The KYC Market Guide for Banks: Compliance and Risk Management Trends 2025

Table of Contents

In 2025, Know Your Customer (KYC) solutions will become critical for banks and financial institutions seeking to strengthen their anti-money laundering (AML) frameworks. Driven by increasing regulatory demands, sophisticated financial crimes and expectations for seamless customer experiences, emerging trends like decentralised identity (DCI) and perpetual KYC (pKYC) are reshaping how financial institutions approach compliance and risk management.

Key components of KYC Solutions to elevate compliance and customer trust

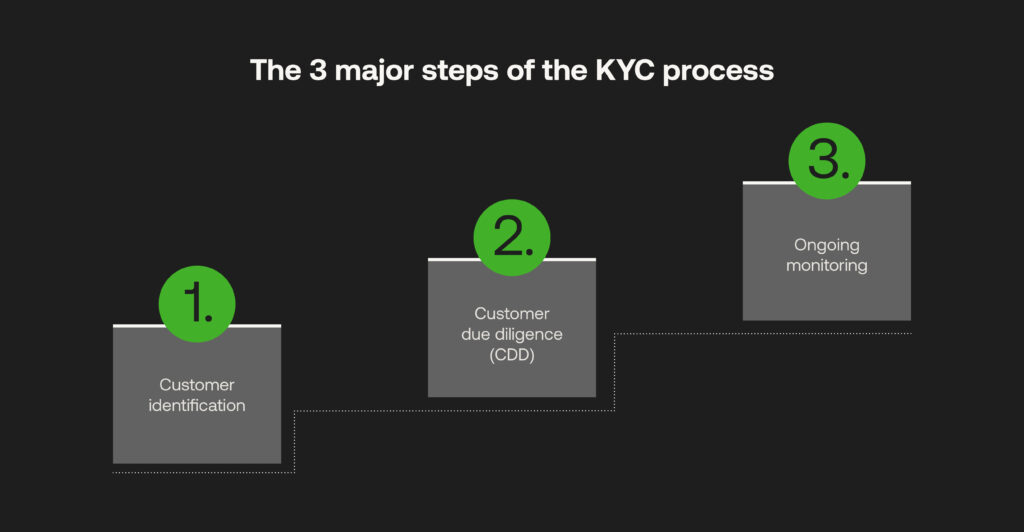

1. Customer Identification Programmes

Modern banking demands more than basic identity verification—it requires a frictionless and secure onboarding process.

RelyComply’s platform enhances Customer Identity Programme (CIP) processes by integrating real-time checks. This makes verification seamless while reducing friction for both banks and customers. By integrating advanced tools, banks can reduce onboarding delays, build trust, and stay ahead in the competitive digital banking landscape.

2. Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

The ability to assess customer risk is no longer optional; it’s a cornerstone of effective compliance and fraud prevention.

RelyComply’s sophisticated CDD and EDD frameworks empower financial institutions to take a proactive stance. By leveraging robust tools for sanctions screening, politically exposed persons (PEP) checks, and dynamic risk assessments, they help banks navigate the complexities of modern financial crime with confidence.

3. Perpetual KYC Monitoring (pKYC)

Static KYC processes are insufficient in today’s world of ever-evolving risks. Continuous KYC Monitoring transforms compliance from a periodic activity into an ongoing strategy.

With RelyComply’s AI-driven capabilities, banks can monitor transactions, behaviours, and patterns in real-time, enabling swift action against emerging threats. This perpetual oversight strengthens compliance and builds a robust foundation for trust and security in customer relationships.

By embracing these approaches to KYC, banks can move beyond meeting regulatory requirements and position themselves as leaders in innovation, efficiency, and customer trust.

Navigating KYC Platforms: one-stop-shop vs. best-of-breed solutions

Technological innovations promise enhanced security, streamlined processes and improved customer experiences. However, as the market evolves, the debate continues between adopting a “one-stop-shop” KYC platform or opting for a “best-of-breed” approach that combines specialised solutions.

One-stop shops offer unified systems and simplified vendor management. Larger banks with extensive operations can benefit significantly from a one-stop shop as it simplifies the orchestration of complex workflows. However, best-of-breed solutions provide flexibility with specialised expertise in addressing high-risk areas, helping banks avoid emerging threats.

The RelyComply platform streamlines compliance integrates advanced risk management tools, and delivers seamless workflows that reduce the complexity of vendor management while enhancing efficiency. By offering flexibility, seamless integration and tailored solutions, RelyComply eliminates the need for multiple specialised vendors, ensuring that financial institutions of all sizes can effectively manage compliance, mitigate risk, and stay ahead in a rapidly evolving regulatory environment.

At RelyComply, we’ve worked closely with Tier 1 banks, gaining firsthand insight into their operational complexities in managing compliance at scale. The evolving debate over whether to adopt a “one-stop-shop ” approach or a “best-of-breed” approach in KYC solutions underscores the need for financial institutions to balance efficiency with adaptability.

At RelyComply, we’ve strategically positioned our platform to offer the best of both worlds—combining deep compliance capabilities with seamless integration, eliminating the need for multiple vendors while enhancing agility. Our experience with Tier 1 institutions has shown that success lies not in choosing one approach over the other but in leveraging solutions that are adaptable, comprehensive, and built for the complexities of modern compliance.

Bradley Elliott – CEO

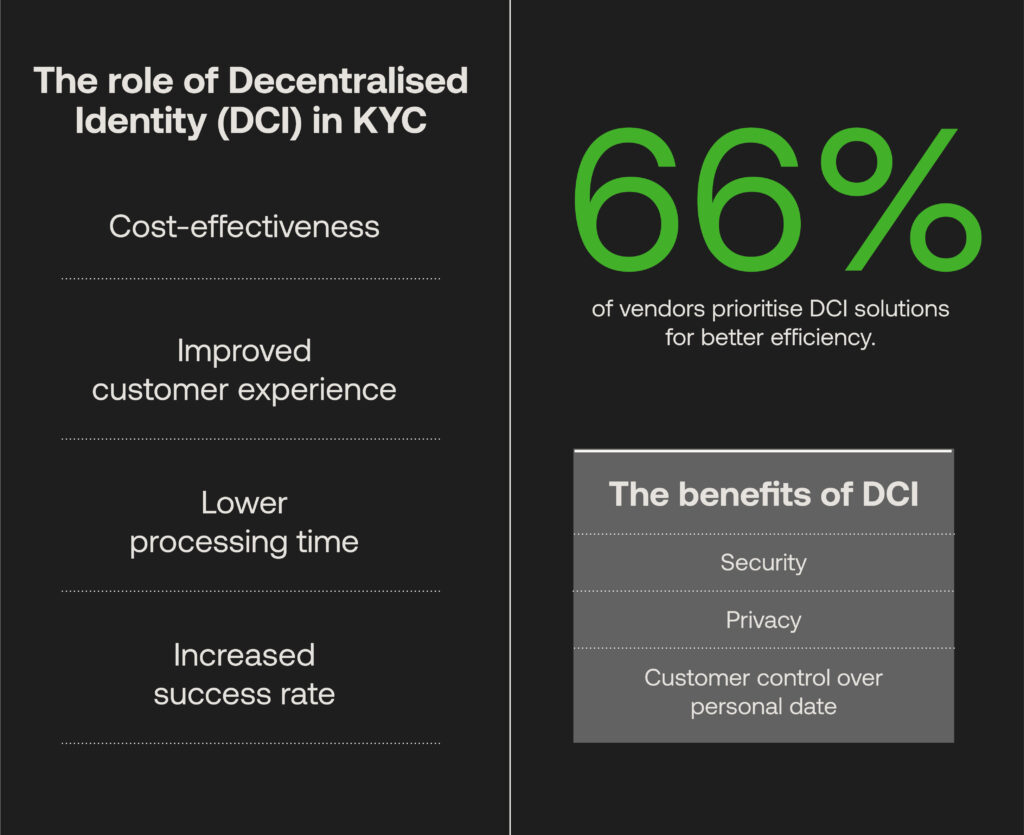

The role of Decentralised Identity (DCI) in KYC

Decentralised identity (DCI) represents a paradigm shift in KYC processes, prioritising efficiency, privacy and regulatory compliance while reimagining how customer data is managed and shared. By enabling users to share only essential information, DCI enhances privacy and empowers individuals with greater control over their data. Its reusable verifications streamline onboarding, reduce operational costs by eliminating the need for centralised databases and align seamlessly with data protection regulations such as GDPR.

Forward-thinking financial institutions should view DCI as a critical innovation, not just a trend. Piloting DCI initiatives and integrating with programmes like the EU’s digital wallet or India’s Aadhaar will position banks to meet evolving compliance standards while delivering a superior customer experience. Embracing DCI today prepares organisations to lead in a more secure, efficient and privacy-conscious financial ecosystem.

Decentralised identity (DCI) isn’t just an innovation; it’s a necessary evolution in KYC that fundamentally redefines how financial institutions manage identity verification. Traditional approaches, reliant on centralised databases and fragmented data points, are becoming increasingly unsustainable in the face of rising regulatory scrutiny and evolving customer expectations. DCI presents a scalable, privacy-first alternative that delivers unparalleled efficiency without compromising compliance.

From a technical standpoint, the shift to DCI eliminates the inherent vulnerabilities of centralised storage, offering cryptographic assurances and verifiable credentials that are tamper-resistant and interoperable across ecosystems. Its reusable verifications are a game-changer, slashing onboarding times and operational overhead while ensuring seamless alignment with stringent frameworks like GDPR.

James Saunders – CTO

AI and real-time risk assessment

Artificial intelligence (AI) is revolutionising compliance and risk management in banking, offering powerful tools to tackle emerging challenges in an increasingly complex landscape.

The rise of deepfakes and synthetic identities has introduced new dimensions of fraud that require sophisticated detection mechanisms. At the same time, regulatory frameworks like the EU AI Act are reshaping the compliance environment, compelling banks to adopt advanced, AI-driven solutions to meet evolving standards while safeguarding their operations.

AI-driven solutions support perpetual KYC (pKYC) by unifying data, automating updates, and prioritising material alerts while balancing privacy compliance. AI-driven tools can analyse vast amounts of data, detect anomalies, and flag suspicious activities with unparalleled speed and accuracy. By automating data updates and leveraging real-time insights, banks can reduce manual workloads and minimise human error. This automation enhances compliance and frees up resources for more strategic initiatives.

One of the most transformative applications of AI in compliance is the emergence of pKYC. Unlike traditional periodic reviews, pKYC relies on continuous customer data monitoring, enabling real-time risk assessments that adapt to changing behaviours and circumstances. This dynamic approach lets banks detect discrepancies between expected and actual customer behaviours, providing a proactive stance against potential threats. By integrating pKYC, financial institutions can achieve enhanced compliance while fostering greater customer trust and transparency.

The future of KYC

The KYC landscape is at a crossroads. With innovations like decentralised identity and perpetual KYC gaining traction, organisations must align their strategies with these trends to remain competitive. Whether you choose a single platform or a specialised approach, the key is to act now.

Delaying modernisation can lead to increased risks, inefficiencies, and non-compliance penalties. By leveraging the right tools and technologies, financial institutions can confidently navigate the complexities of KYC, ensuring regulatory adherence and customer satisfaction.

For instance, a Tier 1 bank leveraging our platform achieved a 30% reduction in onboarding time, significantly improving operational efficiency while maintaining compliance with evolving regulations.

As validated by Gartner’s comprehensive Market Guide, the future of KYC lies in integrated, AI-driven solutions that can adapt to evolving regulatory requirements while maintaining operational efficiency. RelyComply’s innovative approach to combining one-stop shop convenience with best-of-breed capabilities positions us as a leader in this developing landscape.

Transform your bank’s compliance framework with proven KYC solutions trusted by leading financial institutions across the UK and South Africa. Download Gartner’s comprehensive Market Guide to explore actionable insights and see how our end-to-end platform can help your business.