparency.

Remember, this list is not exhaustive. KYC risk assessments require careful consideration of all available information, applying context and judgment to determine the overall risk profile of each customer.

3. Failing to Update KYC Processes

KYC regulations frequently change as new money laundering threats emerge. Updates are often required, as well as documentation and due diligence procedures.

Many companies wrongly assume their existing KYC process will remain compliant indefinitely. However, staying ahead of evolving regulations is essential as criminals use more sophisticated means to get around a system. A KYC process that lasts the same will never be able to be alert to new practices.

For instance, the EU’s AMLD5 required remote identity verification for transactions over €50 and reduced the prepaid card transaction limit to €150. Regulations also continue getting stricter on verifying ultimate beneficial ownership.

Unfortunately, there isn’t a universally accepted “one size fits all” answer to the frequency of KYC procedure reviews. The ideal interval depends on several factors:

Regulations and Industry:

Changes in national and international AML/CFT regulations. These updates often trigger the need to adapt your KYC procedures accordingly. Stay updated on regulatory changes in your jurisdiction and relevant industries.

Risk Level:

Customer risk profiles: High-risk clients warrant more frequent reviews than low-risk ones. Regularly reassess customer risk profiles based on updated information and changing circumstances.

Internal risk assessments: Regularly review your overall business risk assessment to identify areas where your KYC procedures need strengthening.

Technology and Security:

Adoption of new technology: Introducing new technologies for identity verification, data analysis, or automation might necessitate adjustments to your KYC processes.

Security vulnerabilities: Regular penetration testing and security audits can identify potential weaknesses in your KYC systems, prompting revisions to address them.

Other Considerations:

Internal changes: Mergers, acquisitions, or significant company restructuring can impact your KYC processes and necessitate reviews.

Incident reports: Investigate and learn from any internal or external incidents related to KYC failures to implement preventative measures and refine your procedures.

Generally, however, the following approach is recommended:

Yearly minimum: At least once a year, thoroughly review your entire KYC program, including policies, procedures, technology, and training.

Risk-based reviews: Conduct additional reviews for high-risk customers or situations outside your standard procedures.

Triggered reviews: Be prepared to initiate reviews in response to regulatory changes, security incidents, or significant internal events.

Adopting a dynamic and responsive approach to KYC procedure reviews ensures your program remains effective, compliant, and adaptable to evolving risks and industry standards. Remember, ongoing vigilance and proactive improvements are crucial to building a robust KYC foundation for your business.

4. Relying on Outdated Technology

Some financial institutions continue using old KYC systems long after they become ineffective for compliance. Outdated systems do not detect the new types of document fraud and identity deception which criminals are always looking out for, and legacy systems are also prone to inaccurate past data that can fail to adapt to risk.

An advanced end-to-end compliance platform seamlessly integrates with existing systems, avoiding the need to overhaul compliance operations completely. The right solution will neatly incorporate current workflows, pulling data from legacy systems while adding new automation and intelligence capabilities to help battle changing criminal typologies.

Rather than replacing everything from scratch, look for platforms to augment and enhance your technology stack.

5. Having Incomplete Customer Data

Incomplete or outdated customer data creates easily exploitable gaps that criminals seek when probing for KYC oversights. Financial firms must gather essential details upfront, like the source of funds, the nature of business dealings, the transaction rationale, and expected account activity.

Manipulating or fabricating missing information is simple for money launderers.

Many financial institutions fall short of maintaining incomplete client data files. All relevant data points should be collected during initial KYC screening, including employment status, business activities, transaction purpose, estimated account use, etc.

Periodically re-screening customers is crucial to detect changes and keep data current.

- Make your customer data intake meticulous from the outset.

- Build thorough questionnaires covering all relevant bases.

- Conduct frequent reviews to update details that may have changed over time.

- Ensure the housing of complete, high-quality data is a priority for your KYC program to avoid openings for criminals.

6. Internal KYC Communication

Compliance can improve when there is better communication between departments about the importance of KYC.

Employees may need help understanding the latest requirements or their specific responsibilities, but instilling a culture of compliance is critical alongside documenting policies and procedures. Leadership should establish KYC and overall AML compliance as a core value across the institution, including the following:

- Provide regular training to reinforce its importance at all levels.

- Avoid siloed teams by fostering shared responsibility for adherence.

- Make compliance an integral, everyday element woven throughout operations.

- Proactively cultivate an ethical, diligent atmosphere to reduce organisational blind spots.

This can be done by utilising online training modules, workshops, and certification programs to equip your team with the latest knowledge and best practices.

7. Using Manual KYC Processes

Despite technological advances, many financial institutions surprisingly rely on manual KYC task processes. Employees spend valuable time collecting customer data, filling out forms, validating information, and handling documents.

The risks of human error, duplication, and blind spots are much higher with manual workflows, where mistakes can easily slip through the cracks. Instead, automation provides a solution to streamline compliance activities for greater accuracy, speed, and efficiency.

Specific automation opportunities include:

- The technology automatically fetches and compiles customer data from internal and external sources. This removes manual data collection.

- Dynamic online forms with built-in validation to allow customers to submit their information. This eliminates manual entry.

- Automated background checks to verify customer details against global watchlists and sanction lists.

- Document digitisation software to extract key data points from IDs and paperwork. This avoids manual document reviews.

- Rules-based decision engines automatically process low-risk customers while flagging higher-risk entities for human review.

Automation technologies using artificial intelligence and machine learning can optimise as much of the KYC process as possible while partnering with compliant-ready fintech providers to gain access to the latest automation capabilities.

8. Being Complacent About KYC Data Security

Once KYC documents have been collected, companies often become complacent about security.

Breaches that expose customer KYC information can severely damage an organisation’s reputation and bottom line. Look no further than the 2018 Exactis data leak, which exposed the personal details of 340 million people.

Or the 2021 T-Mobile breach impacting over 50 million customers. A second attack followed this in January 2023.

Institutions must look closely at:

- Securing KYC data must be treated with the utmost priority. Specific measures should include:

- Encrypting all customer data in transit and at rest. Use blockchain solutions if suitable.

- Strict access controls, only granting data access to essential staff and multi-factor authentication to access systems.

- Frequent audits of internal data access and external firewalls/endpoints.

- AI-powered cybersecurity tools to detect unauthorised access attempts and anomalous activity.

- Regular staff training on secure practices, including avoiding sharing passwords or clicking suspicious links.

- Well-defined incident response plans that notify regulators and customers during a breach.

- Insurance policies to mitigate potential regulatory fines and lawsuits related to data leaks.

A layered approach to cybersecurity allows you to diligently track access to sensitive KYC data and avoid becoming the next compliance headline.

Streamlining KYC with Automated Solutions

Many of the pitfalls of manual KYC processes can be avoided with the right automation software.

RelyComply offers end-to-end AML capabilities, including innovative KYC automation.

Our AI platform performs intelligent verification, reducing false positives by over 80%. Customisable workflows ensure efficient data collection and client risk profiling.

Disclaimer

This article is intended for educational purposes and reflects information correct at the time of publishing, which is subject to change and cannot guarantee accurate, timely or reliable information for use in future cases.